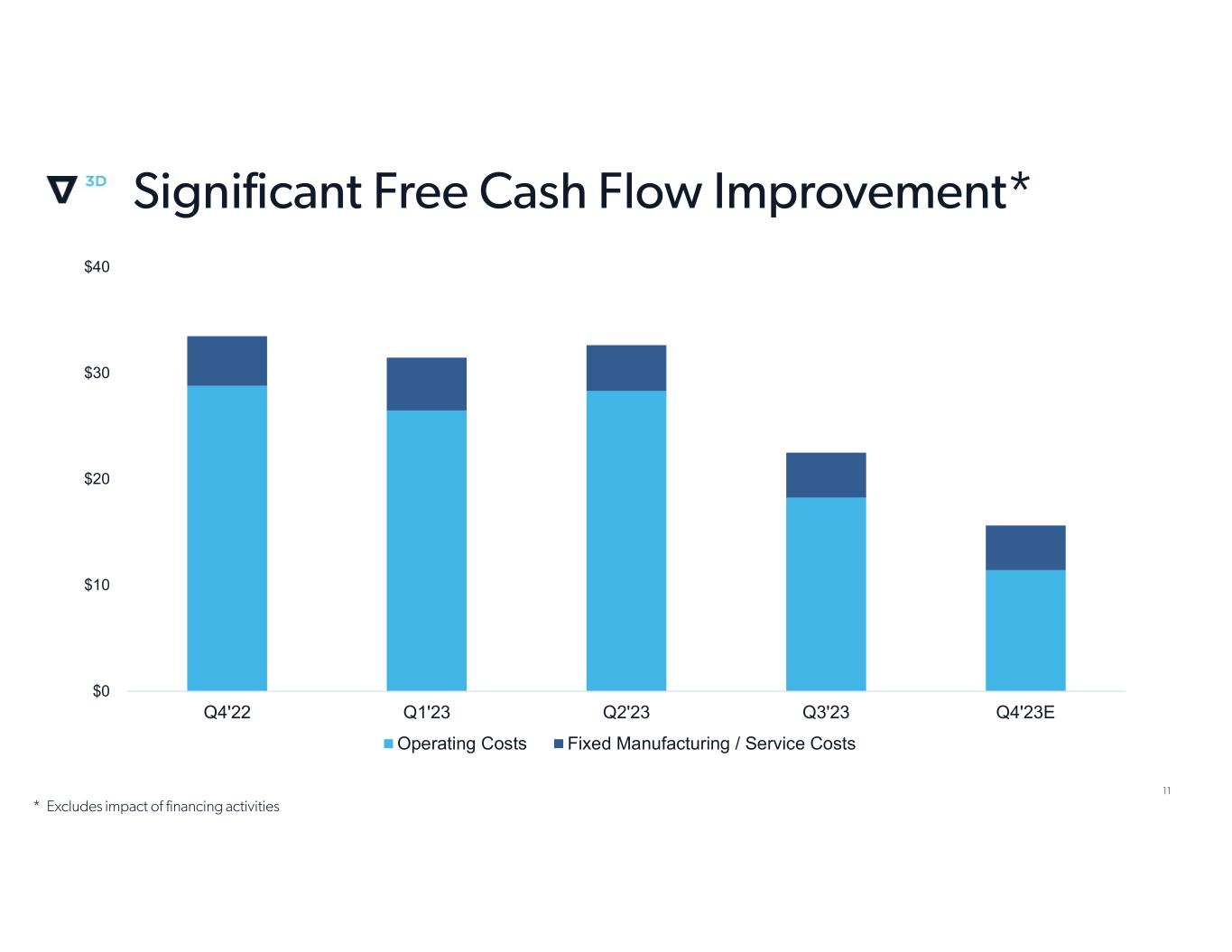

$0 $10 $20 $30 $40 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23E Operating Costs Fixed Manufacturing / Service Costs

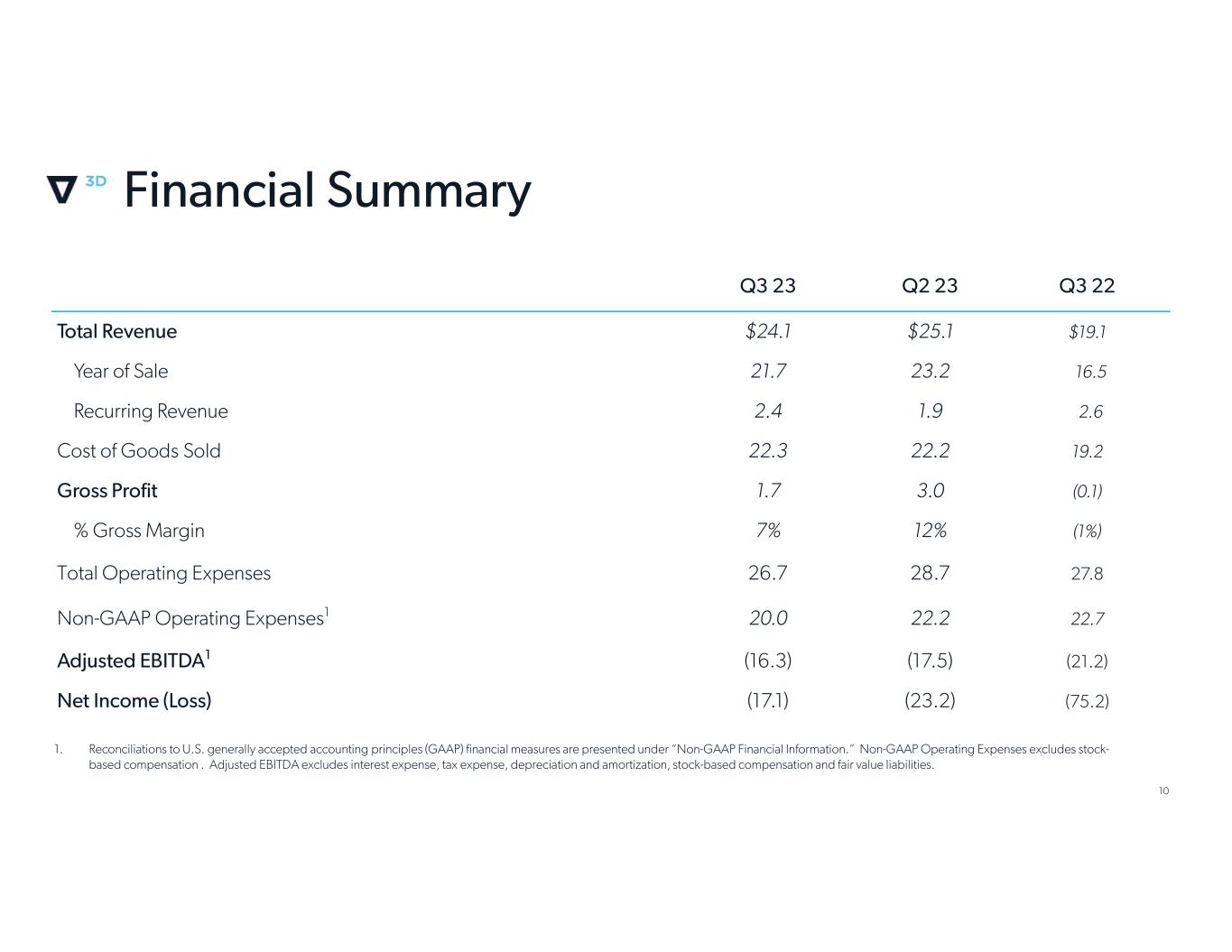

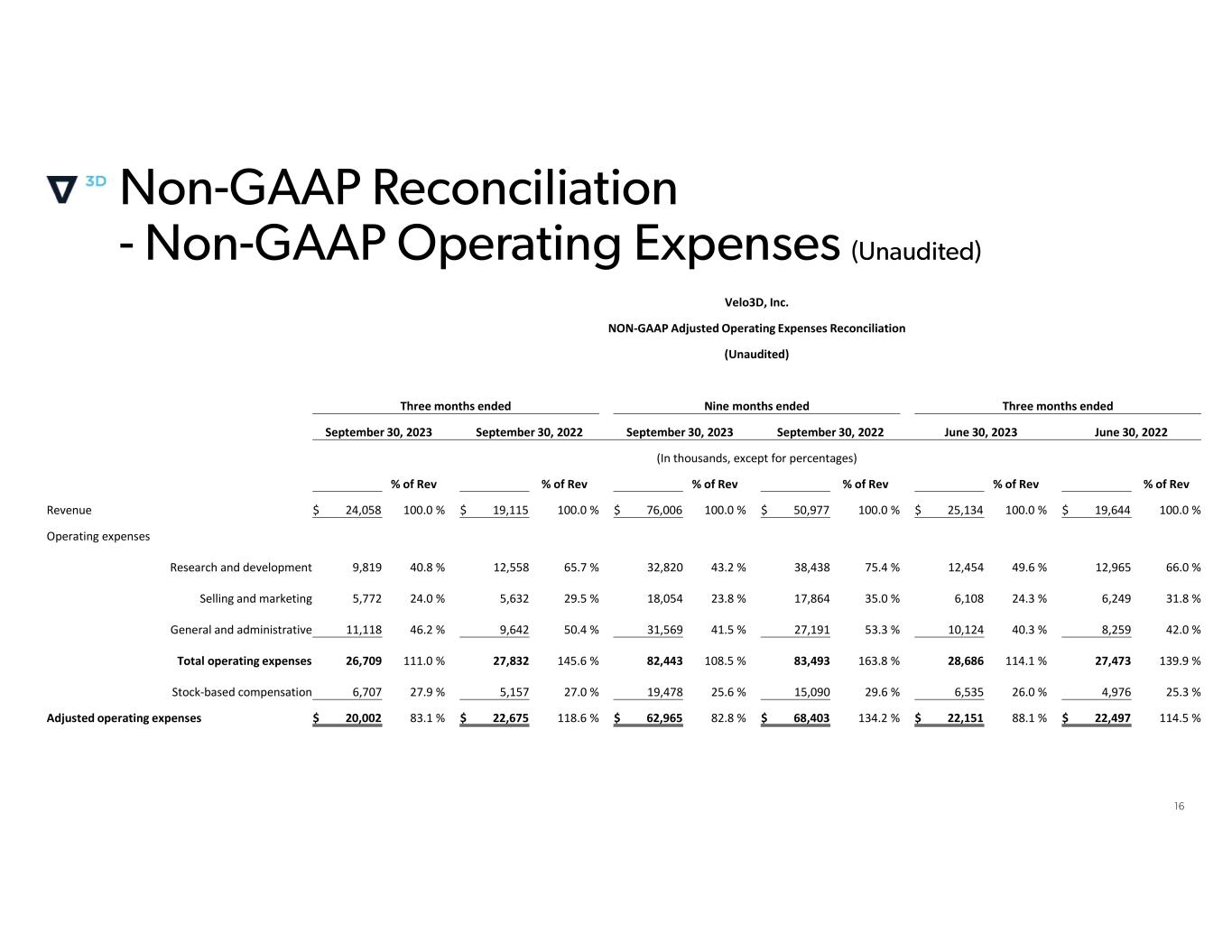

Velo3D, Inc. NON-GAAP Adjusted Operating Expenses Reconciliation (Unaudited) Three months endedNine months endedThree months ended June 30, 2022June 30, 2023September 30, 2022September 30, 2023September 30, 2022September 30, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,644 100.0 %$ 25,134 100.0 %$ 50,977 100.0 %$ 76,006 100.0 %$ 19,115 100.0 %$ 24,058 Revenue Operating expenses 66.0 %12,96549.6 %12,45475.4 %38,43843.2 %32,82065.7 %12,55840.8 %9,819Research and development 31.8 %6,24924.3 %6,10835.0 %17,86423.8 %18,05429.5 %5,63224.0 %5,772Selling and marketing 42.0 %8,25940.3 %10,12453.3 %27,19141.5 %31,56950.4 %9,64246.2 %11,118General and administrative 139.9 %27,473114.1 %28,686163.8 %83,493108.5 %82,443145.6 %27,832111.0 %26,709Total operating expenses 25.3 %4,97626.0 %6,53529.6 %15,09025.6 %19,47827.0 %5,15727.9 %6,707Stock-based compensation 114.5 %$ 22,497 88.1 %$ 22,151 134.2 %$ 68,403 82.8 %$ 62,965 118.6 %$ 22,675 83.1 %$ 20,002 Adjusted operating expenses

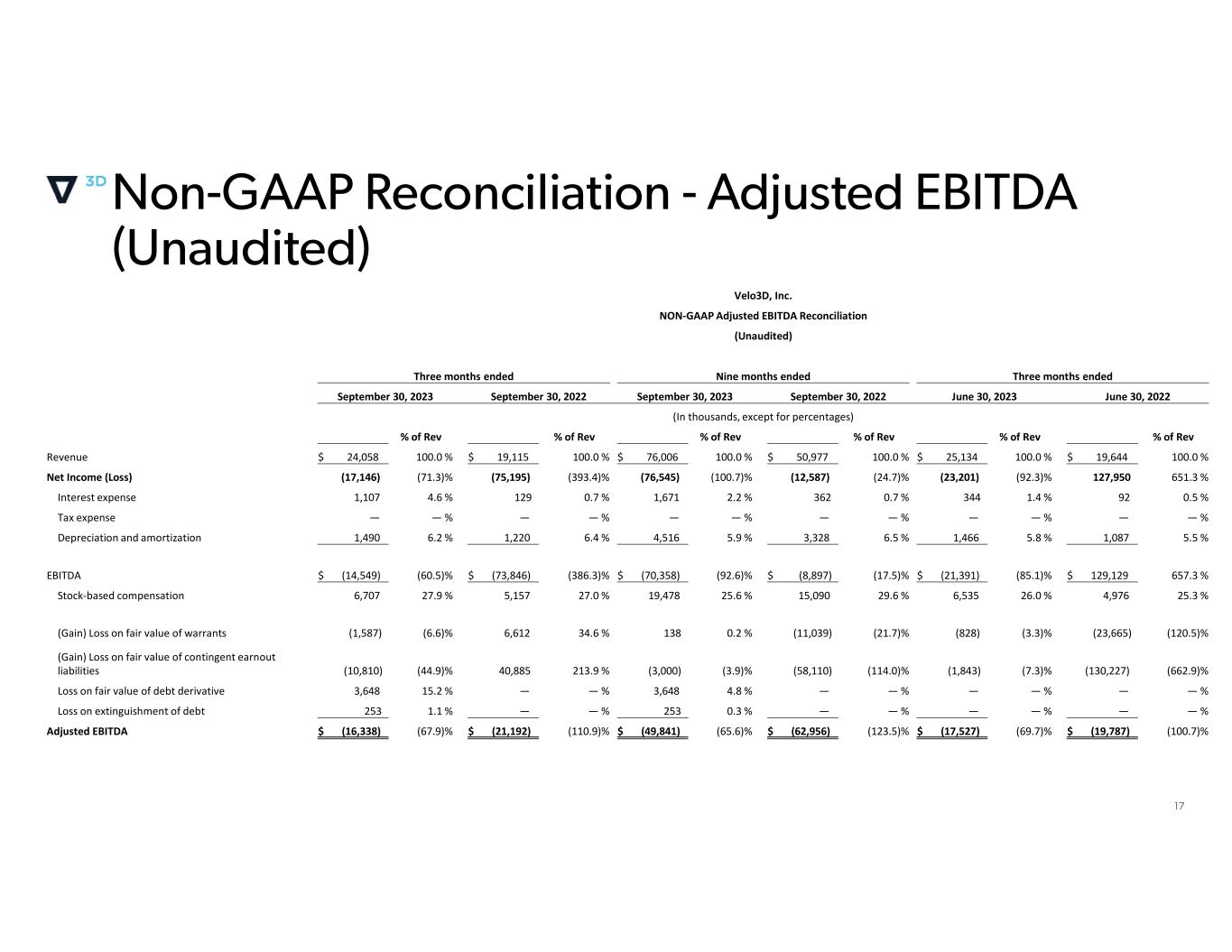

