Third Quarter 2021 Supplementary Slides Without Compromise N O V E M B E R 9 , 2 0 2 1 Exhibit 99.2

Disclaimer 2 Forward Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. The Company’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, the Company’s guidance for full year 2021 (including the Company’s estimates for revenue, total Sapphire shipments, total Sapphire bookings, total Sapphire XC backlog and new customer additions), the Company’s revenue forecast for 2022 and its ability to achieve such forecast, the timing of the Company’s first Sapphire XC shipment, the timing of the Company’s manufacturing facility expansion, the Company’s ability to meet demand forecasts through 2024, the anticipated financial impacts of the merger transaction with JAWS Spitfire, the expected benefits of the Company’s investments, the Company’s expectations regarding its capital requirements, and the Company’s other expectations, hopes, beliefs, intentions or strategies for the future. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the definitive proxy statement/prospectus relating to the business combination (the “Proxy Statement/Prospectus”), which was filed by JAWS Spitfire with the SEC on September 8, 2021 and the other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Most of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the inability to recognize the anticipated benefits of the merger transaction, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key employees; (2) costs related to the merger transaction; (3) changes in the applicable laws or regulations; (4) the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; (5) the impact of the global COVID-19 pandemic; and (6) other risks and uncertainties indicated from time to time described in the Proxy Statement/Prospectus, including those under “Risk Factors” therein, and in the Company’s other filings with the SEC. The Company cautions that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. The Company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. * Additional information on the use of Non-GAAP financial information, industry and market data and trademarks is included in the appendix of this presentation

Benny Buller CEO N O V E M B E R 9 , 2 0 2 1

VELO3D at a Glance 4 C O M P A N Y O V E R V I E W • Founded in 2014 - differentiated additive manufacturing (AM) technology • Scalable solutions that deliver complex, high-value, mission critical metal parts • Significant market opportunity - not accessible by commodity AM competition • Technology offers wide breadth of design capabilities for multiple industries • Complete end to end AM solution • Strong partnerships with SpaceX, Honeywell, Lam Research

VELO3D Product Family 5 Flow™: Print Preparation SW Assure™: Quality Validation Software O N E S O F T W A R E / P R O C E S S P L A T F O R M D R I V I N G A L L P R I N T E R S … Sapphire® Shipping Now Base Printer Sapphire® 1MZ For Tall Parts up to 1M Sapphire® XC Ships Q4’21 Production and Parts Volume Scale 3x lower parts cost 5x larger parts volume

S P A C E A V I A T I O N / D E F E N S E E N E R G Y O T H E R Diverse Customer Base: Space, Aviation, Energy 6 LEADING JET ENGINE MANUFACTURER

Long Term Growth Drivers 7 “Blue ocean” market - $20B+ high value metal part opportunity*1 Land and expand strategy – production applications drive repeat buys 2 New product expansion – full stack solutions for OEM / CM3 Maintain fast growth of customer base – replicate US success globally 4 * Company estimate of size of its AM solutions market as of 2030

Q3 2021

Q3 and YTD1 2021 Highlights • Successfully completed merger with JAWS Spitfire • Strong revenue growth – 22% sequential increase • Shipments up 50% YTD – 15 in 2021 vs 10 in 2020 • Record Q3 bookings - 10 systems in Q3 vs 6 in Q2 • 24 bookings YTD1 through October – achieved full year 2021 plan • Market expansion into Europe – first system shipped to EU customer • Sapphire XC development on track – first customer parts printed in Q3 • Large 2022 backlog – 17 XC firm orders, $85M total orders/pre- orders2 9 1. Year to Date (YTD) data reflects the first 9 months of the respective fiscal year unless otherwise noted 2. $2M to be delivered in 2021

Rapid adoption of Velo3D technology by expanding customer base • Significant increase in end use parts customers – doubled to >100 customers YTD • Reflects broadening market recognition of Velo3D technology’s unique value Increasing parts demand from space, aerospace and energy industries • Significant parts demand growth in Q3 • Velo3D technology critical to several active rocket engine/space programs • Expanding presence in jet engine / aerospace programs – interest by major aerospace OEM’s in qualifying Velo3D technology • Expanding customer base and applications in energy sector – parts currently in use with major energy companies. Contract manufacturers ramping investment in Velo3D systems – 4 shipments in Q3 • Driven by attractive economics and confidence in market for Velo3D technology Key Revenue Drivers - Q3 / 2021 10

Expanding New Customer Adoption in 2021 11 • 12 new system customers in 2021 YTD - 9 shipped and 3 booked • Leading companies in key verticals • Space – Aerojet, Relativity Space, Launcher • Aerospace – Chromalloy, Innoveering, Primus, Major Defense Prime • Contract manufacturers / Other – ADDMAN, Vertex, Wagner, 3D PC • Energy – Schoeller Bleckmann Oilfield Technology • Significant growth in new parts customers • Demonstrates rapid adoption of Velo3D technology - broad range of sectors

