Exhibit 99.2

|

Build the Impossible Disruptive 3D Metal Printing for Mass Adoption MA R C H 2021 |

|

Disclaimer This confidential presentation (the “presentation”) is being delivered to you by Jaws Spitfire Acquisition Corporation (“Jaws Spitfire”) and Velo3D, Inc. (“Velo3D”) for use by Velo3D and Jaws Spitfire in connection with their proposed business combination and the offering of the securities of Jaws Spitfire in a private placement (the “Transaction”). This presentation is for information purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in Velo3D. Any reproduction or distribution of this presentation, in whole or in part, or the disclosure of its contents, without the prior consent of Jaws Spitfire or Velo3D is prohibited. By accepting this presentation, each recipient and its directors, partners, officers, employees, attorney(s), agents and representatives (“recipient”) agrees: (i) to maintain the confidentiality of all information that is contained in this presentation and not already in the public domain; and (ii) to return or destroy all copies of this presentation or portions thereof in its possession following the request for the return or destruction of such copies. This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. This presentation is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to presentations prepared for retail investors, including but not limited to historical financial data that has been subject to audit or third party review by an accountant. No Representations and Warranties This presentation is for informational purposes only and does not purport to contain all of the information that may be required to evaluate a possible investment decision with respect to Jaws Spitfire. The recipient agrees and acknowledges that this presentation is not intended to form the basis of any investment decision by the recipient and does not constitute investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by Jaws Spitfire or Velo3D or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy or completeness of the information in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction between Jaws Spitfire and Velo3D and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The recipient also acknowledges and agrees that the information contained in this presentation is preliminary in nature and is subject to change, and any such changes may be material. Jaws Spitfire and Velo3D disclaim any duty to update the information contained in this presentation. Forward-Looking Statements This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. Jaws Spitfire’s and Velo3D’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Jaws Spitfire’s and Velo3D’s expectations with respect to future performance and anticipated financial impacts of the Transaction, the satisfaction of closing conditions to the Transaction and the timing of the completion of the Transaction. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Jaws Spitfire’s registration statement on Form S-1. In addition, there will be risks and uncertainties described in the proxy statement/prospectus on Form S-4 relating to the business combination, which is expected to be filed by Jaws Spitfire with the Securities and Exchange Commission (the “SEC”) and other documents filed by Jaws Spitfire from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward looking statements. Most of these factors are outside Jaws Spitfire’s and Velo3D’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against Jaws Spitfire or Velo3D following the announcement of the Transaction; (2) the inability to complete the Transaction, including due to the inability to concurrently close the business combination and the private placement of common stock or due to failure to obtain approval of the stockholders of Jaws Spitfire; (3) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regular reviews required to complete the Transaction; (4) the risk that the Transaction disrupts current plans and operations as a result of the announcement and consummation of the Transaction; (5) the inability to recognize the anticipated benefits of the Transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key employees; (6) costs related to the Transaction; (7) changes in the applicable laws or regulations; (8) the possibility that the combined company may be adversely affected by other economic, business, and/or competitive factors; (9) the impact of the global COVID-19 pandemic; and (10) other risks and uncertainties indicated from time to time described in Jaws Spitfire’s registration on Form S-1, including those under “Risk Factors” therein, and in Jaws Spitfire’s other filings with the U.S. Securities and Exchange Commission (“SEC”). Jaws Spitfire and Velo3D caution that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. Neither Jaws Spitfire nor Velo3D undertakes or accepts any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Industry and Market Data In this presentation, Jaws Spitfire and Velo3D rely on and refer to publicly available information and statistics regarding market participants in the sectors in which Velo3D competes and other industry data. Any comparison of Velo3D to the industry or to any of its competitors is based on this publicly available information and statistics and such comparisons assume the reliability of the information available to Velo3D. Velo3D obtained this information and statistics from third-party sources, including reports by market research firms and company filings. While Velo3D believes such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated information. Neither Velo3D nor Jaws Spitfire has independently verified the information provided by the third-party sources. Trademarks This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM © or ® symbols, but Jaws Spitfire and Velo3D will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. | Confidential & Proprietary |

|

Disclaimer Private Placement The securities to which this presentation relates have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any other jurisdiction. This presentation relates to securities that Jaws Spitfire intends to offer in reliance on exemptions from the registration requirements of the Securities Act and other applicable laws. These exemptions apply to offers and sales of securities that do not involve a public offering. The securities have not been approved or recommended by any federal, state or foreign securities authorities, nor have any of these authorities passed upon the merits of this offering or determined that this presentation is accurate or complete. Any representation to the contrary is a criminal offense Financial and Other Information The financial information contained in this presentation has been taken from or prepared based on the historical financial statements of Velo3D for the periods presented. An audit of these financial statements is in process. Accordingly, such financial information and data may not be included in, may be adjusted in or may be presented differently in any registration statement to be filed with the SEC by Jaws Spitfire in connection with the Transaction. We have not yet completed our closing procedures for the three months ended December 31, 2020. This presentation contains certain estimated preliminary financial results and key operating metrics for the year ended December 31, 2020. This information is preliminary and subject to change. As such, our actual results may differ from the estimated preliminary results presented here and will not be finalized until we complete of our year-end accounting procedures. This presentation includes certain non-GAAP financial measures (including on a forward-looking basis) such as EBITDA and EBITDA Margin. These non-GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Velo3D believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Velo3D. Velo3D’s management uses forward-looking non-GAAP measures to evaluate Velo3D’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in Velo3D’s financial measures. In addition, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, Velo3D’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Use of Projections This presentation also contains certain financial forecasts, including projected revenue. Neither Jaws Spitfire’s nor Velo3D’s independent auditors have studied, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. In this presentation, certain of the above-mentioned projected information has been provided for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Projections are inherently uncertain due to a number of factors outside of Jaws Spitfire’s or Velo3D’s control. While all financial projections, estimates and targets are necessarily speculative, Jaws Spitfire and Velo3D believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the combined company after the Transaction or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. Participation in Solicitation Jaws Spitfire and Velo3D and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Jaws Spitfire’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Jaws Spitfire’s directors and officers in Jaws Spitfire’s filings with the SEC, including Jaws Spitfire’s registration statement on Form S-1, which was originally filed with the SEC on November 17, 2020. To the extent that holdings of Jaws Spitfire’s securities have changed from the amounts reported in Jaws Spitfire’s registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Jaws Spitfire’s shareholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, which is expected to be filed by Jaws Spitfire with the SEC. Investors and security holders of Jaws Spitfire and Velo3D are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Jaws Spitfire and Velo3D through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Jaws Spitfire can be obtained free of charge by directing a written request to Jaws Spitfire Acquisition Corporation, 1601 Washington Avenue, Suite 800, Miami Beach, FL 33139. | Confidential & Proprietary |

|

JAWS Spitfire Overview JAWS Spitfire team brings an exceptional track record of investing and growing multi-billion dollar platforms in the public markets across a wide industry spectrum JA W S S P IT F IR E W O R L D - CL A S S CA P A B I L I T I ES Proven stewards of investor capital with deep public market expertise ü ü ü ü JA W S S P IT F IR E L E A D E R S H IP Barry Sternlicht C H A I R M A N Created several multi-billion dollar public companies Built long-term shareholder value through buy-and-build M&A platforms Served on Brown University’s endowment investment committee Matt Walters C E O & D I R E C T O R Directs private investment strategy with a particular focus on technology and related sectors Investment professional at L Catterton, a global private equity fund, prior to JAWS B.A. from the University of Virginia and an M.S. in Finance from Fairfield University | Confidential & Proprietary |

