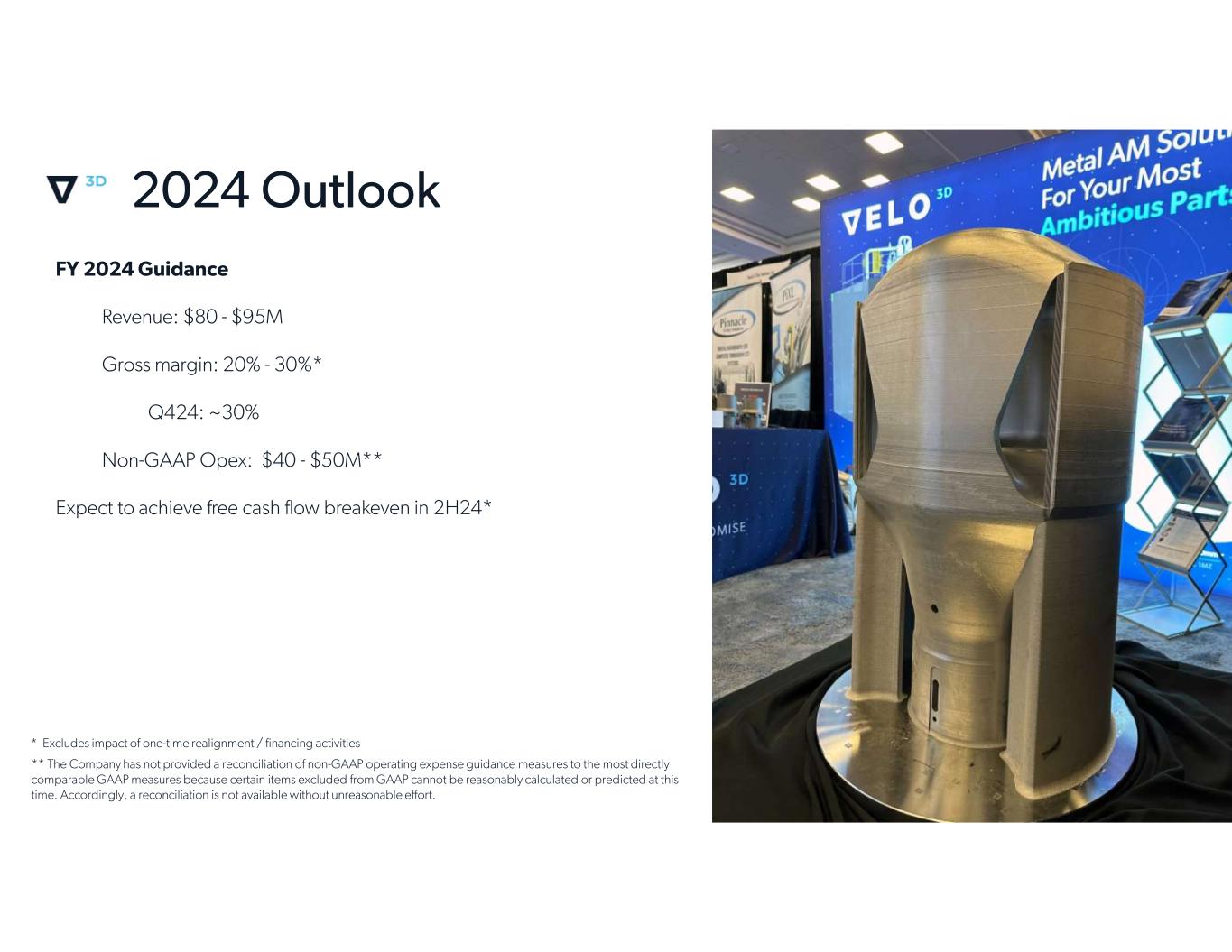

This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. The company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the company’s guidance for full year 2024 (including the company’s estimates for full year revenue gross margin and non-GAAP operating expenses), the company's expectations regarding its ability to reduce its first quarter 2024 non-GAAP operating expenses, the company’s expectations regarding improvements in cash flow in the first quarter of 2024 and through the first half of 2024, the company's strategic realignment and initiatives (including the company's plans and targets for operating expense reduction and bookings growth), the company’s expectations regarding its liquidity and capital requirements, the company’s strategic business review process to explore alternatives in order to maximize stockholder value, and the company’s other expectations, hopes, beliefs, intentions or strategies for the future. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “FY 2022 10-K”), which was filed by the company with the SEC on March 20, 2023 and the other documents filed by the company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the inability of the company to execute its business plan, which may be affected by, among other things, competition, the ability of the company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key employees; (2) changes in the applicable laws or regulations; (3) the company’s ability to service and comply with its indebtedness; (4) the company’s ability to raise financing in the future; (5) the company’s ability to continue as a going concern; (6) the company’s ability to maintain the listing of its common stock on the New York Stock Exchange; (7) the possibility that the company may be adversely affected by other economic, business, and/or competitive factors; (8) the impact of the global COVID-19 pandemic; and (9) other risks and uncertainties indicated from time to time described in the FY 2022 10-K, including those under “Risk Factors” therein, and in the company’s other filings with the SEC. The company cautions that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

• • • • • • • • • • • • • •

6% 30%

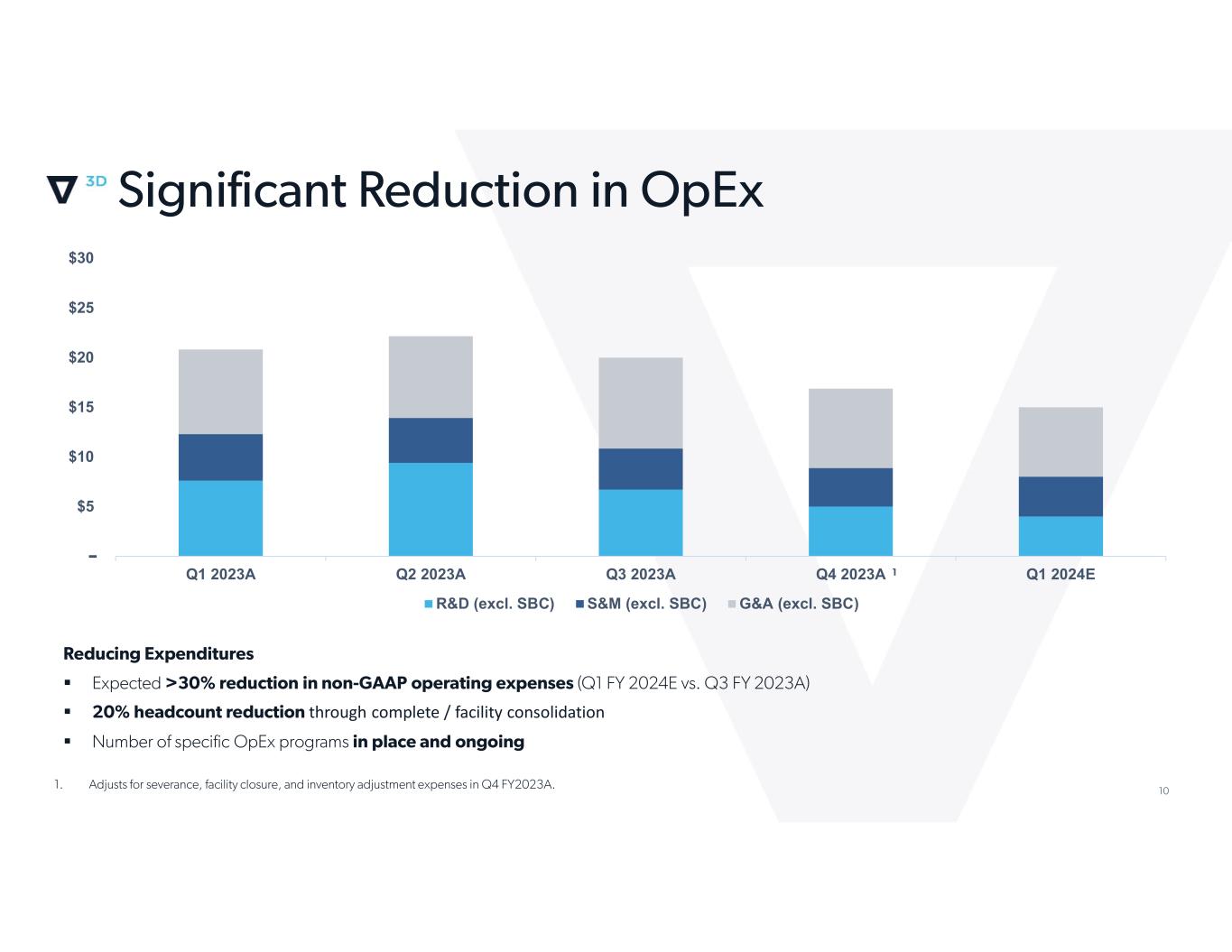

through complete / facility consolidation $5 $10 $15 $20 $25 $30 Q1 2023A Q2 2023A Q3 2023A Q4 2023A Q1 2024E R&D (excl. SBC) S&M (excl. SBC) G&A (excl. SBC)

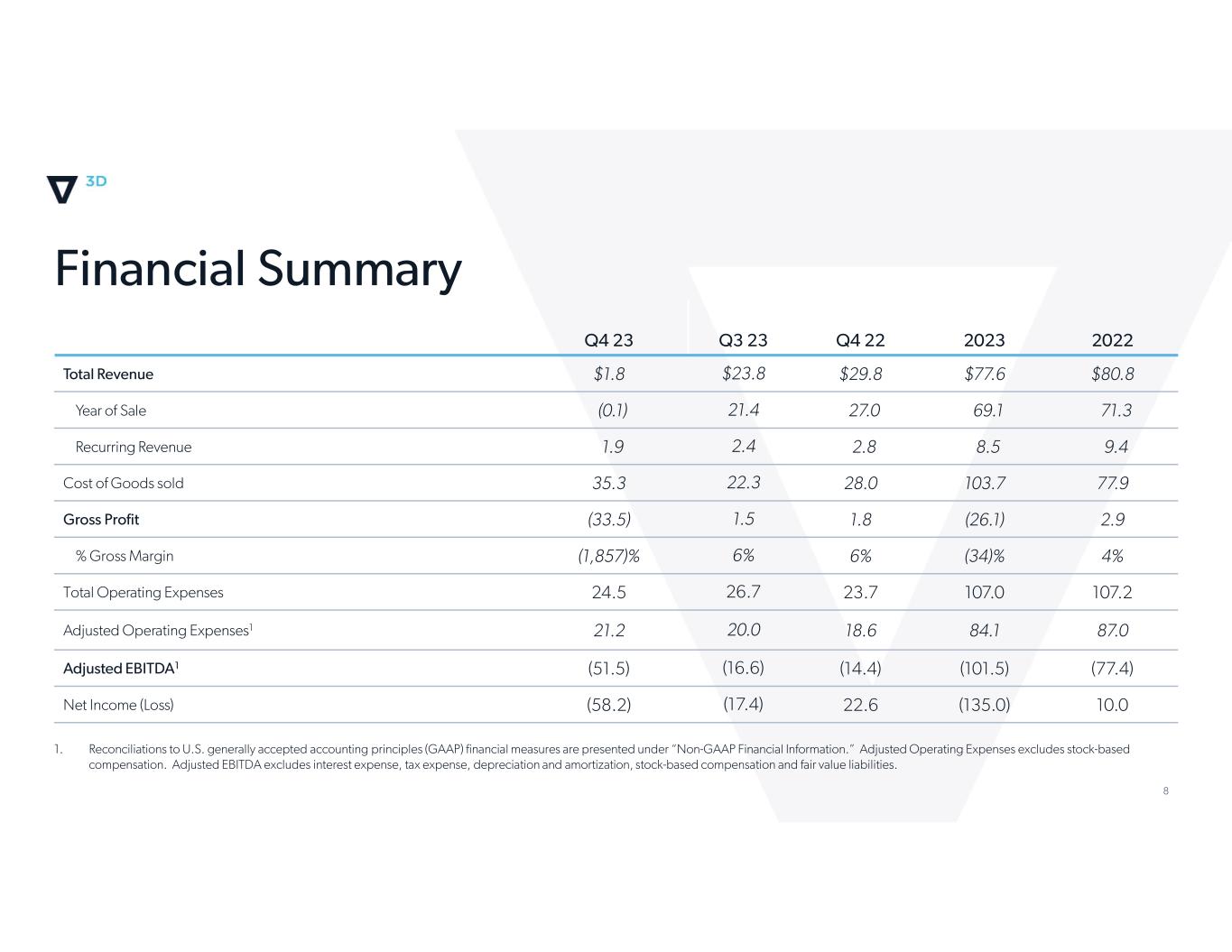

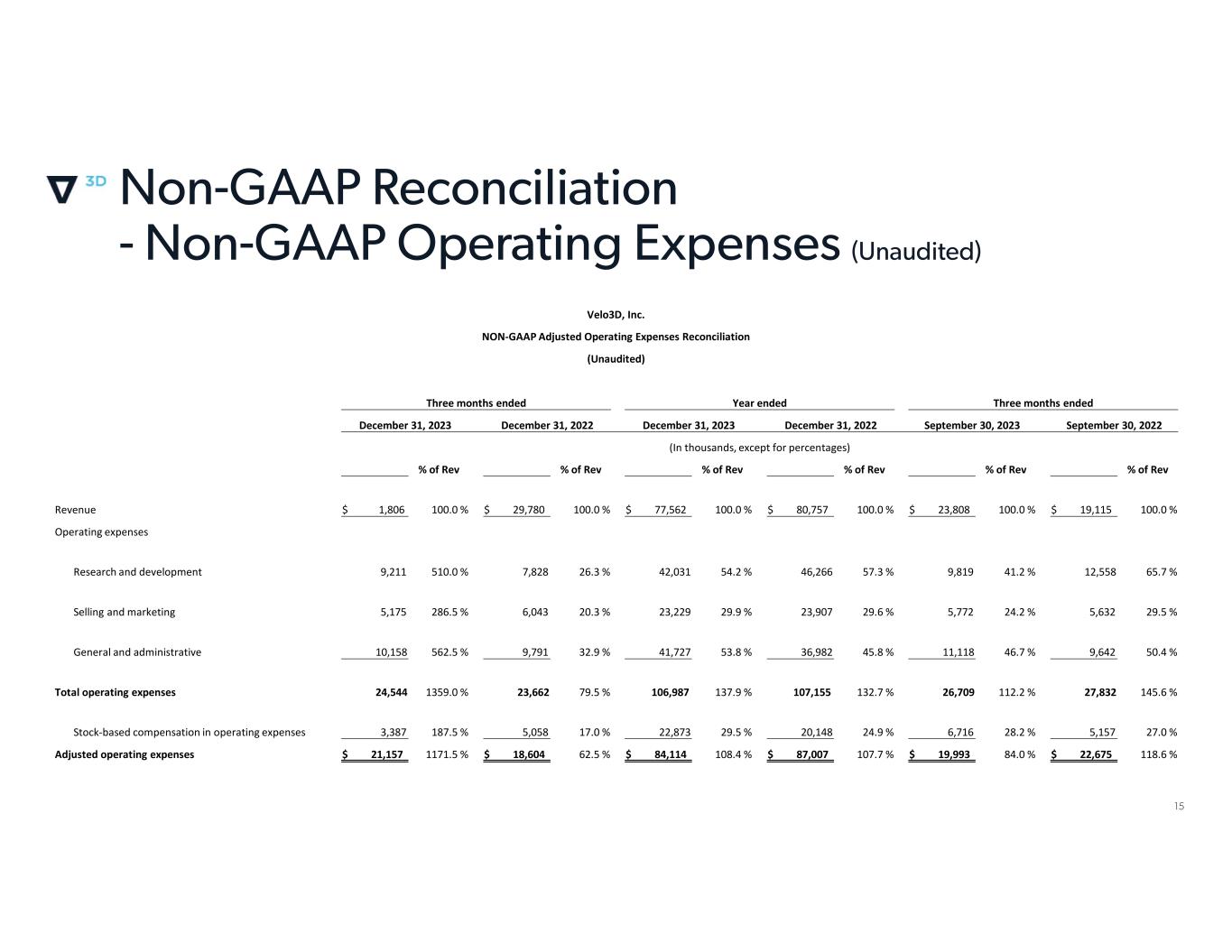

Velo3D, Inc. NON-GAAP Adjusted Operating Expenses Reconciliation (Unaudited) Three months endedYear endedThree months ended September 30, 2022September 30, 2023December 