Our software is fully integrated into the design, production and quality control platform with our Sapphire and Sapphire XC systems. All our data flows are fully encrypted to ensure protection of our customers’ sensitive information.

We maintain control of our software systems for products sold under both our 3D printer sale transactions and recurring payment transactions.

Flow

Flow software powers the whole family of Sapphire AM printers. Our systems rely on the same manufacturing process for all of our printer solutions. Flow is a highly advanced and proprietary software platform, which scans part designs for unique geometrical features. It uses advanced computational algorithms to prescribe specific manufacturing “recipes” and processes specific to the Sapphire production systems to ensure that the part is produced with the required specifications.

Sapphire and Sapphire XC

The Sapphire printer system is our first generation production machine. As of June 30, 2021, 33 machines have been shipped and are currently in the field. Sapphire uses PBF technology and supports a build module of 315 millimeter diameter by 400 millimeter tall, and volume of up to 31 liters. Sapphire XC is our newest generation of printer and is expected to start shipping by the end of 2021. XC stands for “extra capacity” and has a larger build module of 600 millimeter diameter by 550 millimeter tall, and volume of up to 155 liters. Sapphire XC is based on the same fundamental design of our original Sapphire printers. The Sapphire XC printer system is designed with the intent that all recipes and parts designed for the original Sapphire printers are fully compatible with the Sapphire XC printer systems, as the new system is designed to carry over processes and metrologies. Sapphire XC will offer up to five times faster production rate and is anticipated to reduce part production costs by 65% to 80%.

Our machines have the ability to make parts with thousands of composite structures, including titanium, nickel-alloys, nickel super alloys, steel and steel alloys. Any metal that is cold-weldable is able to be used as a base layer in our machines. We currently have recipes for nine alloys and add recipes for additional metal alloys based on customer demand.

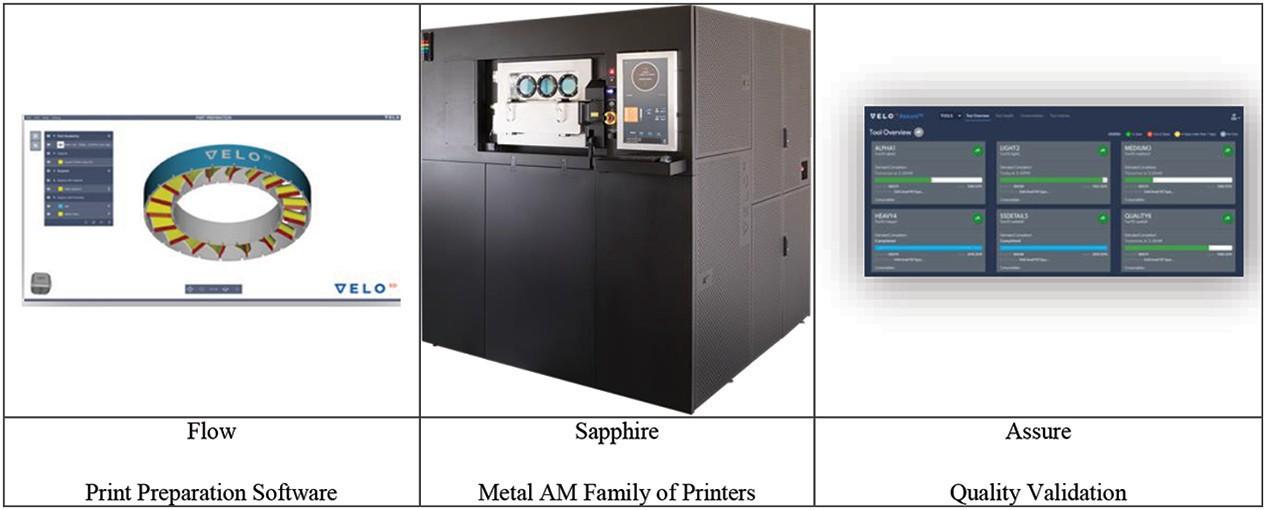

Assure

Assure is an advanced quality control system software platform that includes closed loop process metrologies to ensure repeatable, consistent part quality. The platform works with complex sensors, which allow prompt control modulation of the Sapphire laser systems to calibrate production outcomes within tolerances.

213