|

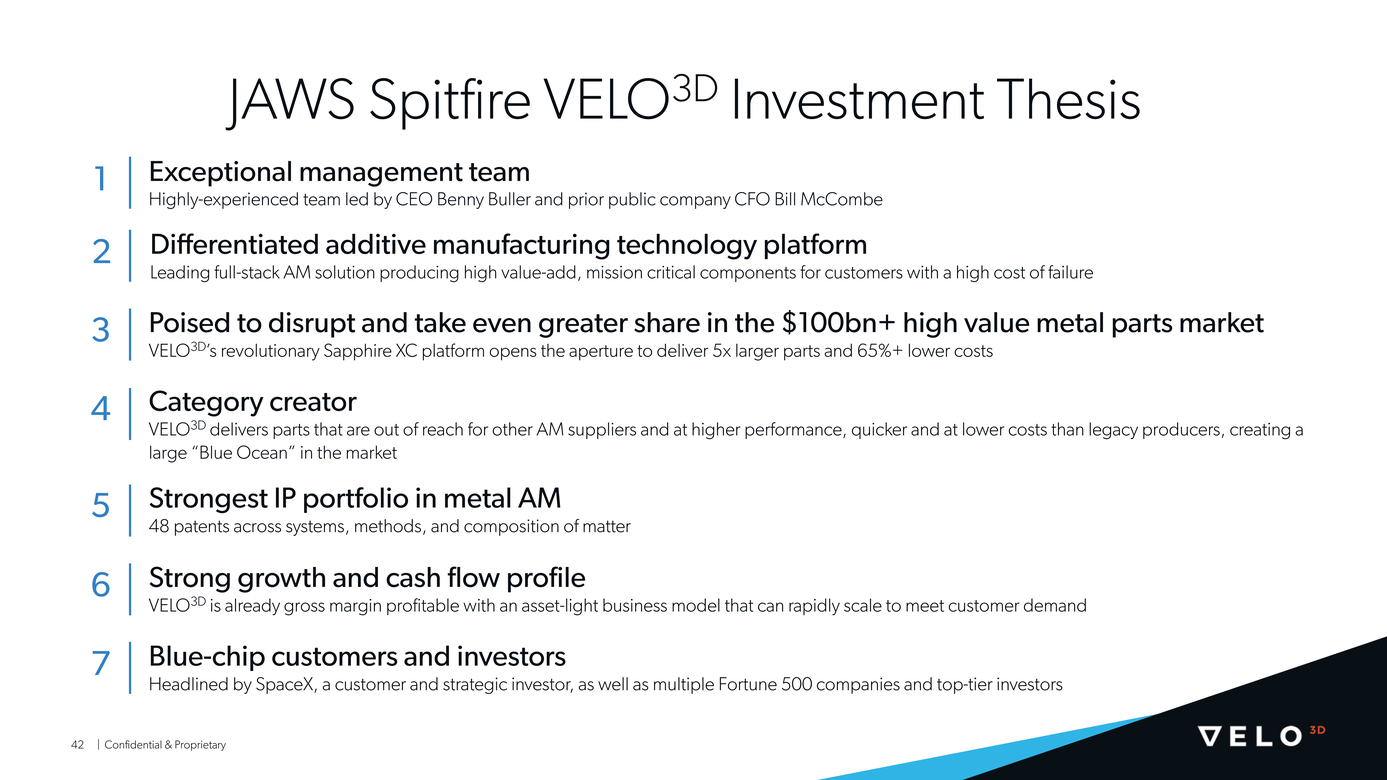

JAWS Spitfire VELO3D Investment Thesis Exceptional management team Highly-experienced team led by CEO Benny Buller and prior public company CFO Bill McCombe Differentiated additive manufacturing technology platform Leading full-stack AM solution producing high value-add, mission critical components for customers with a high cost of failure Poised to disrupt and take even greater share in the $100bn+ high value metal parts market VELO3D’s revolutionary Sapphire XC platform opens the aperture to deliver 5x larger parts and 65%+ lower costs Category creator VELO3D delivers parts that are out of reach for other AM suppliers and at higher performance, quicker and at lower costs than legacy producers, creating a large “Blue Ocean” in the market Strongest IP portfolio in metal AM 48 patents across systems, methods, and composition of matter Strong growth and cash flow profile VELO3D is already gross margin profitable with an asset-light business model that can rapidly scale to meet customer demand Blue-chip customers and investors Headlined by SpaceX, a customer and strategic investor, as well as multiple Fortune 500 companies and top-tier investors | Confidential & Proprietary |