31, 2022December 31, 2023December 31, 2022December 31, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,115 100.0 %$ 23,808 100.0 %$ 80,757 100.0 %$ 77,562 100.0 %$ 29,780 100.0 %$ 1,806 Revenue Operating expenses 65.7 %12,55841.2 %9,81957.3 %46,26654.2 %42,03126.3 %7,828510.0 %9,211Research and development 29.5 %5,63224.2 %5,77229.6 %23,90729.9 %23,22920.3 %6,043286.5 %5,175Selling and marketing 50.4 %9,64246.7 %11,11845.8 %36,98253.8 %41,72732.9 %9,791562.5 %10,158General and administrative 145.6 %27,832112.2 %26,709132.7 %107,155137.9 %106,98779.5 %23,6621359.0 %24,544Total operating expenses 27.0 %5,15728.2 %6,71624.9 %20,14829.5 %22,87317.0 %5,058187.5 %3,387Stock-based compensation in operating expenses 118.6 %$ 22,675 84.0 %$ 19,993 107.7 %$ 87,007 108.4 %$ 84,114 62.5 %$ 18,604 1171.5 %$ 21,157 Adjusted operating expenses

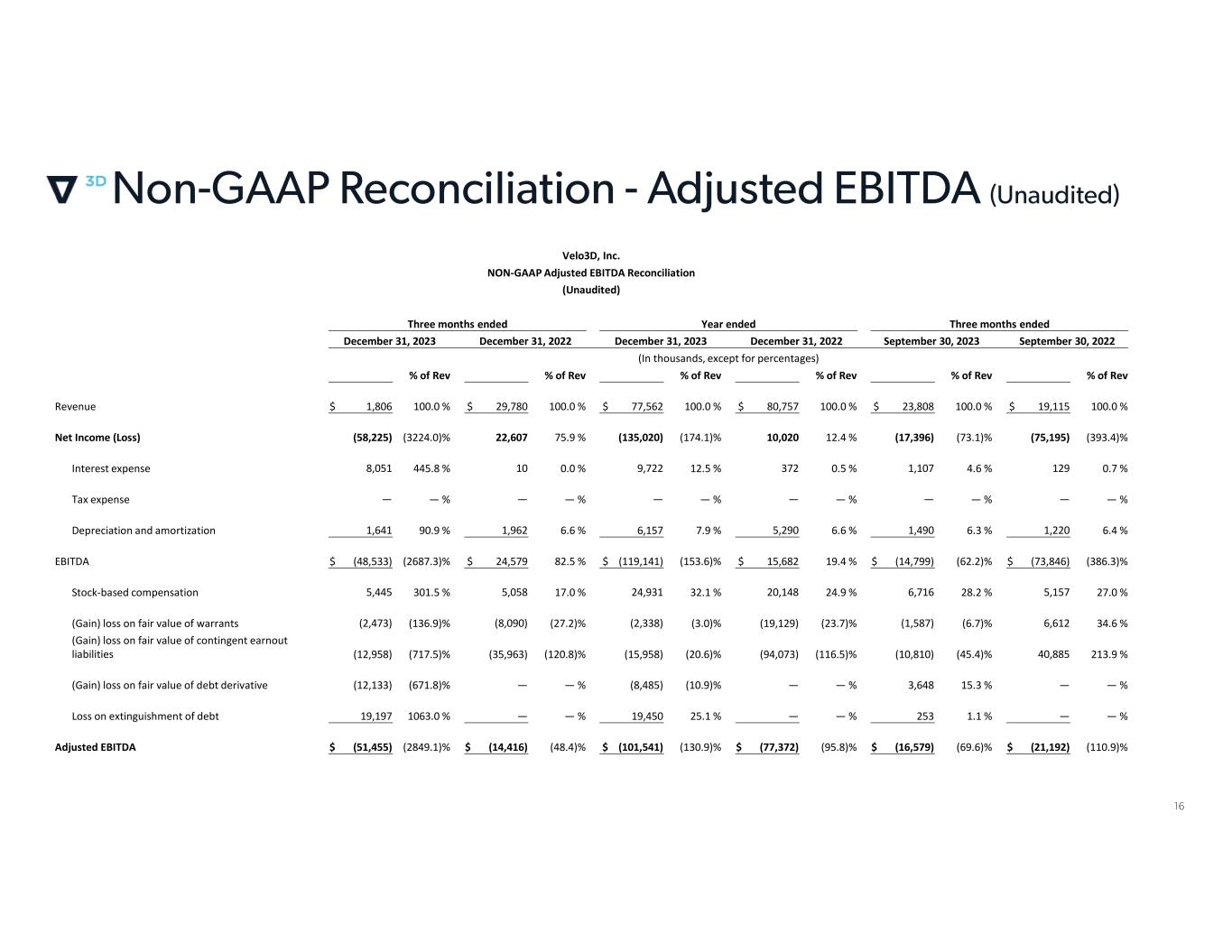