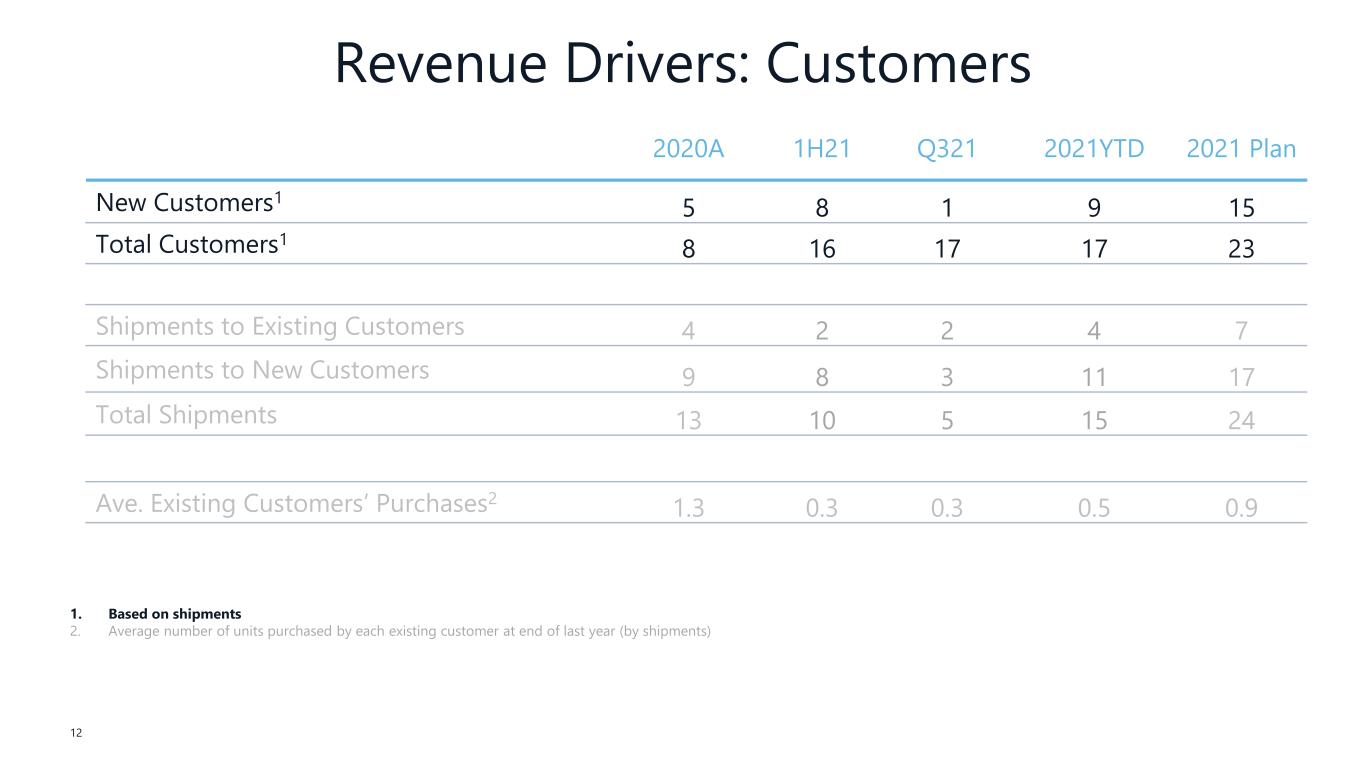

Revenue Drivers: Customers 12 2020A 1H21 Q321 2021YTD 2021 Plan New Customers1 5 8 1 9 15 Total Customers1 8 16 17 17 23 Shipments to Existing Customers 4 2 2 4 7 Shipments to New Customers 9 8 3 11 17 Total Shipments 13 10 5 15 24 Ave. Existing Customers’ Purchases2 1.3 0.3 0.3 0.5 0.9 1. Based on shipments 2. Average number of units purchased by each existing customer at end of last year (by shipments)

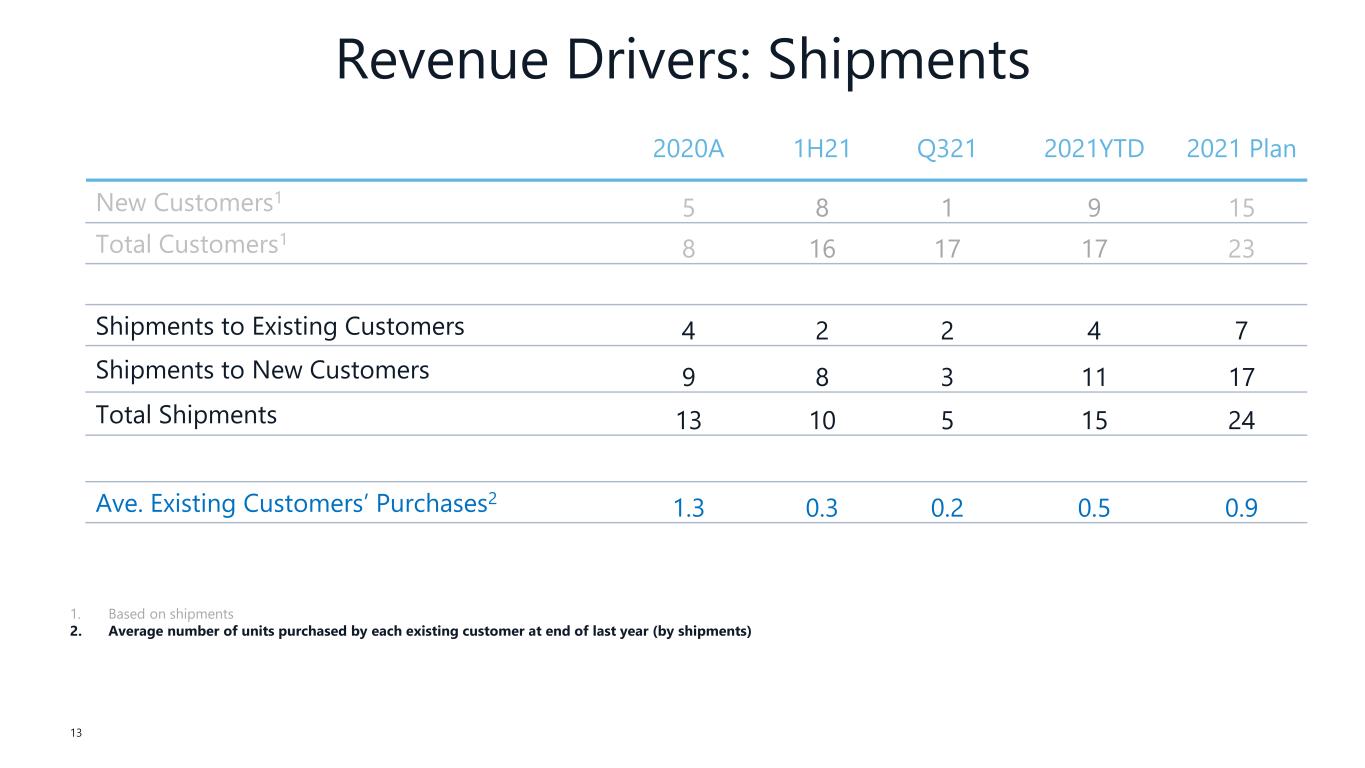

Revenue Drivers: Shipments 13 2020A 1H21 Q321 2021YTD 2021 Plan New Customers1 5 8 1 9 15 Total Customers1 8 16 17 17 23 Shipments to Existing Customers 4 2 2 4 7 Shipments to New Customers 9 8 3 11 17 Total Shipments 13 10 5 15 24 Ave. Existing Customers’ Purchases2 1.3 0.3 0.2 0.5 0.9 1. Based on shipments 2. Average number of units purchased by each existing customer at end of last year (by shipments)