Velo3D, Inc. NON-GAAP Adjusted EBITDA Reconciliation (Unaudited) Three months endedNine months endedThree months ended June 30, 2022June 30, 2023September 30, 2022September 30, 2023September 30, 2022September 30, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,644 100.0 %$ 25,134 100.0 %$ 50,977 100.0 %$ 76,006 100.0 %$ 19,115 100.0 %$ 24,058 Revenue 651.3 %127,950(92.3)%(23,201)(24.7)%(12,587)(100.7)%(76,545)(393.4)%(75,195)(71.3)%(17,146)Net Income (Loss) 0.5 %921.4 %3440.7 %3622.2 %1,6710.7 %1294.6 %1,107Interest expense — %—— %—— %—— %—— %—— %—Tax expense 5.5 %1,0875.8 %1,4666.5 %3,3285.9 %4,5166.4 %1,2206.2 %1,490Depreciation and amortization 657.3 %$ 129,129 (85.1)%$ (21,391)(17.5)%$ (8,897)(92.6)%$ (70,358)(386.3)%$ (73,846)(60.5)%$ (14,549)EBITDA 25.3 %4,97626.0 %6,53529.6 %15,09025.6 %19,47827.0 %5,15727.9 %6,707Stock-based compensation (120.5)%(23,665)(3.3)%(828)(21.7)%(11,039)0.2 %13834.6 %6,612(6.6)%(1,587)(Gain) Loss on fair value of warrants (662.9)%(130,227)(7.3)%(1,843)(114.0)%(58,110)(3.9)%(3,000)213.9 %40,885(44.9)%(10,810) (Gain) Loss on fair value of contingent earnout liabilities — %—— %—— %—4.8 %3,648— %—15.2 %3,648Loss on fair value of debt derivative — %—— %—— %—0.3 %253— %—1.1 %253Loss on extinguishment of debt (100.7)%$ (19,787)(69.7)%$ (17,527)(123.5)%$ (62,956)(65.6)%$ (49,841)(110.9)%$ (21,192)(67.9)%$ (16,338)Adjusted EBITDA