Velo3D, Inc. NON-GAAP Adjusted EBITDA Reconciliation (Unaudited) Three months endedYear endedThree months ended September 30, 2022September 30, 2023December 31, 2022December 31, 2023December 31, 2022December 31, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,115 100.0 %$ 23,808 100.0 %$ 80,757 100.0 %$ 77,562 100.0 %$ 29,780 100.0 %$ 1,806 Revenue (393.4)%(75,195)(73.1)%(17,396)12.4 %10,020(174.1)%(135,020)75.9 %22,607(3224.0)%(58,225)Net Income (Loss) 0.7 %1294.6 %1,1070.5 %37212.5 %9,7220.0 %10445.8 %8,051Interest expense — %—— %—— %—— %—— %—— %—Tax expense 6.4 %1,2206.3 %1,4906.6 %5,2907.9 %6,1576.6 %1,96290.9 %1,641Depreciation and amortization (386.3)%$ (73,846)(62.2)%$ (14,799)19.4 %$ 15,682 (153.6)%$ (119,141)82.5 %$ 24,579 (2687.3)%$ (48,533)EBITDA 27.0 %5,15728.2 %6,71624.9 %20,14832.1 %24,93117.0 %5,058301.5 %5,445Stock-based compensation 34.6 %6,612(6.7)%(1,587)(23.7)%(19,129)(3.0)%(2,338)(27.2)%(8,090)(136.9)%(2,473)(Gain) loss on fair value of warrants 213.9 %40,885(45.4)%(10,810)(116.5)%(94,073)(20.6)%(15,958)(120.8)%(35,963)(717.5)%(12,958) (Gain) loss on fair value of contingent earnout liabilities — %—15.3 %3,648— %—(10.9)%(8,485)— %—(671.8)%(12,133)(Gain) loss on fair value of debt derivative — %—1.1 %253— %—25.1 %19,450— %—1063.0 %19,197Loss on extinguishment of debt (110.9)%$ (21,192)(69.6)%$ (16,579)(95.8)%$ (77,372)(130.9)%$ (101,541)(48.4)%$ (14,416)(2849.1)%$ (51,455)Adjusted EBITDA

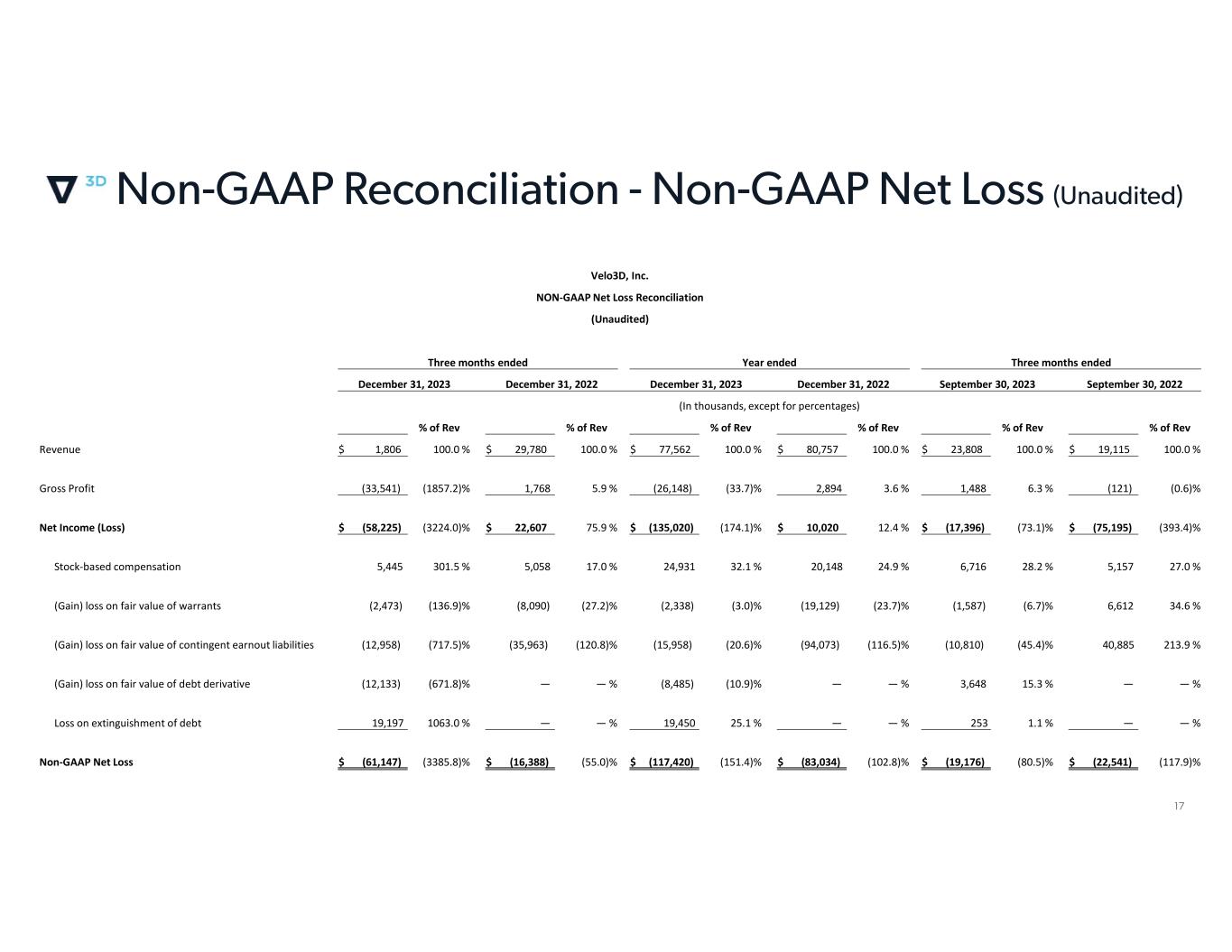

Velo3D, Inc. NON-GAAP Net Loss Reconciliation (Unaudited) Three months endedYear endedThree months ended September 30, 2022September 30, 2023December 31, 2022December 31, 2023December 31, 2022December 31, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,115 100.0 %$ 23,808 100.0 %$ 80,757 100.0 %$ 77,562 100.0 %$ 