|

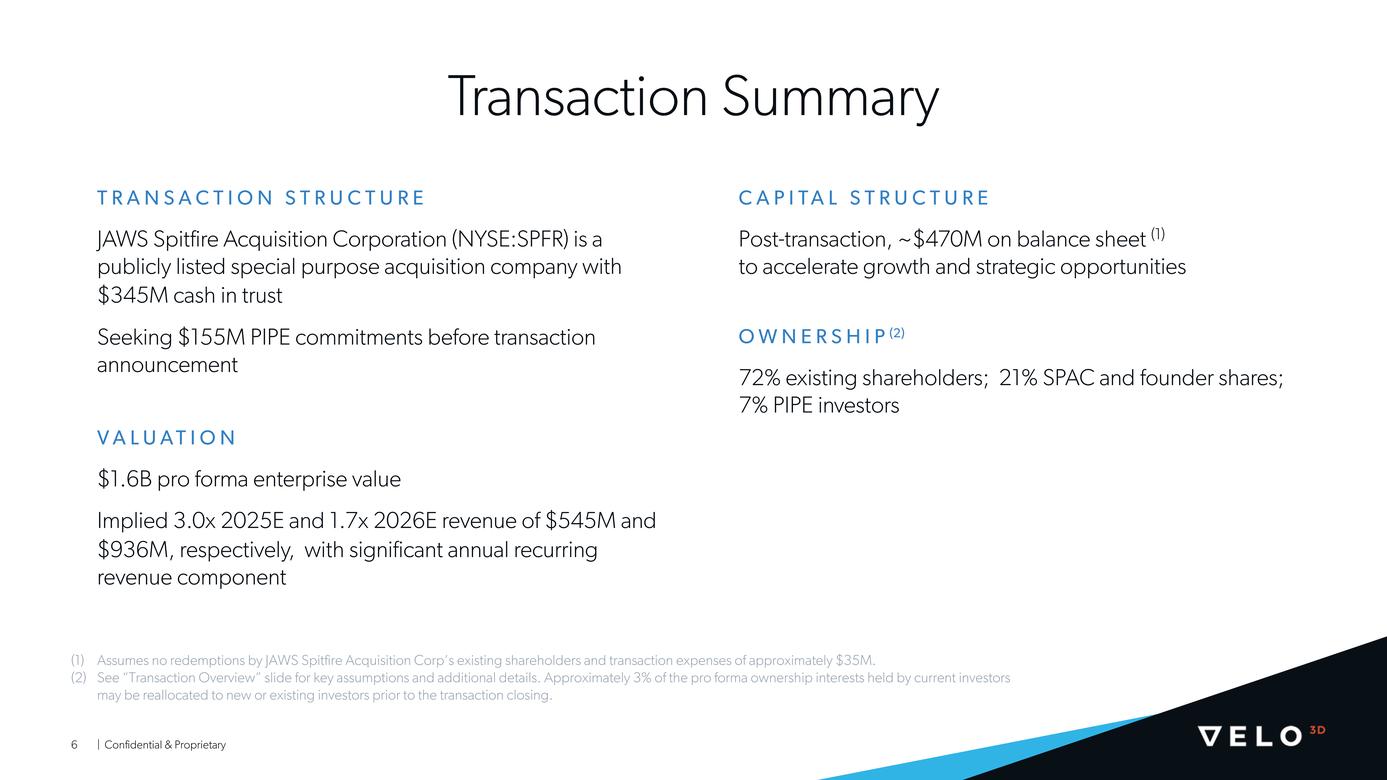

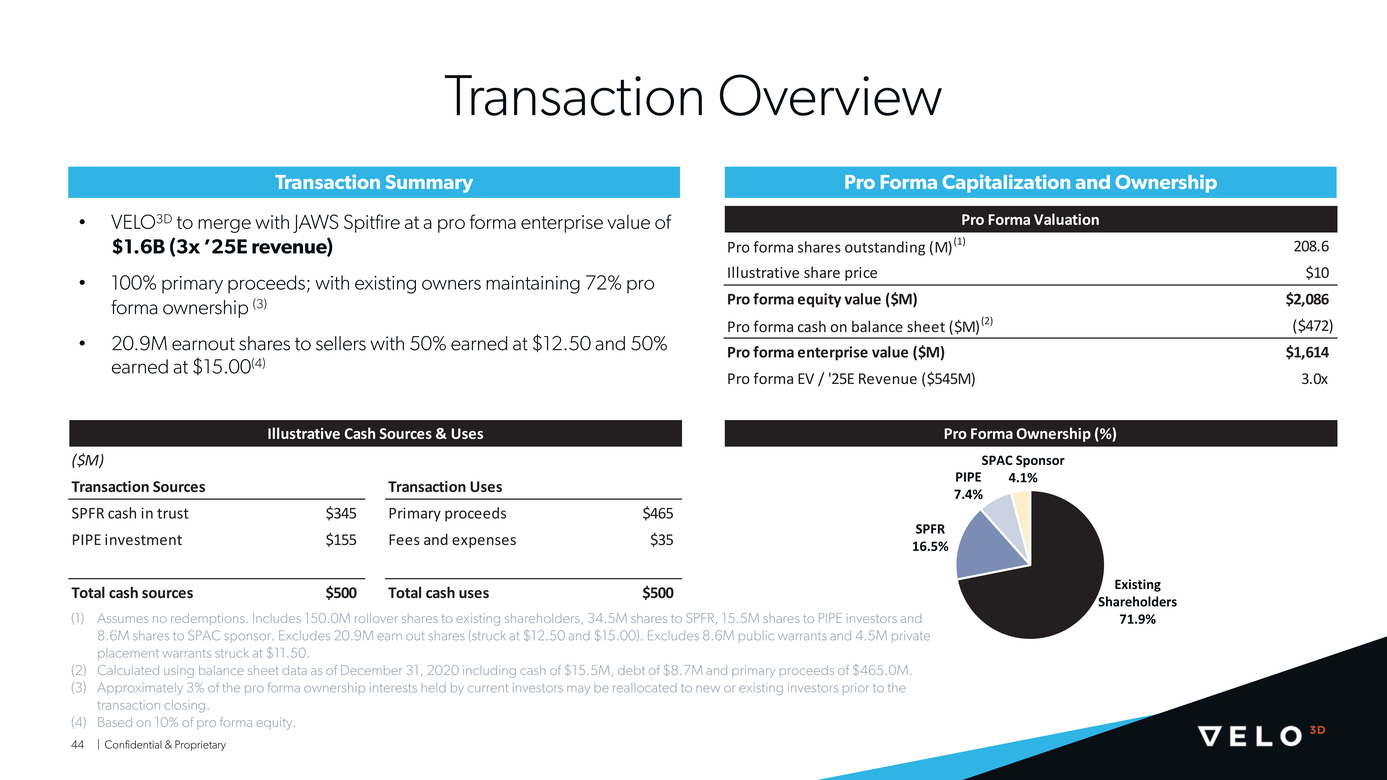

Transaction Summary TR A N S A C TI O N S TR U C TU R E JAWS Spitfire Acquisition Corporation (NYSE:SPFR) is a publicly listed special purpose acquisition company with $345M cash in trust Seeking $155M PIPE commitments before transaction announcement VA L U A T I O N $1.6B pro forma enterprise value Implied 3.0x 2025E and 1.7x 2026E revenue of $545M and $936M, respectively, with significant annual recurring revenue component CA PI TA L S T RU CT U RE Post-transaction, ~$470M on balance sheet (1) to accelerate growth and strategic opportunities OW N E R S H I P (2) 72% existing shareholders; 21% SPAC and founder shares; 7% PIPE investors Assumes no redemptions by JAWS Spitfire Acquisition Corp’s existing shareholders and transaction expenses of approximately $35M. See “Transaction Overview” slide for key assumptions and additional details. Approximately 3% of the pro forma ownership interests held by current investors may be reallocated to new or existing investors prior to the transaction closing. | Confidential & Proprietary |

|

Track Record Delivering on Impossible Missions Benny Buller F O U N D E R , C E O Bill McCombe C F O Technology unit of Israeli Intelligence National Security Award at age 29 Chief Financial Officer, Maxar Chief Financial Officer, HZO | Confidential & Proprietary |

|

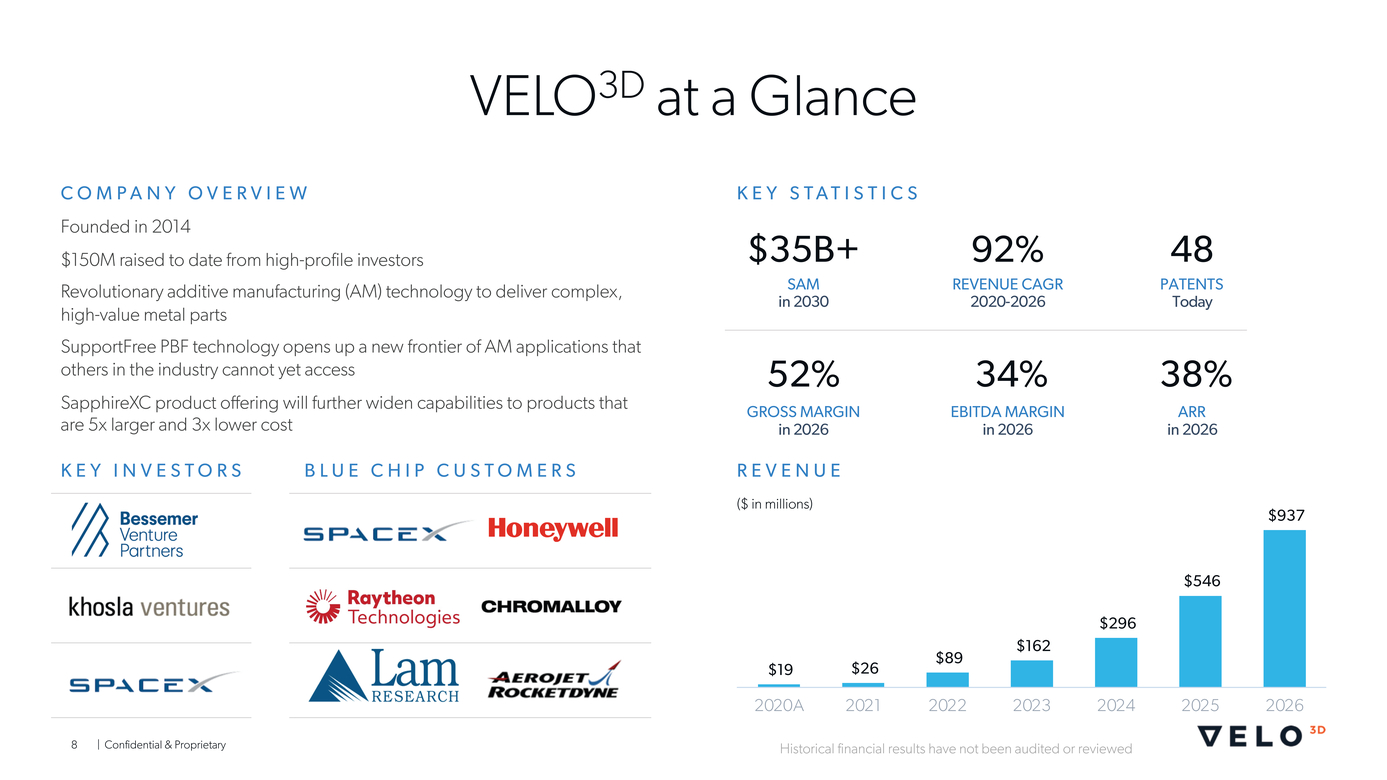

VELO3D at a Glance CO M P A N Y O V E RV I E W Founded in 2014 $150M raised to date from high-profile investors Revolutionary additive manufacturing (AM) technology to deliver complex, high-value metal parts SupportFree PBF technology opens up a new frontier of AM applications that others in the industry cannot yet access SapphireXC product offering will further widen capabilities to products that are 5x larger and 3x lower cost KEY S T A T I S T I C S $35B+ SAM in 2030 52% GROSS MARGIN in 2026 92% REVENUE CAGR 2020-2026 34% EBITDA MARGIN in 2026 48 PATENTS Today 38% ARR in 2026 KEY I N V ES T O R SBL U E C H I P C U S T O M E R S RE V E N U E ($ in millions) $937 $546 $296 $19 $26 $89 $162 | Confidential & Proprietary Historical financial results have not been audited or reviewed |

|

Metal Additive Manufacturing (AM): High Interest but Low Adoption PRO M I S E Consolidate complex assemblies containing dozens of parts into one Higher performance products, 10x shorter lead time, 2x lower cost REA L I T Y o f 1 s t GE N E R A T I O N A M Can’t produce required designs Performance degradation Too hard to implement It’s not impossible if you have the right underlying technology | Confidential & Proprietary |