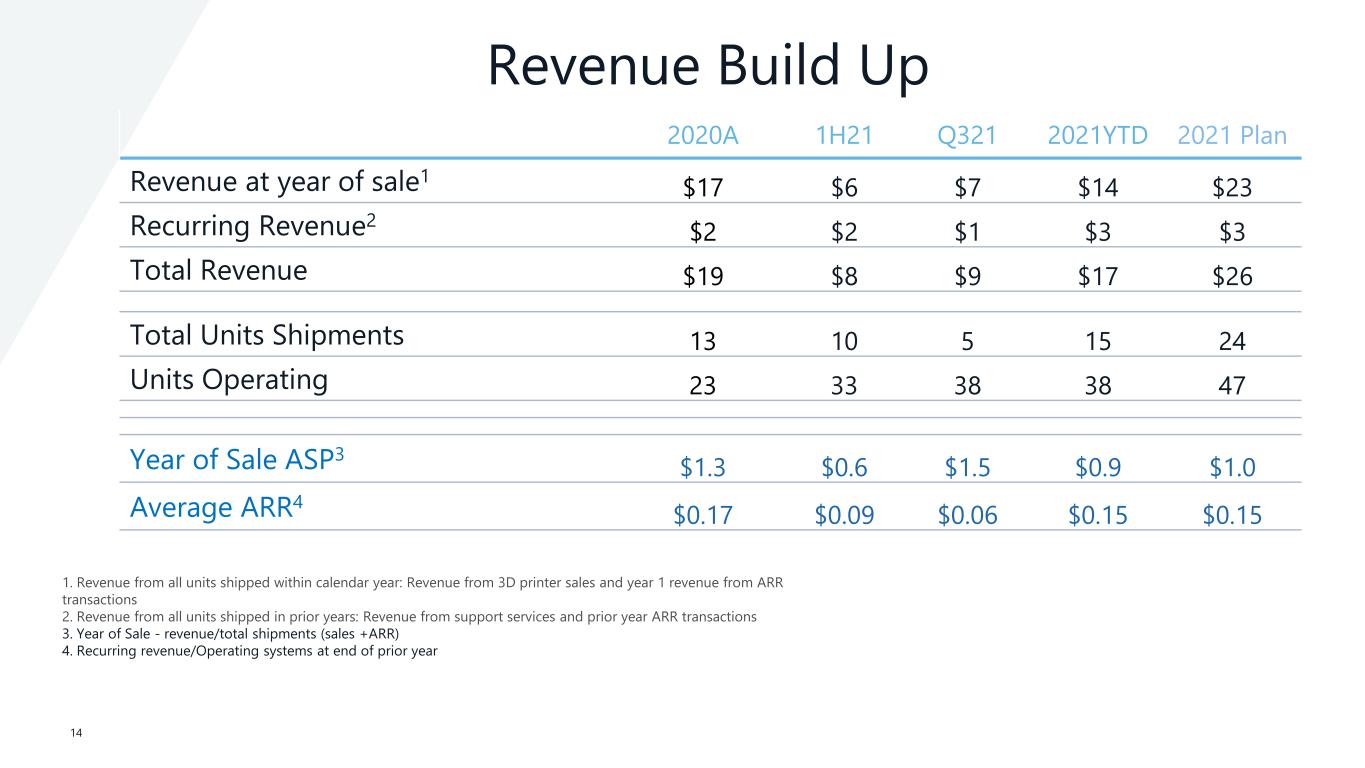

Revenue Build Up 14 2020A 1H21 Q321 2021YTD 2021 Plan Revenue at year of sale1 $17 $6 $7 $14 $23 Recurring Revenue2 $2 $2 $1 $3 $3 Total Revenue $19 $8 $9 $17 $26 Total Units Shipments 13 10 5 15 24 Units Operating 23 33 38 38 47 Year of Sale ASP3 $1.3 $0.6 $1.5 $0.9 $1.0 Average ARR4 $0.17 $0.09 $0.06 $0.15 $0.15 1. Revenue from all units shipped within calendar year: Revenue from 3D printer sales and year 1 revenue from ARR transactions 2. Revenue from all units shipped in prior years: Revenue from support services and prior year ARR transactions 3. Year of Sale - revenue/total shipments (sales +ARR) 4. Recurring revenue/Operating systems at end of prior year

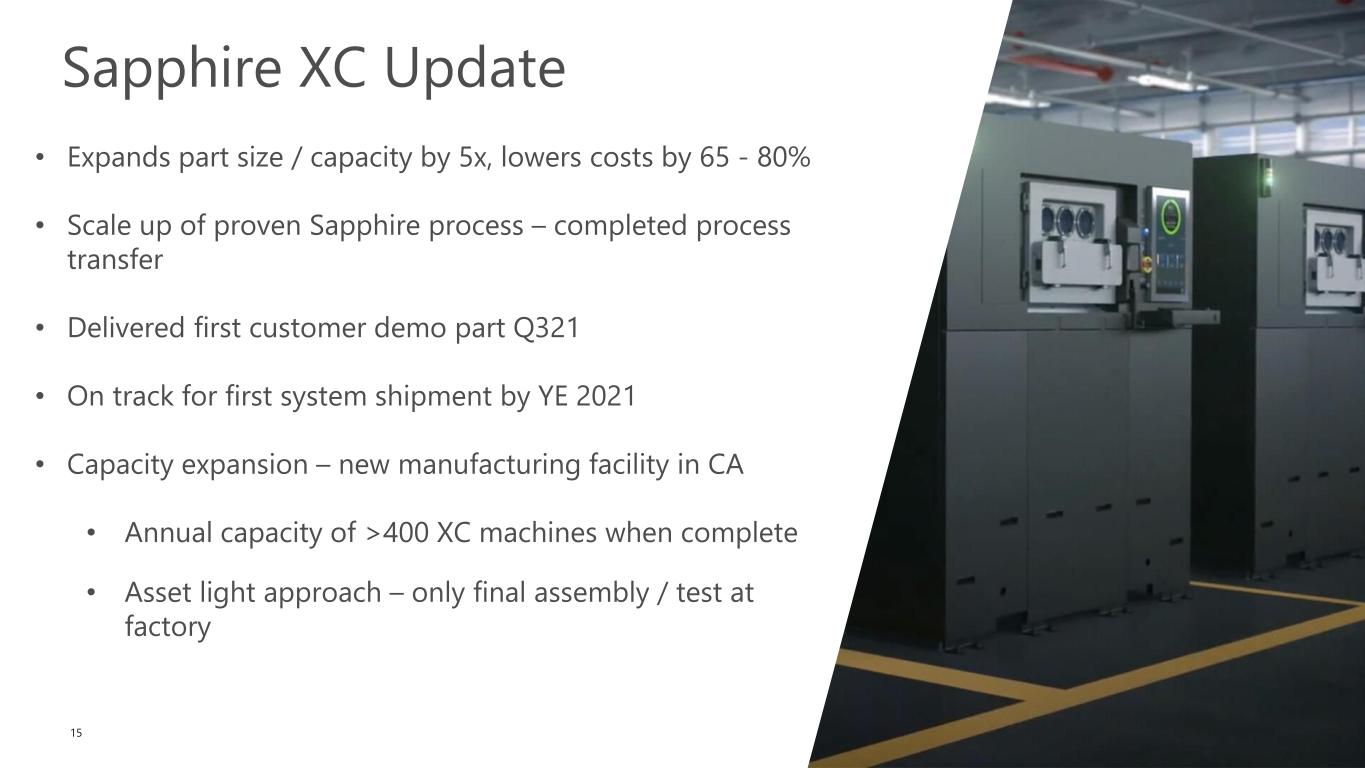

• Expands part size / capacity by 5x, lowers costs by 65 - 80% • Scale up of proven Sapphire process – completed process transfer • Delivered first customer demo part Q321 • On track for first system shipment by YE 2021 • Capacity expansion – new manufacturing facility in CA • Annual capacity of >400 XC machines when complete • Asset light approach – only final assembly / test at factory Sapphire XC Update 15