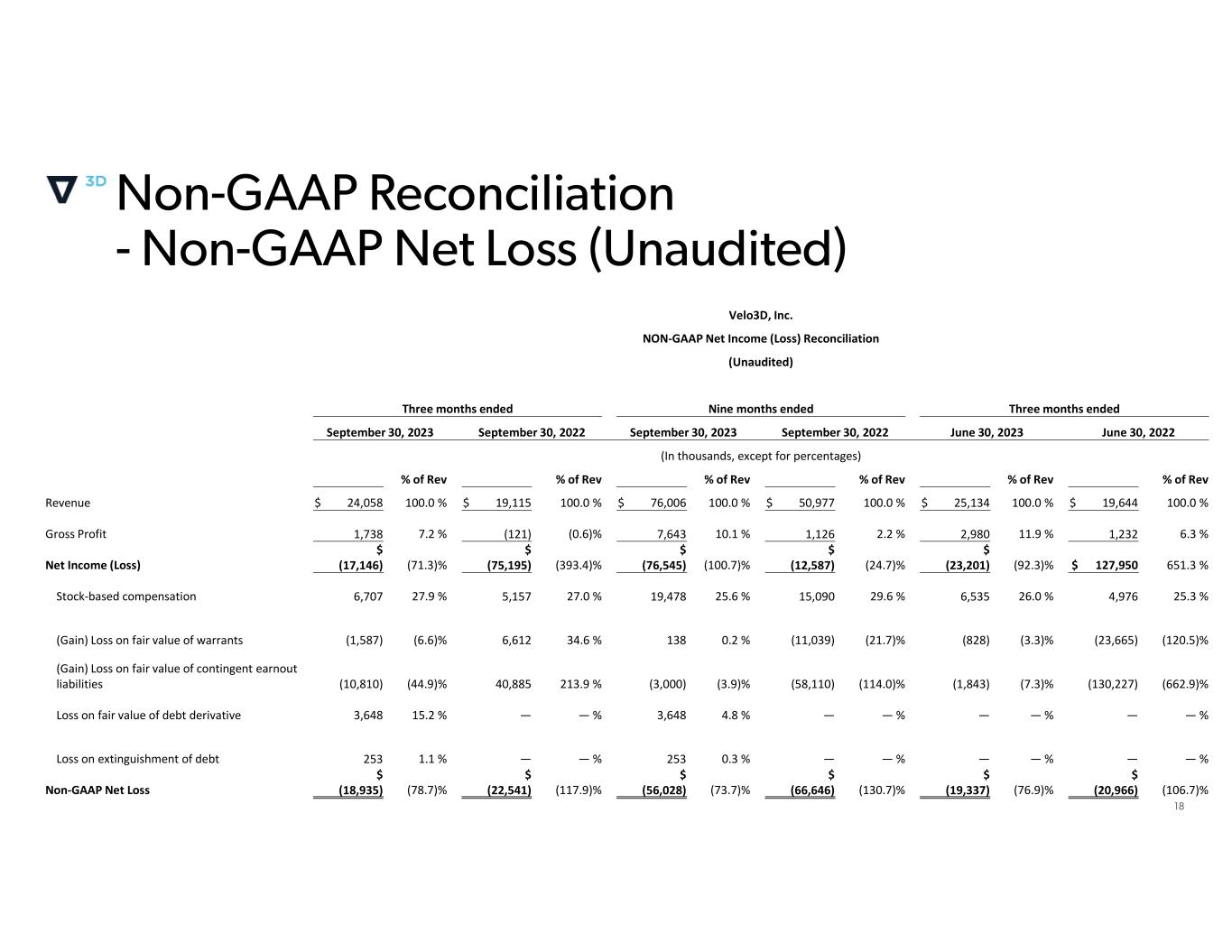

Velo3D, Inc. NON-GAAP Net Income (Loss) Reconciliation (Unaudited) Three months endedNine months endedThree months ended June 30, 2022June 30, 2023September 30, 2022September 30, 2023September 30, 2022September 30, 2023 (In thousands, except for percentages) % of Rev% of Rev% of Rev% of Rev% of Rev% of Rev 100.0 %$ 19,644 100.0 %$ 25,134 100.0 %$ 50,977 100.0 %$ 76,006 100.0 %$ 19,115 100.0 %$ 24,058 Revenue 6.3 %1,23211.9 %2,9802.2 %1,12610.1 %7,643(0.6)%(121)7.2 %1,738Gross Profit 651.3 %$ 127,950 (92.3)% $ (23,201)(24.7)% $ (12,587)(100.7)% $ (76,545)(393.4)% $ (75,195)(71.3)% $ (17,146)Net Income (Loss) 25.3 %4,97626.0 %6,53529.6 %15,09025.6 %19,47827.0 %5,15727.9 %6,707Stock-based compensation (120.5)%(23,665)(3.3)%(828)(21.7)%(11,039)0.2 %13834.6 %6,612(6.6)%(1,587)(Gain) Loss on fair value of warrants (662.9)%(130,227)(7.3)%(1,843)(114.0)%(58,110)(3.9)%(3,000)213.9 %40,885(44.9)%(10,810) (Gain) Loss on fair value of contingent earnout liabilities — %—— %—— %—4.8 %3,648— %—15.2 %3,648Loss on fair value of debt derivative — %—— %—— %—0.3 %253— %—1.1 %253Loss on extinguishment of debt (106.7)% $ (20,966)(76.9)% $ (19,337)(130.7)% $ (66,646)(73.7)% $ (56,028)(117.9)% $ (22,541)(78.7)% $ (18,935)Non-GAAP Net Loss