|

VELO3D Cracked the Code of Metal AM Highly differentiated technology enabling production of holy-grail parts behind pursuit of AM Selling full-stack >$1M and ARR production solution Unleashing AM adoption in $100B high value production market Deep technology: 6 years, $150M of development, protected by 48 granted patents | Confidential & Proprietary |

|

Building the Impossible: 22 Systems in 3 Years Raptor engine a breakthrough in rocket engine technology VELO3D technology critical for SpaceX’s most efficient and challenging engine Powering breakthrough of Super-Heavy and Starship launch costs 1 System SpaceX VELO3D Investor 11| Confidential & Proprietary |

|

Big and Growing Market |

|

Dramatically Accelerating Growth of High Value Metal AM Market 201 9 2030 $101B High value metal parts market $180B High value metal parts market $2B $35B High value Metal AM market grows High Value Metal AM TAM High value metal AM market We believe VELO3D will enable and alone serve $20B of 2030 market | Confidential & Proprietary |

|

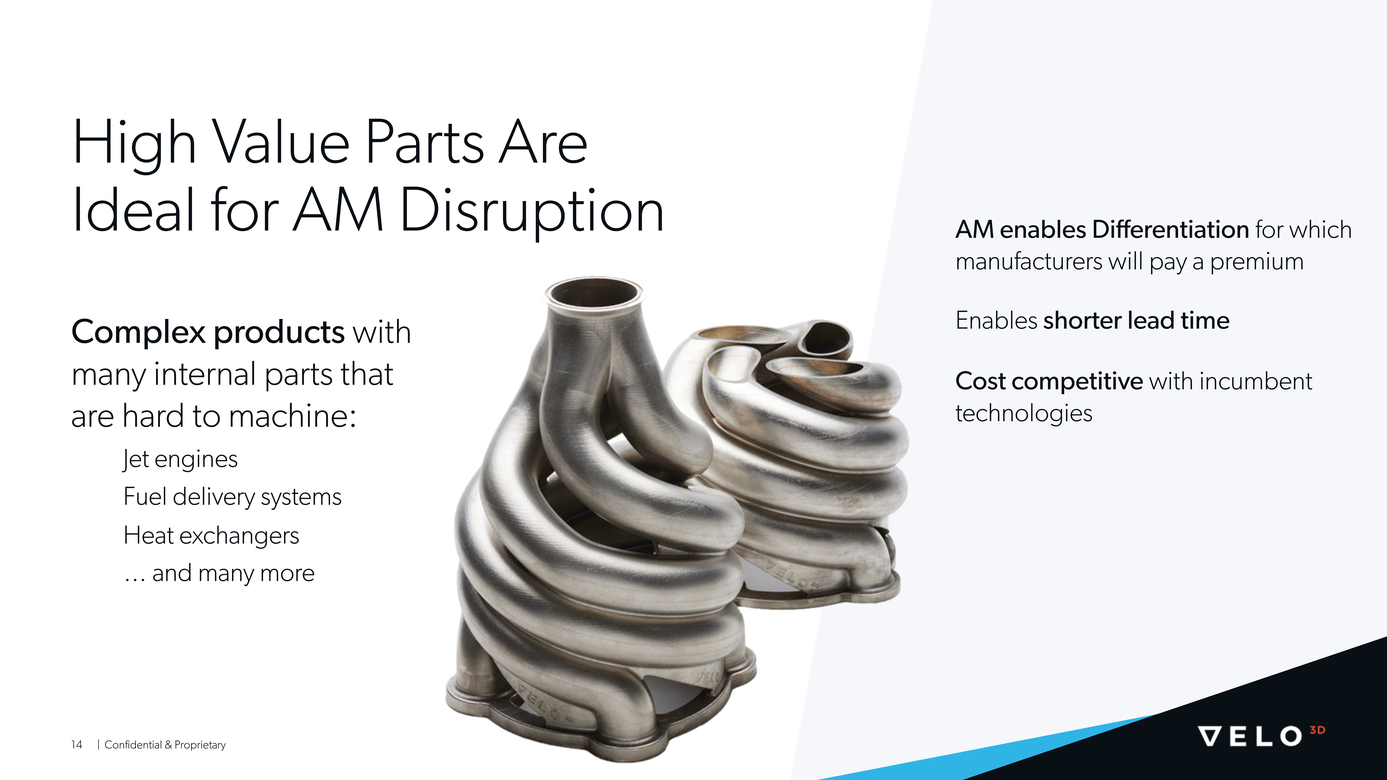

High Value Parts Are Ideal for AM Disruption Complex products with many internal parts that are hard to machine: Jet engines Fuel delivery systems Heat exchangers … and many more AM enables Differentiation for which manufacturers will pay a premium Enables shorter lead time Cost competitive with incumbent technologies | Confidential & Proprietary |

|

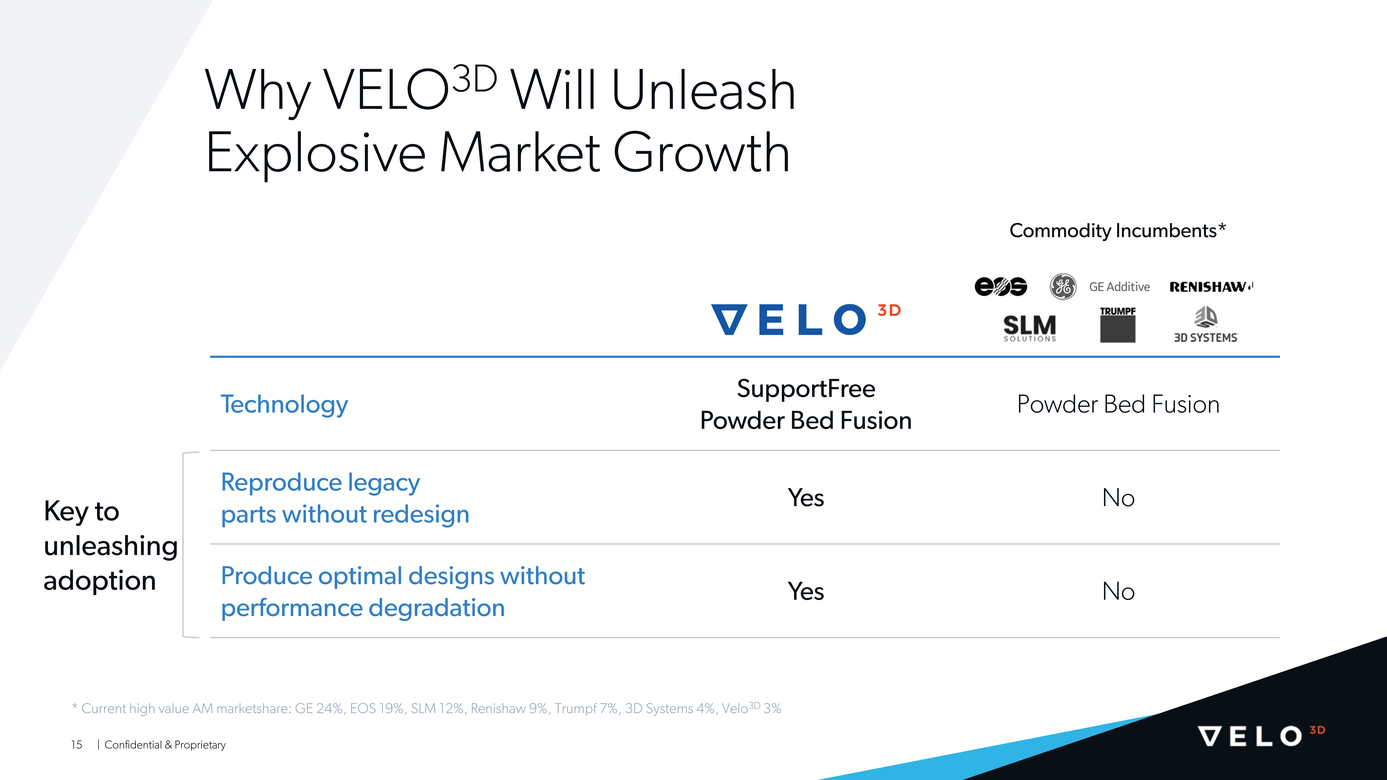

Why VELO3D Will Unleash Explosive Market Growth Commodity Incumbents* Technology Powder Bed FusionPowder Bed Fusion Key to unleashing adoption Reproduce legacy parts without redesignYesNo Produce optimal designs without performance degradationYesNo * Current high value AM marketshare: GE 24%, EOS 19%, SLM 12%, Renishaw 9%, Trumpf 7%, 3D Systems 4%, Velo3D 3% | Confidential & Proprietary |