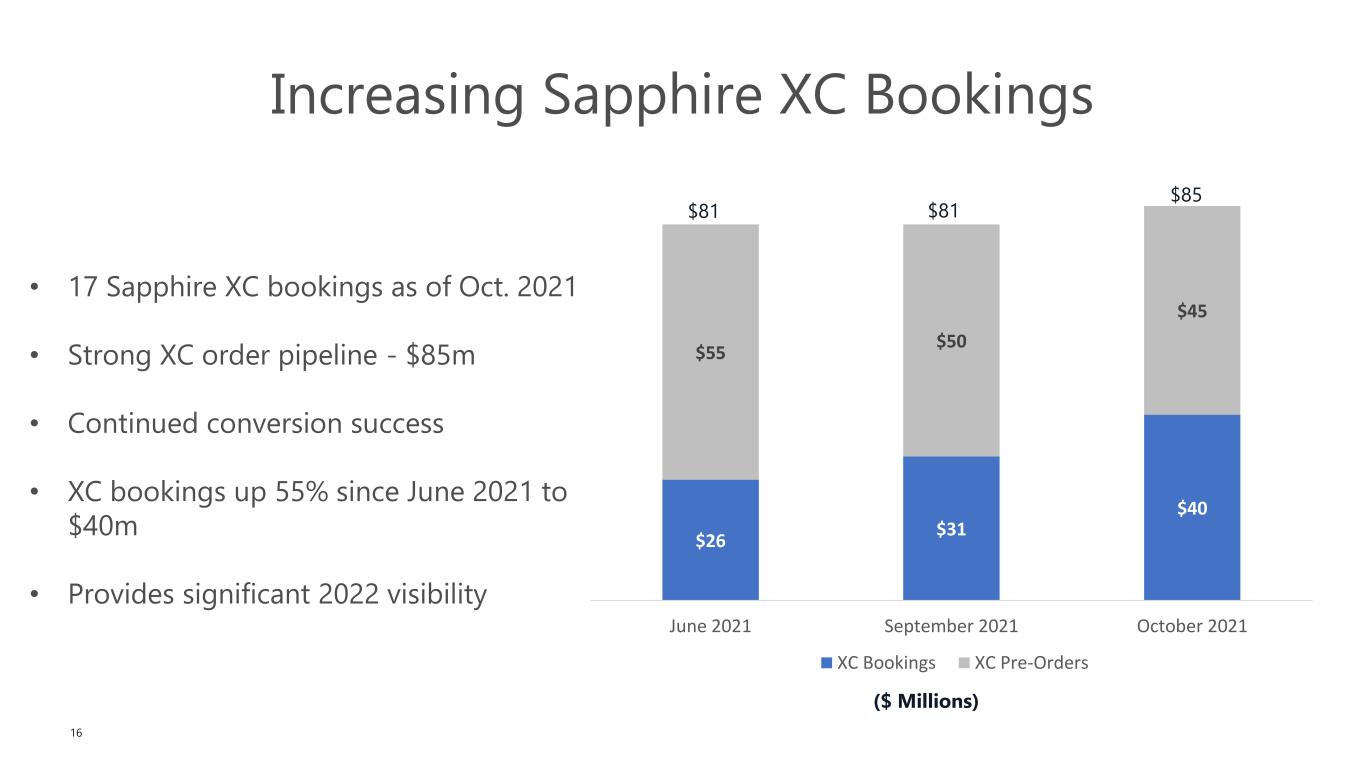

$26 $31 $40 $55 $50 $45 June 2021 September 2021 October 2021 XC Bookings XC Pre-Orders Increasing Sapphire XC Bookings 16 • 17 Sapphire XC bookings as of Oct. 2021 • Strong XC order pipeline - $85m • Continued conversion success • XC bookings up 55% since June 2021 to $40m • Provides significant 2022 visibility $81 $81 $85 ($ Millions)

Bill McCombe CFO N O V E M B E R 9 , 2 0 2 1

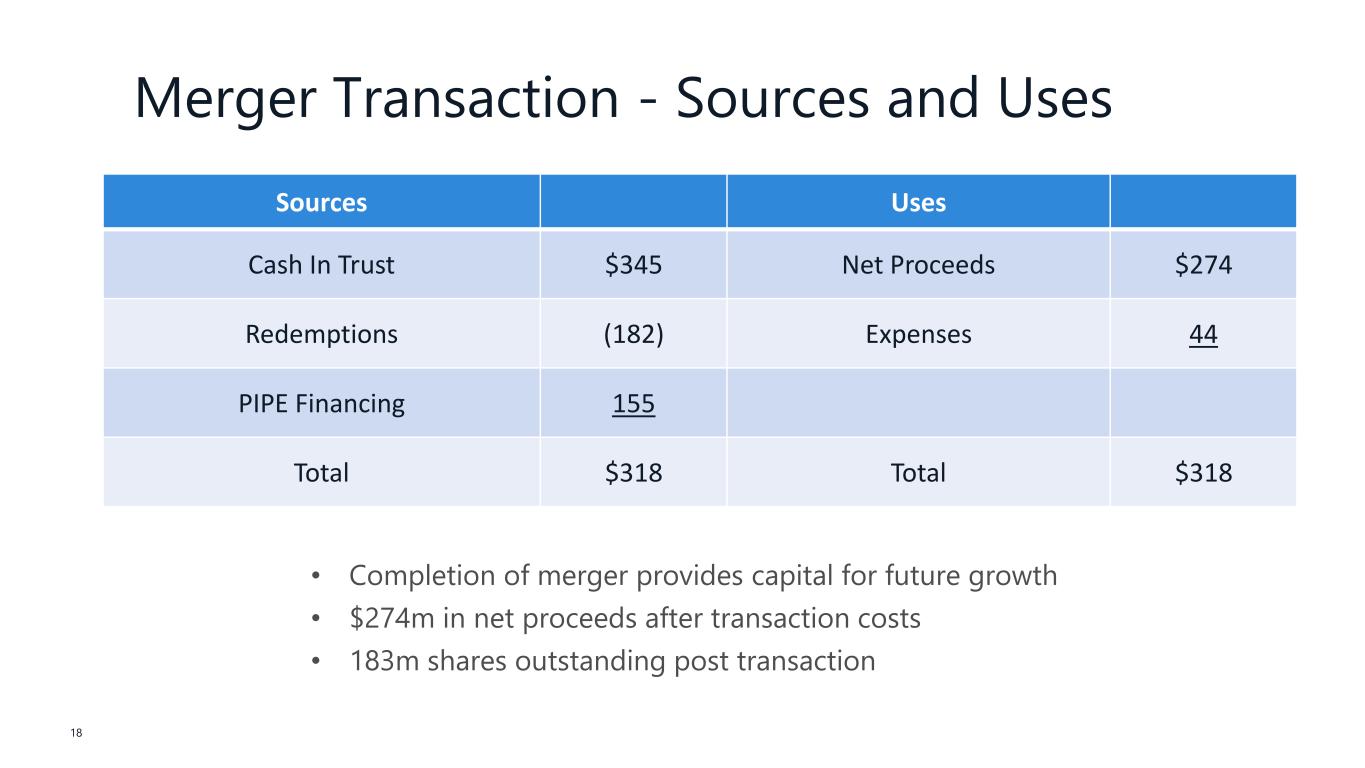

Merger Transaction - Sources and Uses • Completion of merger provides capital for future growth • $274m in net proceeds after transaction costs • 183m shares outstanding post transaction Sources Uses Cash In Trust $345 Net Proceeds $274 Redemptions (182) Expenses 44 PIPE Financing 155 Total $318 Total $318 18