29,780 100.0 %$ 1,806 Revenue (0.6)%(121)6.3 %1,4883.6 %2,894(33.7)%(26,148)5.9 %1,768(1857.2)%(33,541)Gross Profit (393.4)%$ (75,195)(73.1)%$ (17,396)12.4 %$ 10,020 (174.1)%$ (135,020)75.9 %$ 22,607 (3224.0)%$ (58,225)Net Income (Loss) 27.0 %5,15728.2 %6,71624.9 %20,14832.1 %24,93117.0 %5,058301.5 %5,445Stock-based compensation 34.6 %6,612(6.7)%(1,587)(23.7)%(19,129)(3.0)%(2,338)(27.2)%(8,090)(136.9)%(2,473)(Gain) loss on fair value of warrants 213.9 %40,885(45.4)%(10,810)(116.5)%(94,073)(20.6)%(15,958)(120.8)%(35,963)(717.5)%(12,958)(Gain) loss on fair value of contingent earnout liabilities — %—15.3 %3,648— %—(10.9)%(8,485)— %—(671.8)%(12,133)(Gain) loss on fair value of debt derivative — %—1.1 %253— %—25.1 %19,450— %—1063.0 %19,197Loss on extinguishment of debt (117.9)%$ (22,541)(80.5)%$ (19,176)(102.8)%$ (83,034)(151.4)%$ (117,420)(55.0)%$ (16,388)(3385.8)%$ (61,147)Non-GAAP Net Loss