|

We Unlock Large Scale Opportunities |

|

Solving Big Problems for a Diverse Customer Base: Space, Aviation, Energy + SP A C E AV I A T I O N / DE F E NSE EN ERG Y OT H E R LEADING JET ENGINE MANUFACTURER EA C H S EG M EN T C O N T R I B U T ES B ET W EEN 15 - 35% O F 2020 R EV EN U E 1 17| Confidential & Proprietary [1] Historical financial results have not been audited or reviewed |

|

Honeywell’s $400M Supply Chain Problem PRO B L EMSO L U T I O N Challenging sourcing of legacy parts (low volume, high mix/value) After a decade <5% producible by commodity AM Parts printable with VELO3D VELO3D qualification completion: Q2’21 | Confidential & Proprietary |

|

Energy Supplier $50M Lead Time Problem PRO B L EMSO L U T I O N $6B flow control company – thousands of low volume, high value parts – 1 yr lead time Production disruptions to its Energy customers AM enables spares on demand – only VELO3D can produce geometry Digital inventory is a >$500M/year VELO3D opportunity in Energy sector[1] | Confidential & Proprietary (1) Based on management estimates of future demand and market dynamics. |

|

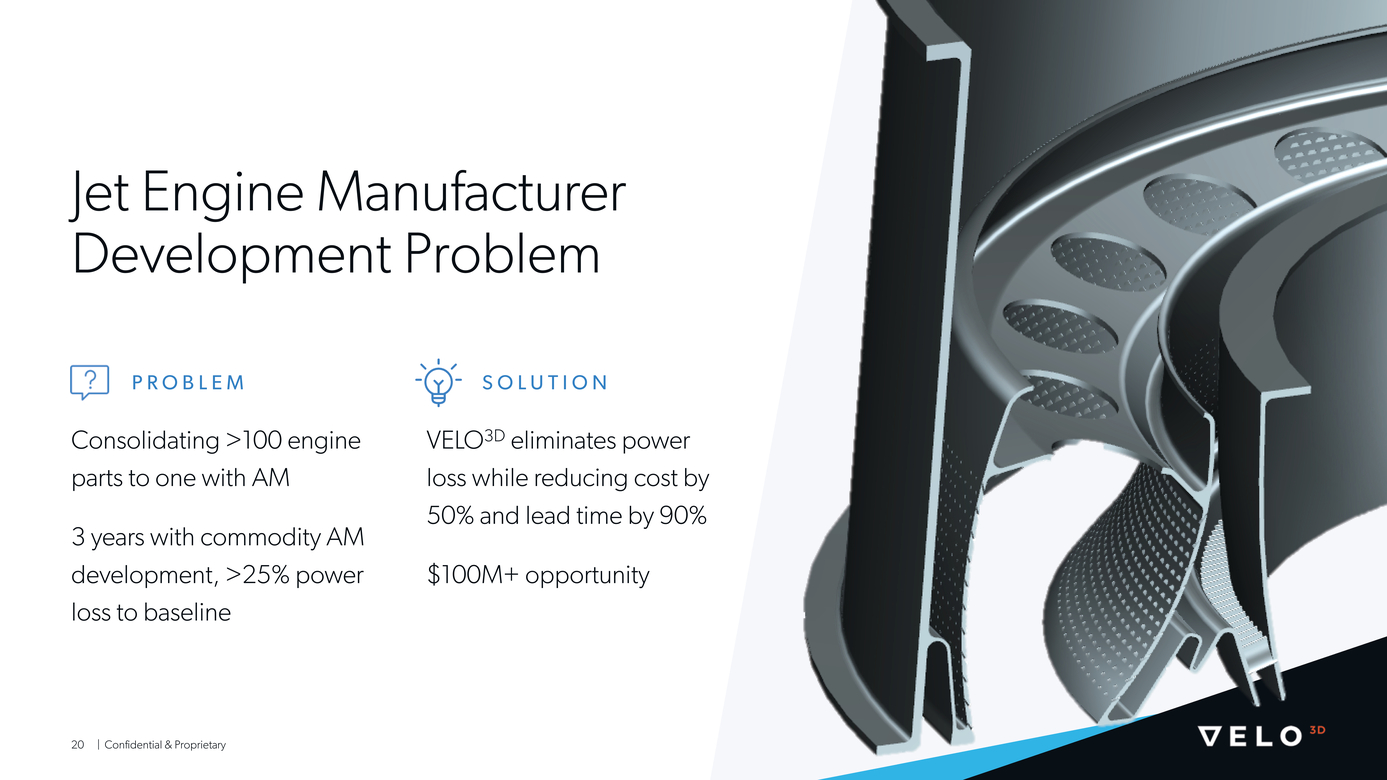

Jet Engine Manufacturer Development Problem PRO B L EMSO L U T I O N Consolidating >100 engine parts to one with AM 3 years with commodity AM development, >25% power loss to baseline VELO3D eliminates power loss while reducing cost by 50% and lead time by 90% $100M+ opportunity 20 | Confidential & Proprietary |

|

Disruptive and Defensible Technology |

|

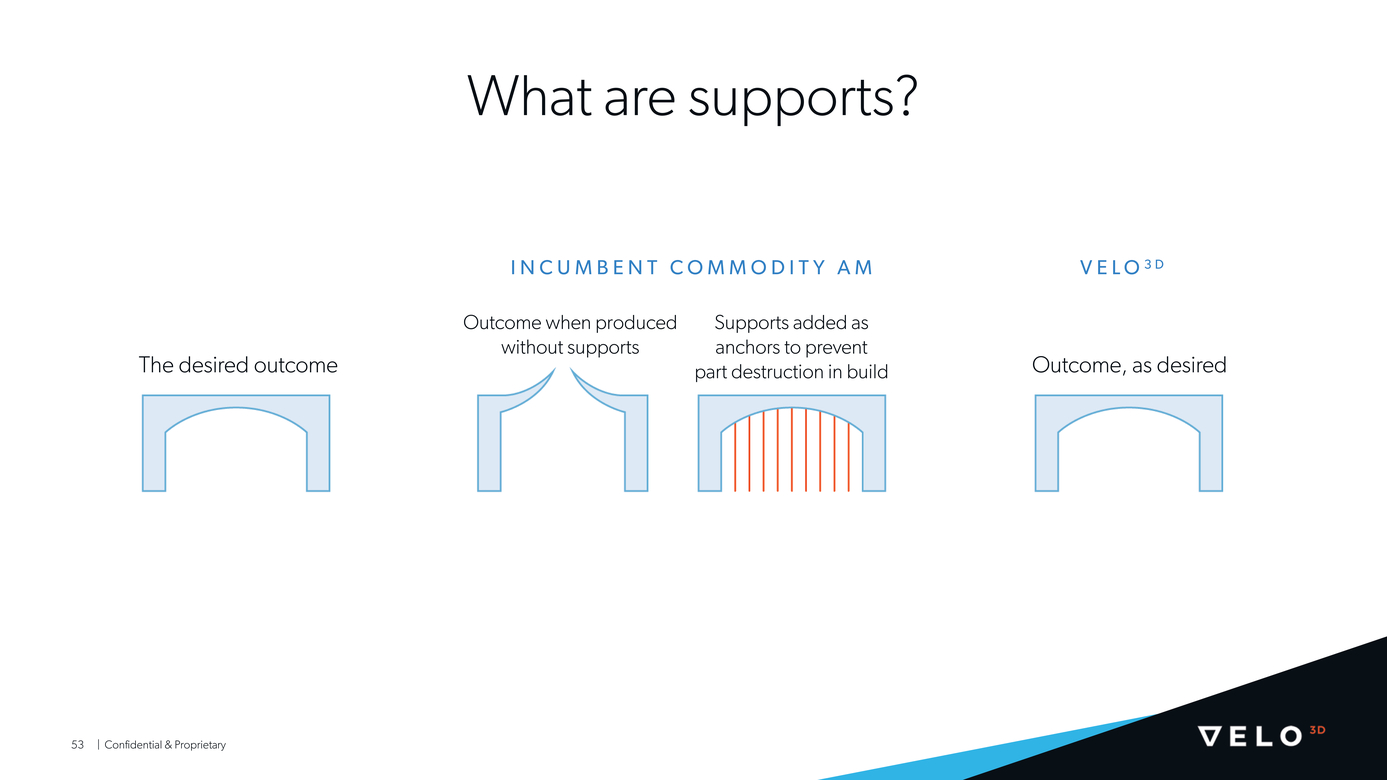

Incumbent commodity AM requires supports that can be internal and inaccessible This generally prevents the production of parts with complex internal geometries VELO3D Game-changing SupportFree Technology VELO3D technology can produce any design, even those with most complex internal geometries 22 | Confidential & Proprietary |