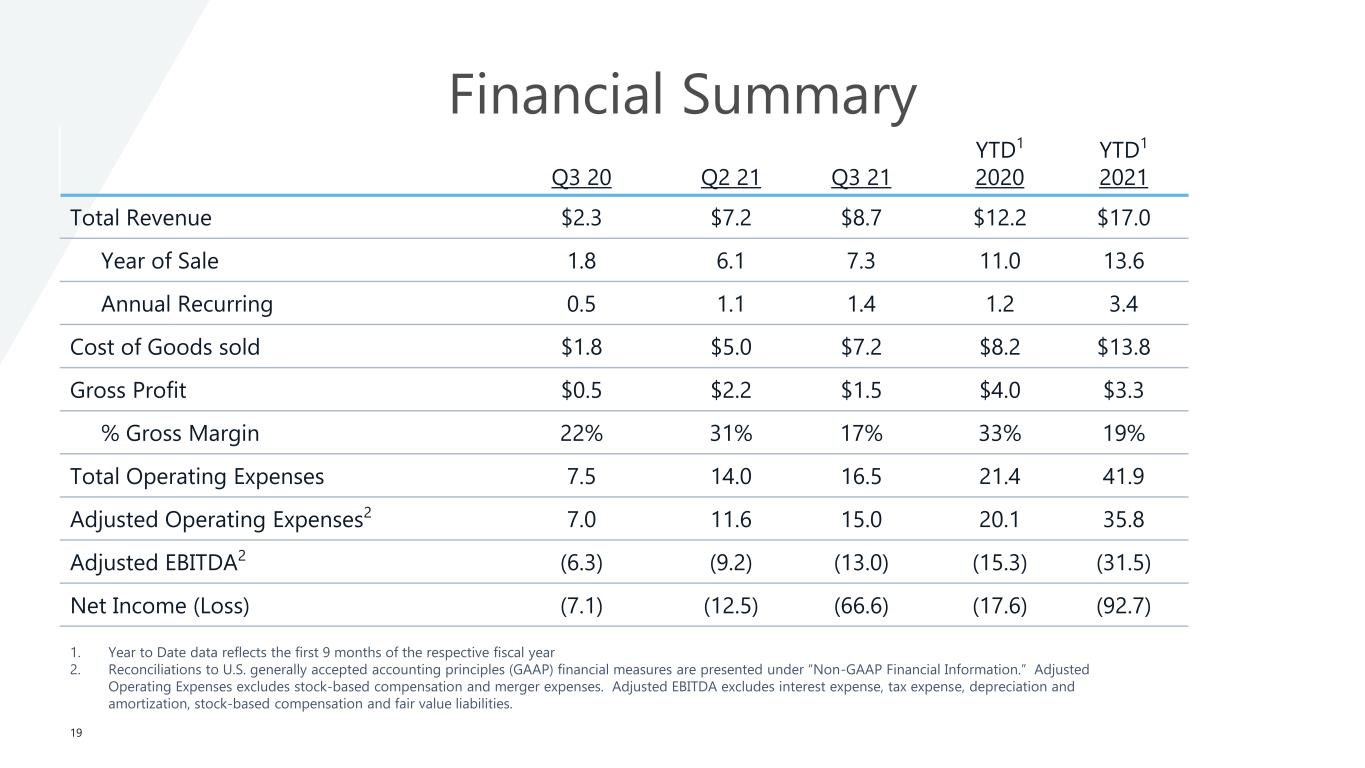

Financial Summary 19 Q3 20 Q2 21 Q3 21 YTD1 2020 YTD1 2021 Total Revenue $2.3 $7.2 $8.7 $12.2 $17.0 Year of Sale 1.8 6.1 7.3 11.0 13.6 Annual Recurring 0.5 1.1 1.4 1.2 3.4 Cost of Goods sold $1.8 $5.0 $7.2 $8.2 $13.8 Gross Profit $0.5 $2.2 $1.5 $4.0 $3.3 % Gross Margin 22% 31% 17% 33% 19% Total Operating Expenses 7.5 14.0 16.5 21.4 41.9 Adjusted Operating Expenses2 7.0 11.6 15.0 20.1 35.8 Adjusted EBITDA2 (6.3) (9.2) (13.0) (15.3) (31.5) Net Income (Loss) (7.1) (12.5) (66.6) (17.6) (92.7) 1. Year to Date data reflects the first 9 months of the respective fiscal year 2. Reconciliations to U.S. generally accepted accounting principles (GAAP) financial measures are presented under “Non-GAAP Financial Information.” Adjusted Operating Expenses excludes stock-based compensation and merger expenses. Adjusted EBITDA excludes interest expense, tax expense, depreciation and amortization, stock-based compensation and fair value liabilities.