|

Breakthrough is Enabled by Full-Stack Solution Flow™ Print Preparation SW Assure™ Quality Validation Sapphire® Metal AM Family of Printers UN D E R LY I N G M A N UF A C T UR I N G P R O C E S S 23 | Confidential & Proprietary |

|

“VELO3D is at least 5 years ahead of any competition” –HE A DO F A M , 24 | Confidential & Proprietary |

|

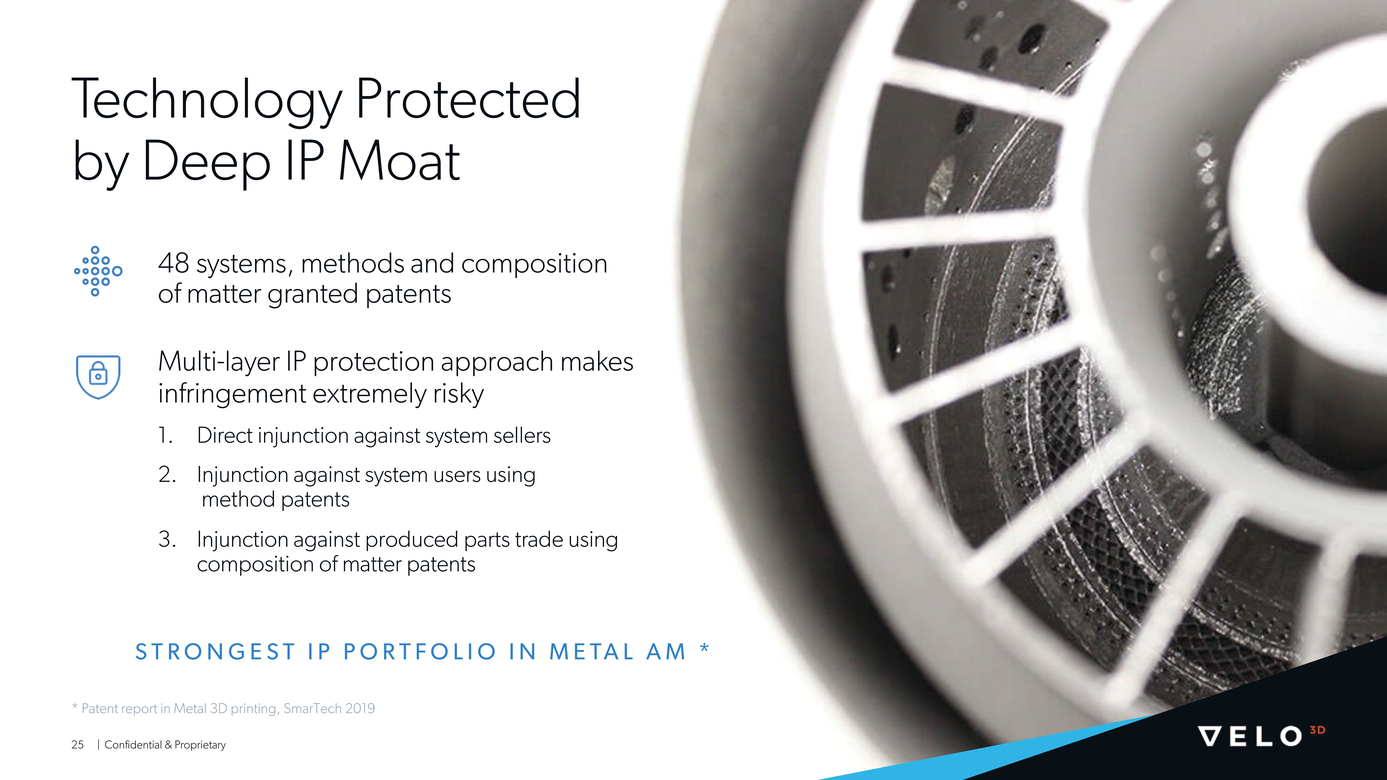

Technology Protected by Deep IP Moat 48 systems, methods and composition of matter granted patents Multi-layer IP protection approach makes infringement extremely risky Direct injunction against system sellers Injunction against system users using method patents Injunction against produced parts trade using composition of matter patents ST R O N G E ST I P P O R T F O L I O I N M E TA L A M * * Patent report in Metal 3D printing, SmarTech 2019 25 | Confidential & Proprietary |

|

Proven Traction and Growth |

|

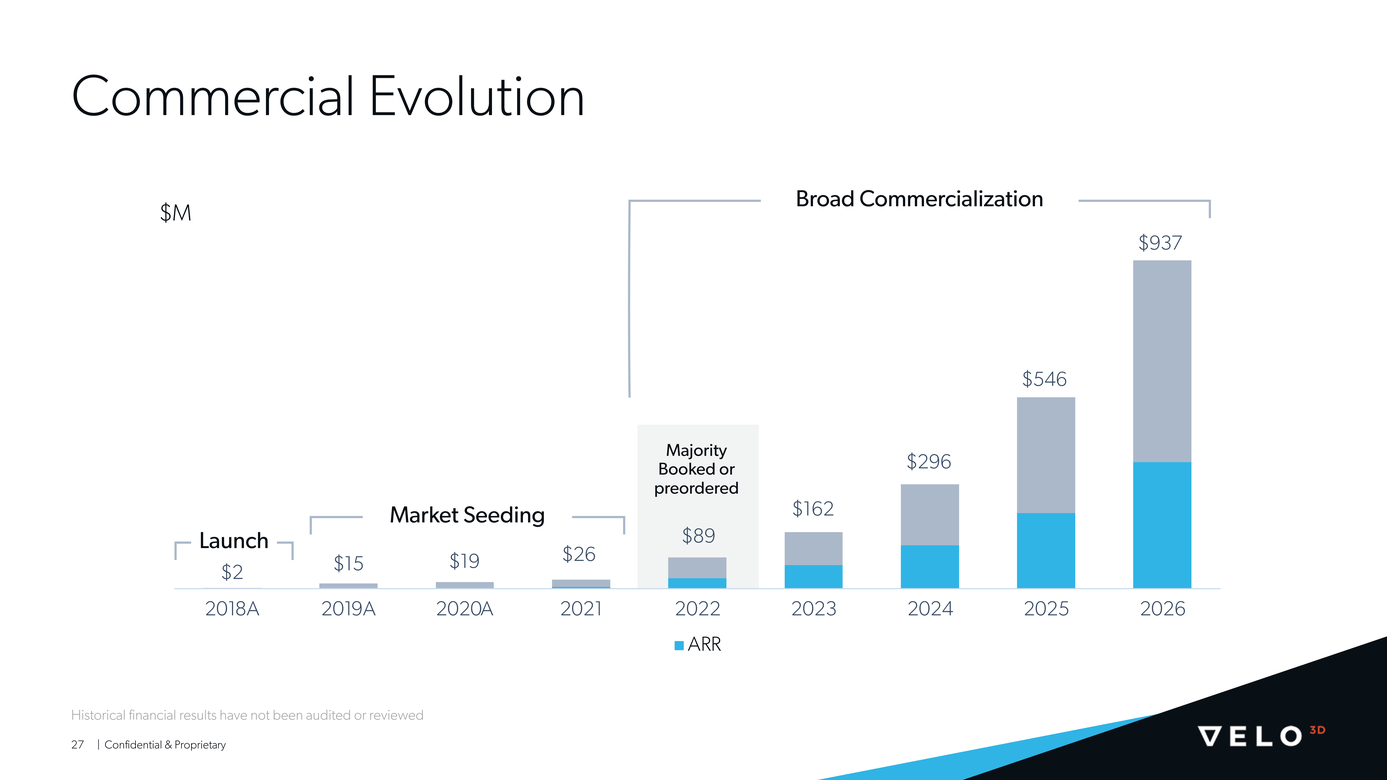

Commercial Evolution $M Broad Commercialization $937 $546 Majority Booked or preordered $296 Market Seeding $162 Launch $2 $89 $15 $19 $26 2018A2019A2020A202120222023202420252026 ARR Historical financial results have not been audited or reviewed 27 | Confidential & Proprietary |

|

Growth Drivers “Blue ocean” market Land and expand strategy Expand competitive advantage with new products Accelerate new customer acquisition | Confidential & Proprietary |

|

For many customers seeking: Creating a $20B “Blue Ocean” Differentiated performance Reduced production lead times Cost savings VELO3D is the only option to transition to AM | Confidential & Proprietary |

|

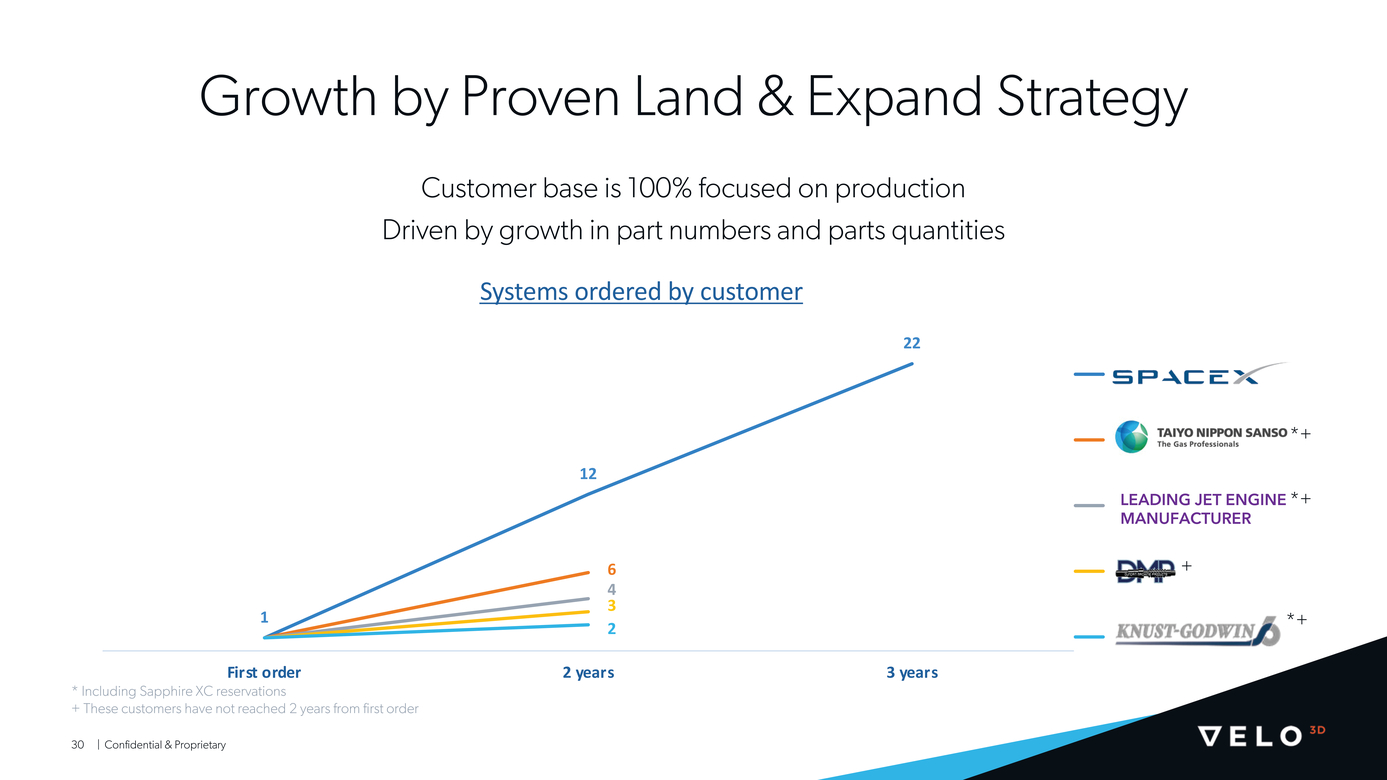

Growth by Proven Land & Expand Strategy Customer base is 100% focused on production Driven by growth in part numbers and parts quantities Systems ordered by customer 22 *+ 12 LEADING JET ENGINE *+ MANUFACTURER 6+ 4 3 12*+ First order2 years3 years * Including Sapphire XC reservations + These customers have not reached 2 years from first order | Confidential & Proprietary |

|

Sapphire XC, Shipping 2021, Further Expands Addressable Market LA R GE R M A R K E T Producing parts of 400% larger volume BI G G E R I M P A C T Dropping parts cost by 65-80% serving wider range of applications CU RREN T B A CK L O G O F S A PPH I RE X C S Y S T EM S : $ 4 7. 5 M | Confidential & Proprietary |

|

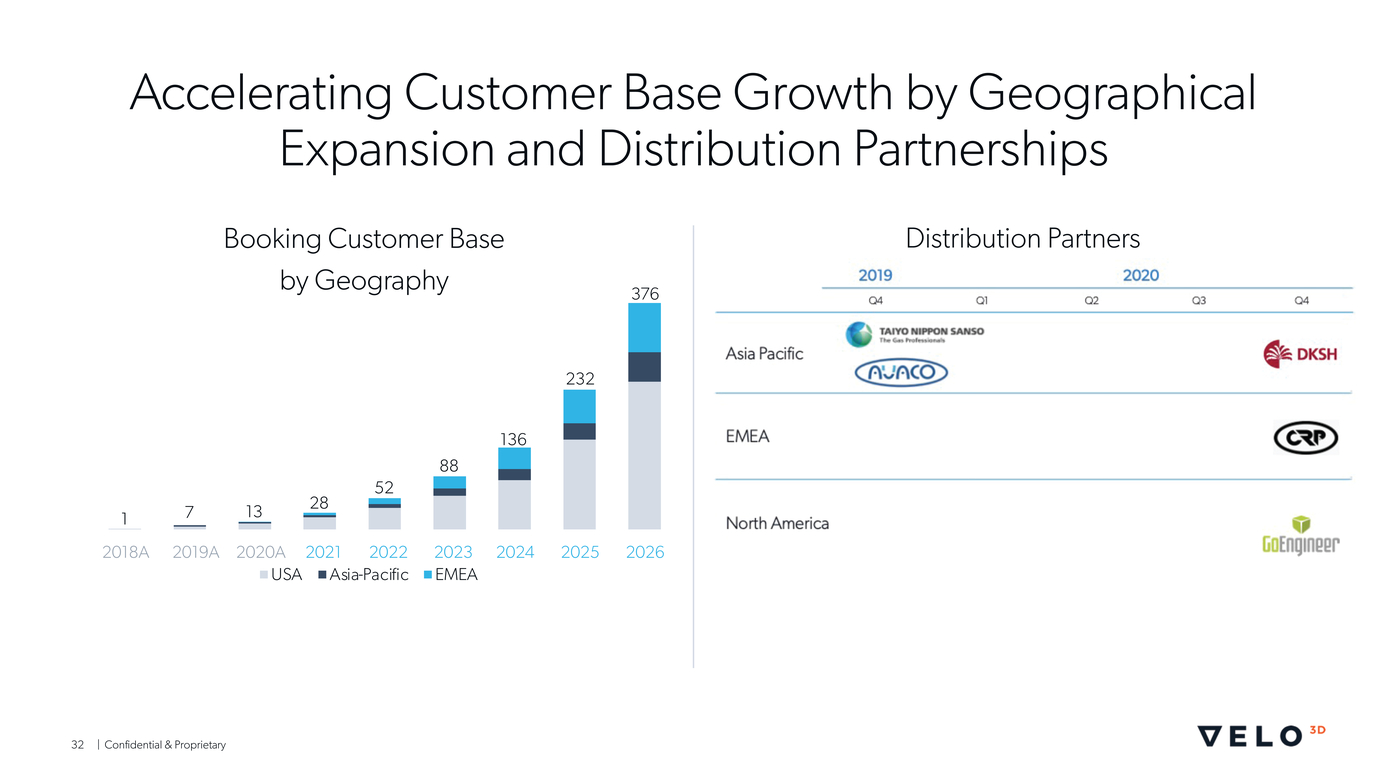

Accelerating Customer Base Growth by Geographical Expansion and Distribution Partnerships Booking Customer Base by Geography 232 376 Distribution Partners 136 52 171328 | Confidential & Proprietary |