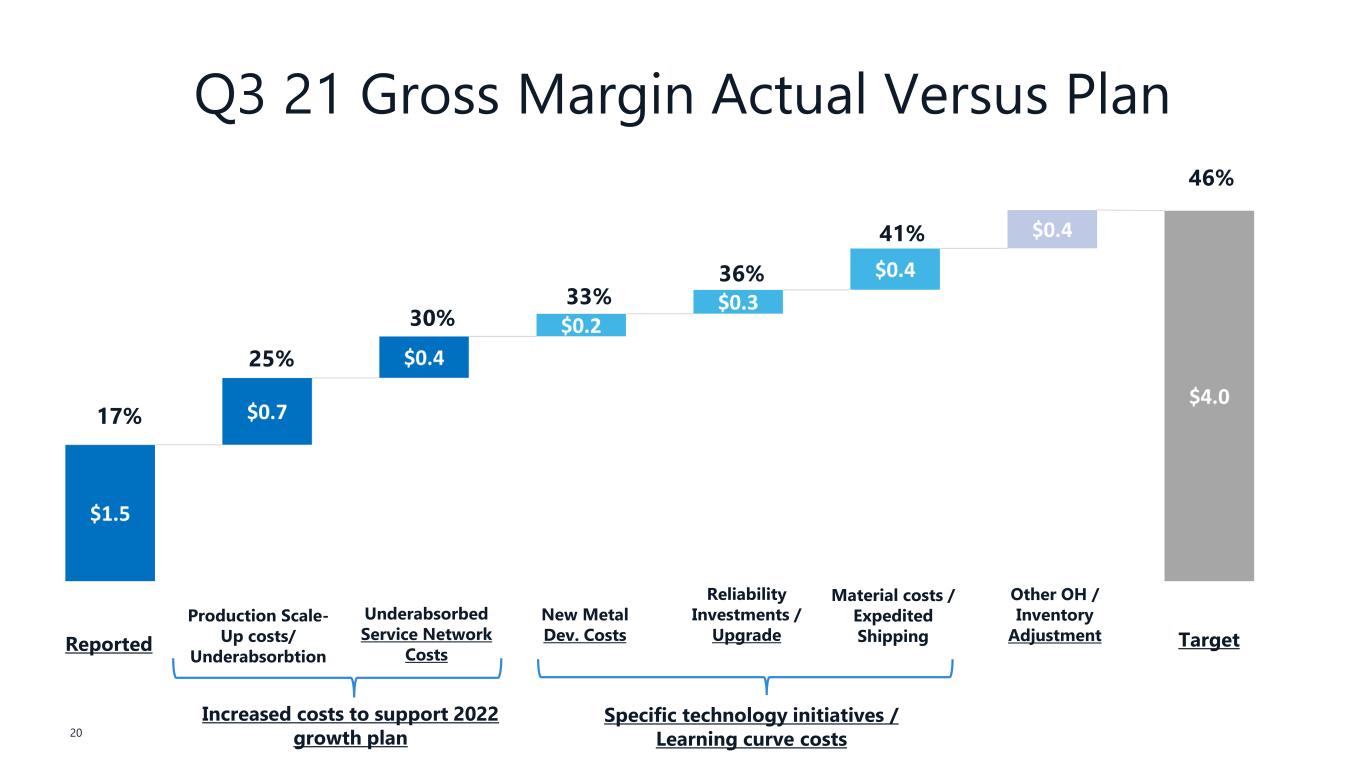

Q3 21 Gross Margin Actual Versus Plan 20 17% 30% 36% 46% Reported Production Scale- Up costs/ Underabsorbtion New Metal Dev. Costs Material costs / Expedited Shipping Other OH / Inventory Adjustment Target 25% 41% 33% Reliability Investments / Upgrade Underabsorbed Service Network Costs Increased costs to support 2022 growth plan Specific technology initiatives / Learning curve costs

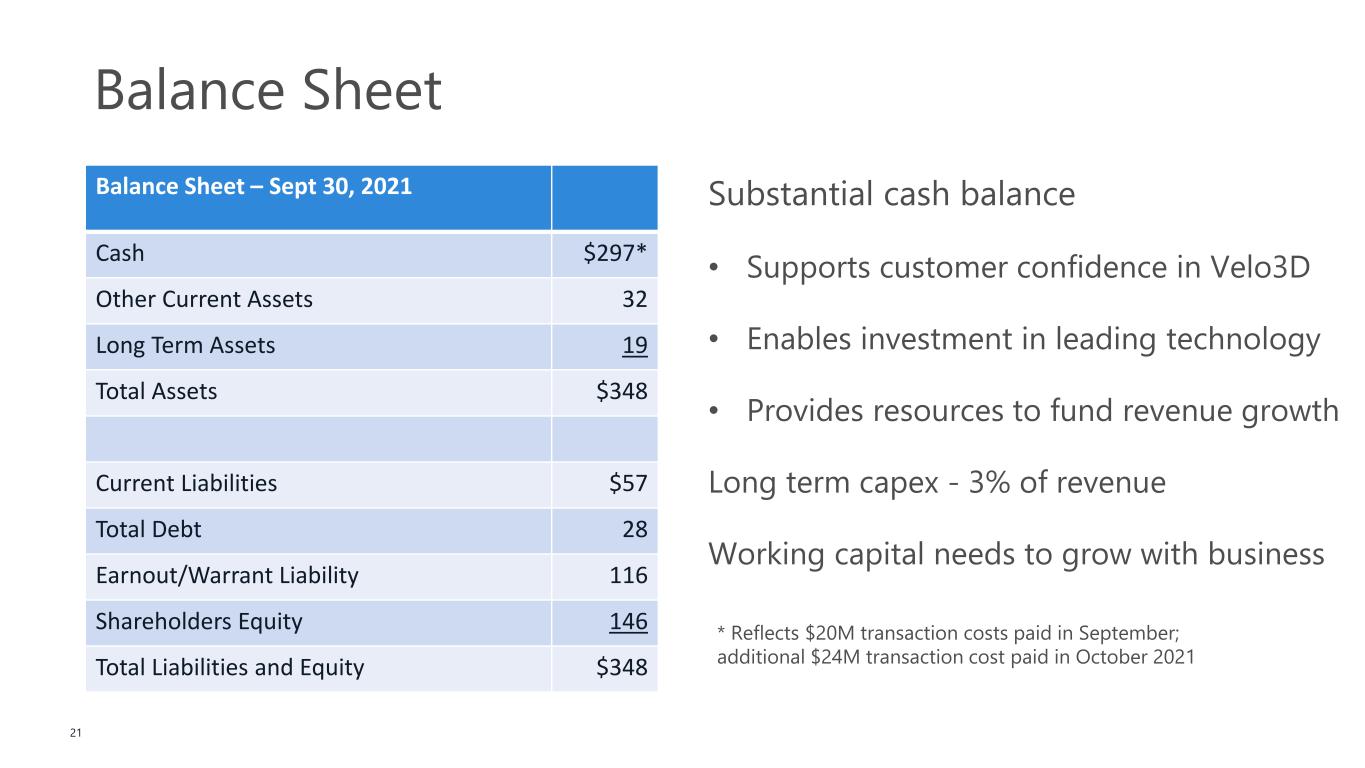

Balance Sheet Balance Sheet – Sept 30, 2021 Cash $297* Other Current Assets 32 Long Term Assets 19 Total Assets $348 Current Liabilities $57 Total Debt 28 Earnout/Warrant Liability 116 Shareholders Equity 146 Total Liabilities and Equity $348 21 Substantial cash balance • Supports customer confidence in Velo3D • Enables investment in leading technology • Provides resources to fund revenue growth Long term capex - 3% of revenue Working capital needs to grow with business * Reflects $20M transaction costs paid in September; additional $24M transaction cost paid in October 2021

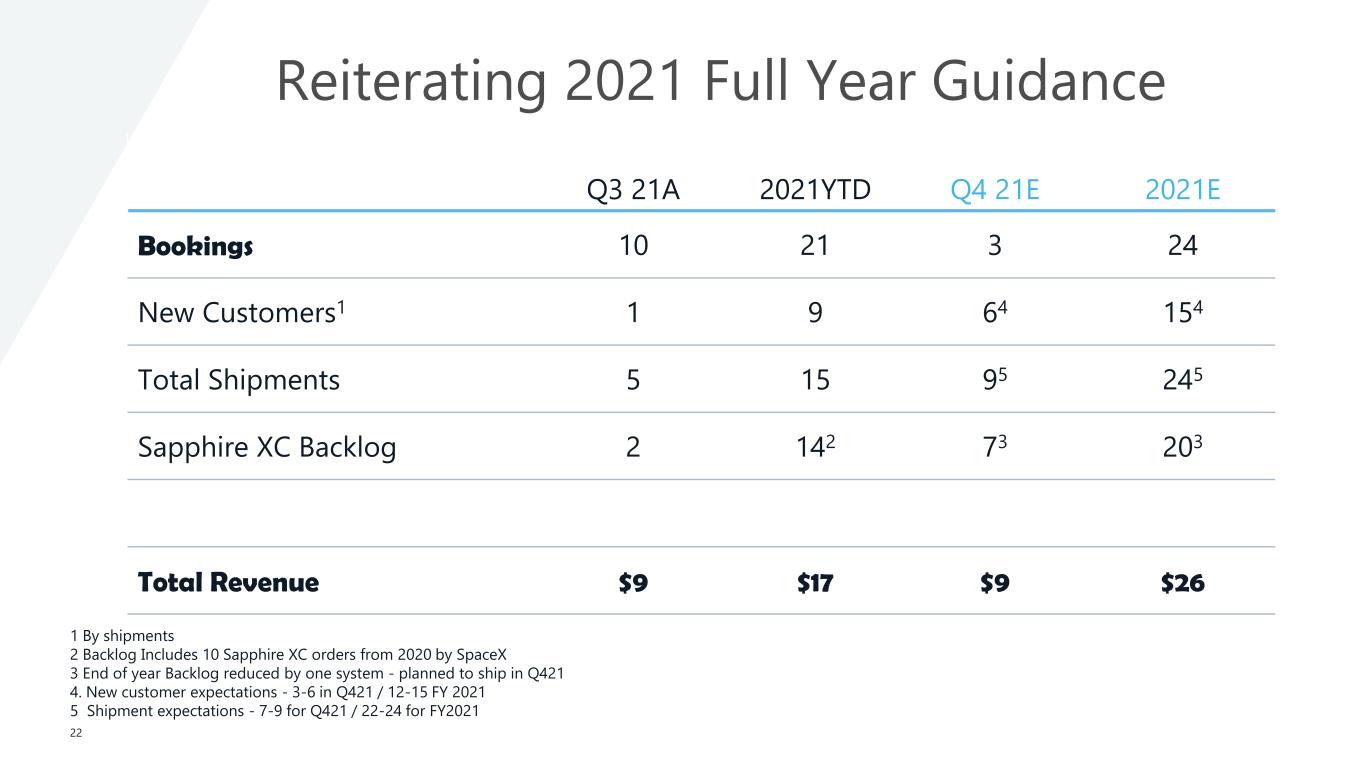

Reiterating 2021 Full Year Guidance 22 Q3 21A 2021YTD Q4 21E 2021E Bookings 10 21 3 24 New Customers1 1 9 64 154 Total Shipments 5 15 95 245 Sapphire XC Backlog 2 142 73 203 Total Revenue $9 $17 $9 $26 1 By shipments 2 Backlog Includes 10 Sapphire XC orders from 2020 by SpaceX 3 End of year Backlog reduced by one system - planned to ship in Q421 4. New customer expectations - 3-6 in Q421 / 12-15 FY 2021 5 Shipment expectations - 7-9 for Q421 / 22-24 for FY2021

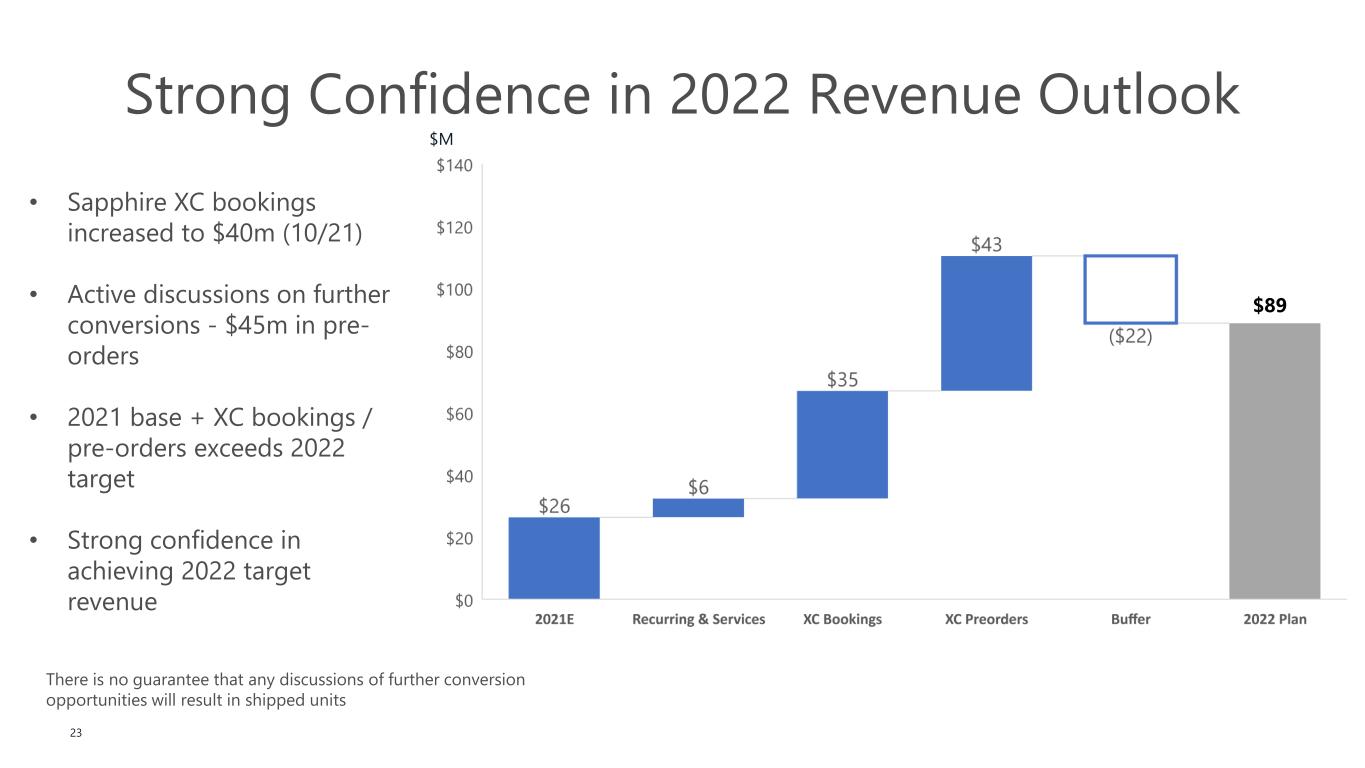

Strong Confidence in 2022 Revenue Outlook 23 • Sapphire XC bookings increased to $40m (10/21) • Active discussions on further conversions - $45m in pre- orders • 2021 base + XC bookings / pre-orders exceeds 2022 target • Strong confidence in achieving 2022 target revenue $89 $M There is no guarantee that any discussions of further conversion opportunities will result in shipped units

Q&A

Appendix info@velo3d.com

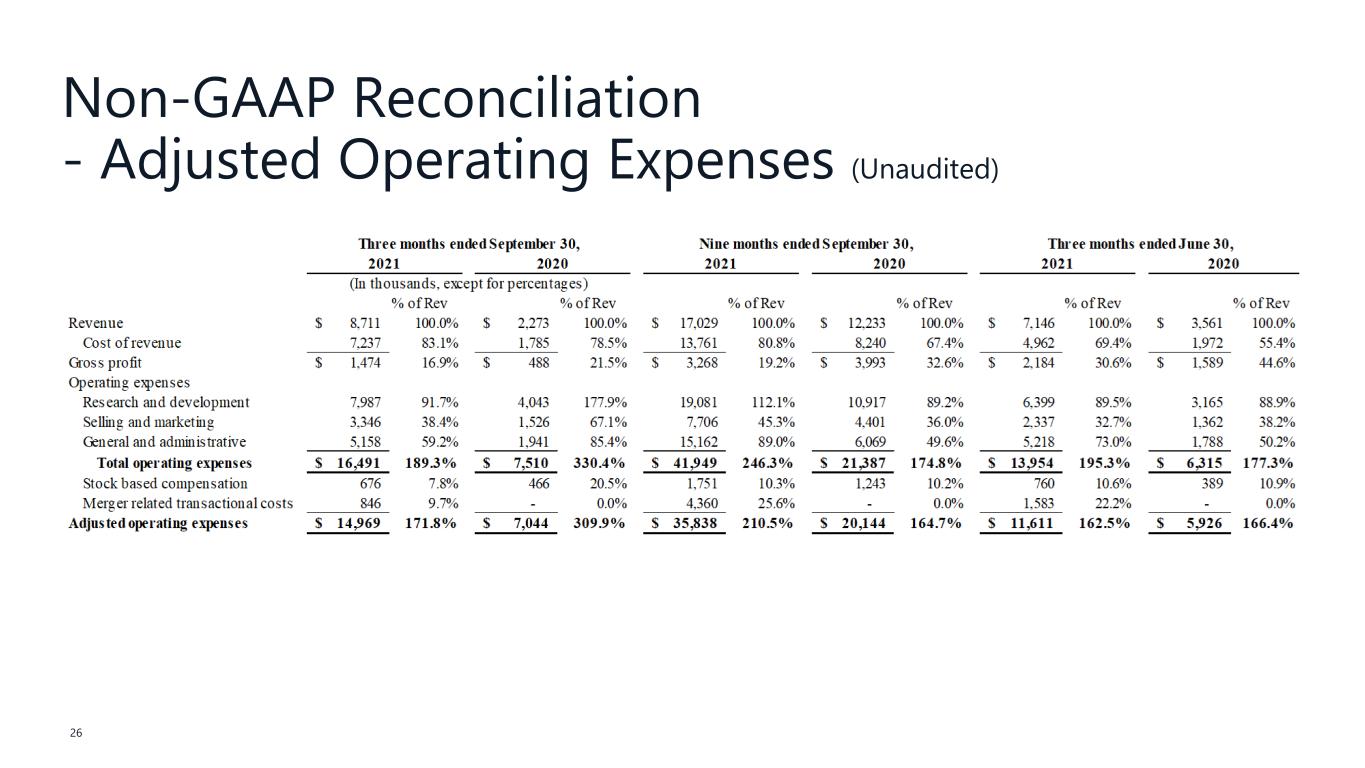

Non-GAAP Reconciliation - Adjusted Operating Expenses (Unaudited) 26

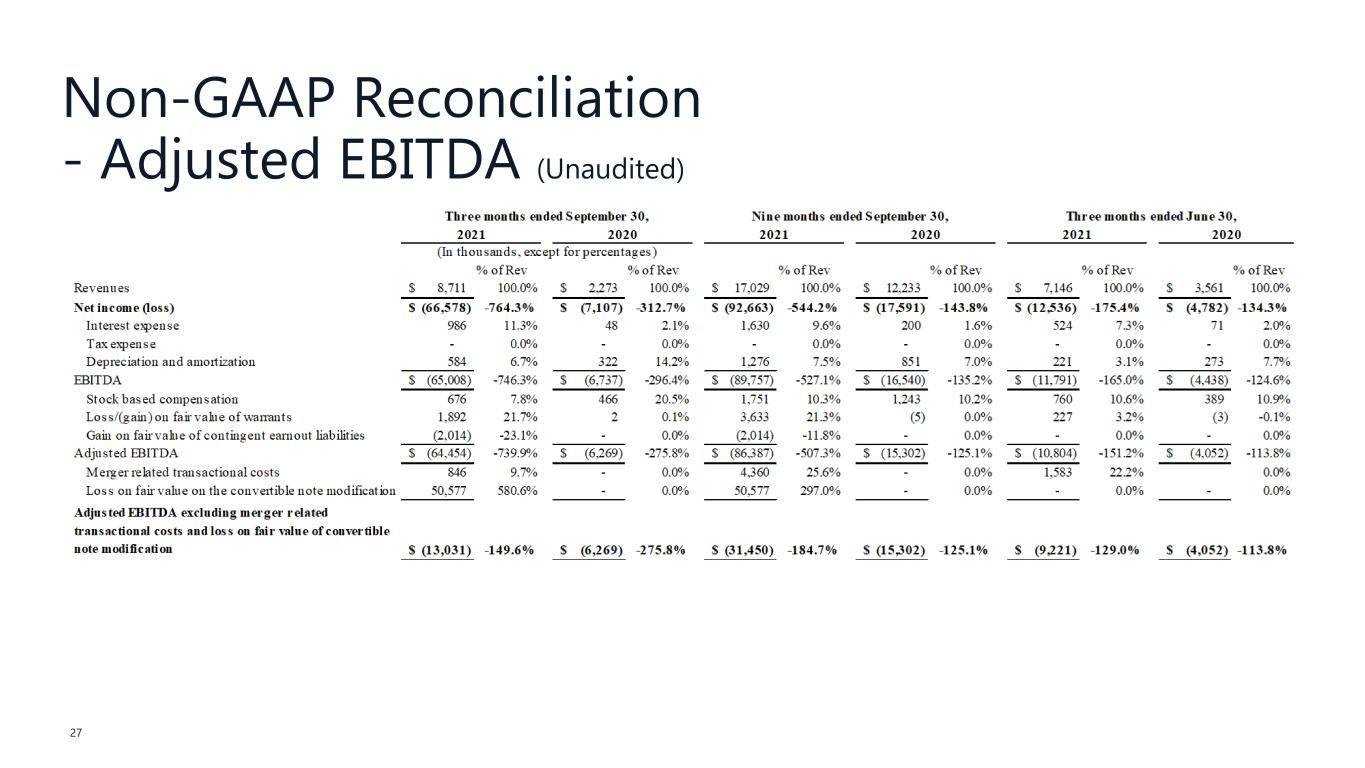

Non-GAAP Reconciliation - Adjusted EBITDA (Unaudited) 27

Non-GAAP Reconciliation - Non-GAAP Net Income (Loss) (Unaudited) 28

Disclaimer 29 Industry and Market Data In this presentation, the Company relies on and refers to publicly available information and statistics regarding the market in which the Company competes and other industry data. The Company obtained this information and statistics from third-party sources, including reports by market research firms and company filings. While the Company believes such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information. The Company has not independently verified the information provided by third-party sources. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of the respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Non-GAAP Financial Information The Company uses non-GAAP financial measures, such as Adjusted operating expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA excluding merger costs and loss on convertible note extinguishment, and Non-GAAP net income (loss), to help it make strategic decisions, establish budgets and operational goals for managing its business, analyze its financial results and evaluate its performance. The Company also believes that the presentation of these non-GAAP financial measures in this presentation provides an additional tool for investors to use in comparing the Company’s core business and results of operations over multiple periods. However, the non-GAAP financial measures presented in this presentation may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. The non-GAAP financial measures presented in this presentation should not be considered as the sole measure of the Company’s performance and should not be considered in isolation from, or as a substitute for, comparable financial measures calculated in accordance with generally accepted accounting principles accepted in the United States (“GAAP”). For reconciliations of these non-GAAP financial measures to the Company’s GAAP financial measures, see Appendix A to this presentation. You should review these reconciliations and not rely on any single financial measure to evaluate the Company business.

Third Quarter 2021 Supplementary Slides Without Compromise N O V E M B E R 9 , 2 0 2 1