|

Strong Financials |

|

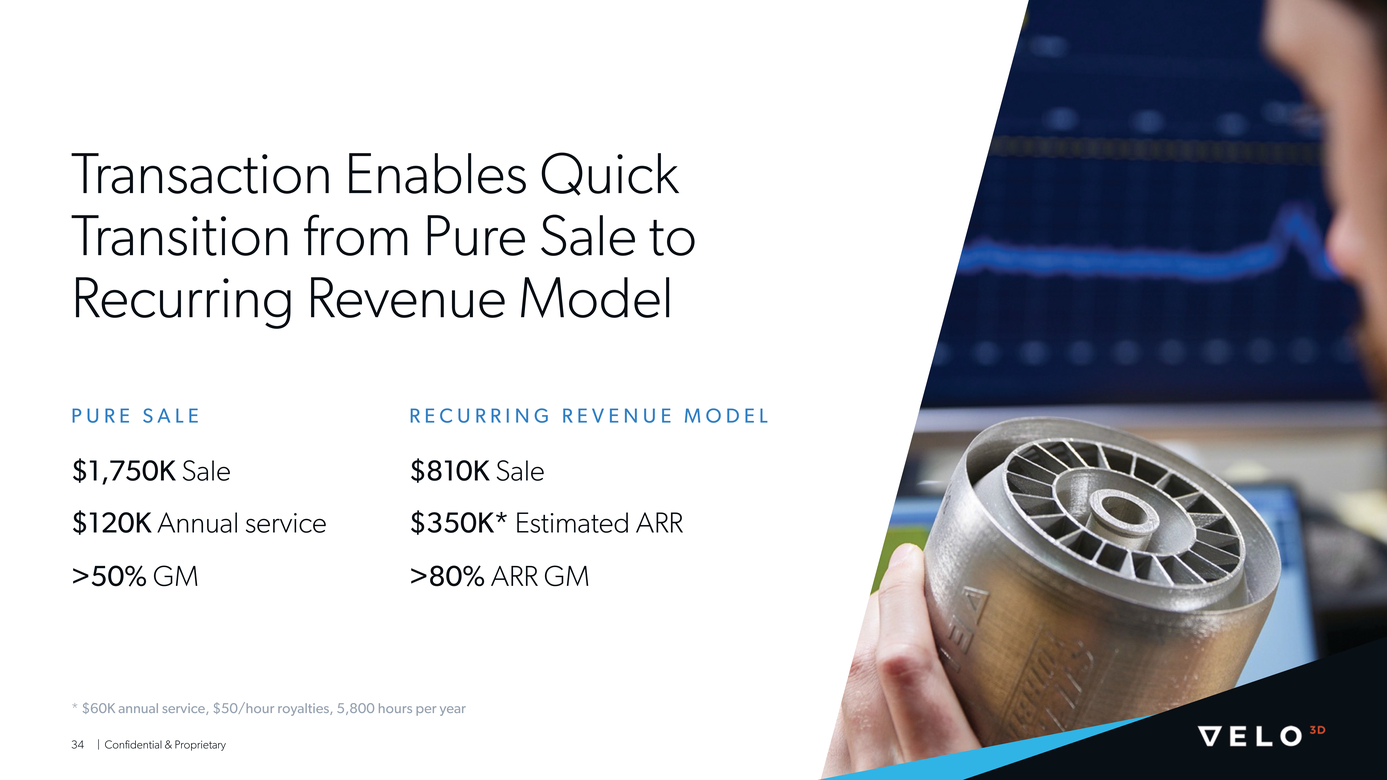

Transaction Enables Quick Transition from Pure Sale to Recurring Revenue Model PU RE S A L E RECU RRI N G REV EN U E M O D EL $1,750K Sale $120K Annual service >50% GM $810K Sale $350K* Estimated ARR >80% ARR GM * $60K annual service, $50/hour royalties, 5,800 hours per year | Confidential & Proprietary |

|

Demonstrated High Margin Unit Economics Pure Sale Recurring Revenue Model Revenue & Gross Profit ($000s)Cumulative Gross Margin (%)Revenue & Gross Profit ($000s)Cumulative Gross Margin (%) Annual RevenueAnnual Gross ProfitCumulative Gross Margin | Confidential & Proprietary |

|

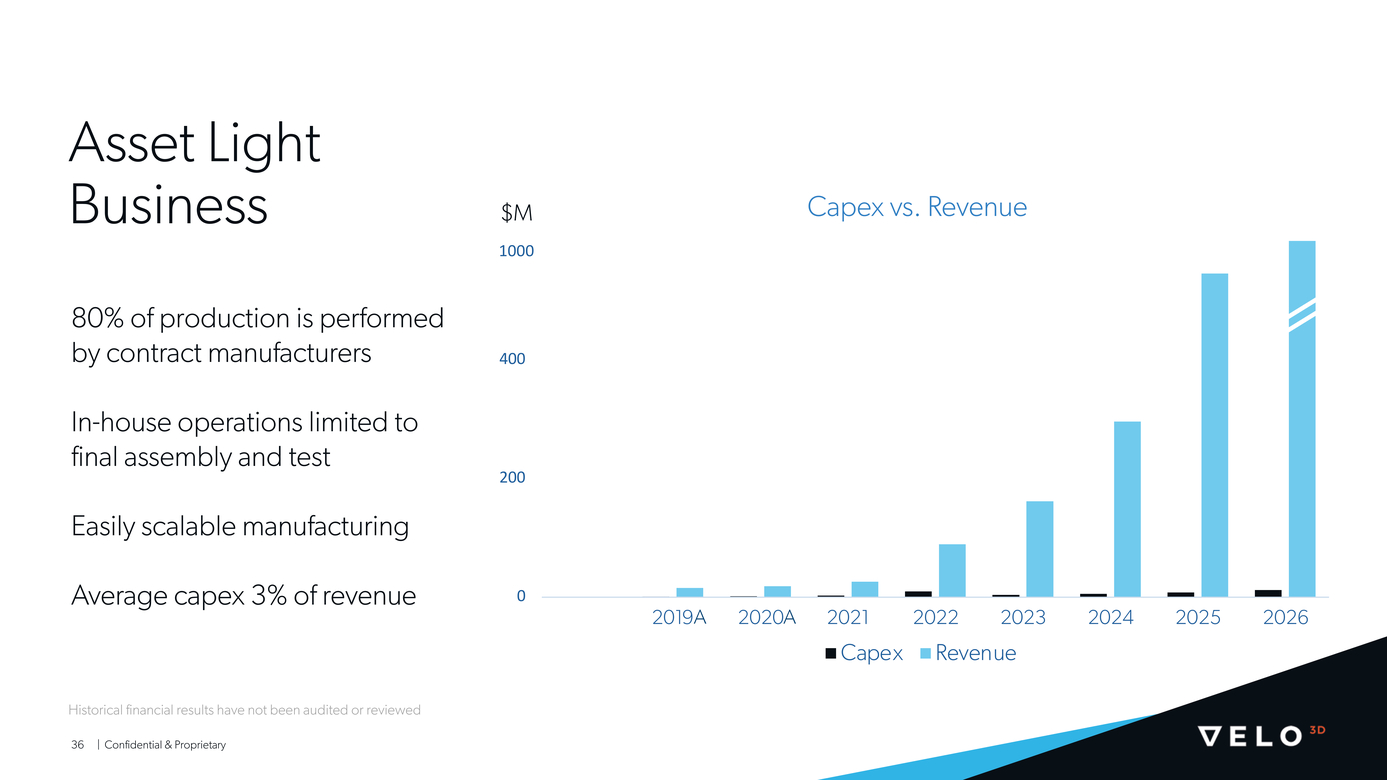

600 $M 1000 Capex vs. Revenue 400 200 0 80% of production is performed by contract manufacturers In-house operations limited to final assembly and test Easily scalable manufacturing Average capex 3% of revenue 2019A 2020A 202120222023202420252026 CapexRevenue Historical financial results have not been audited or reviewed | Confidential & Proprietary |

|

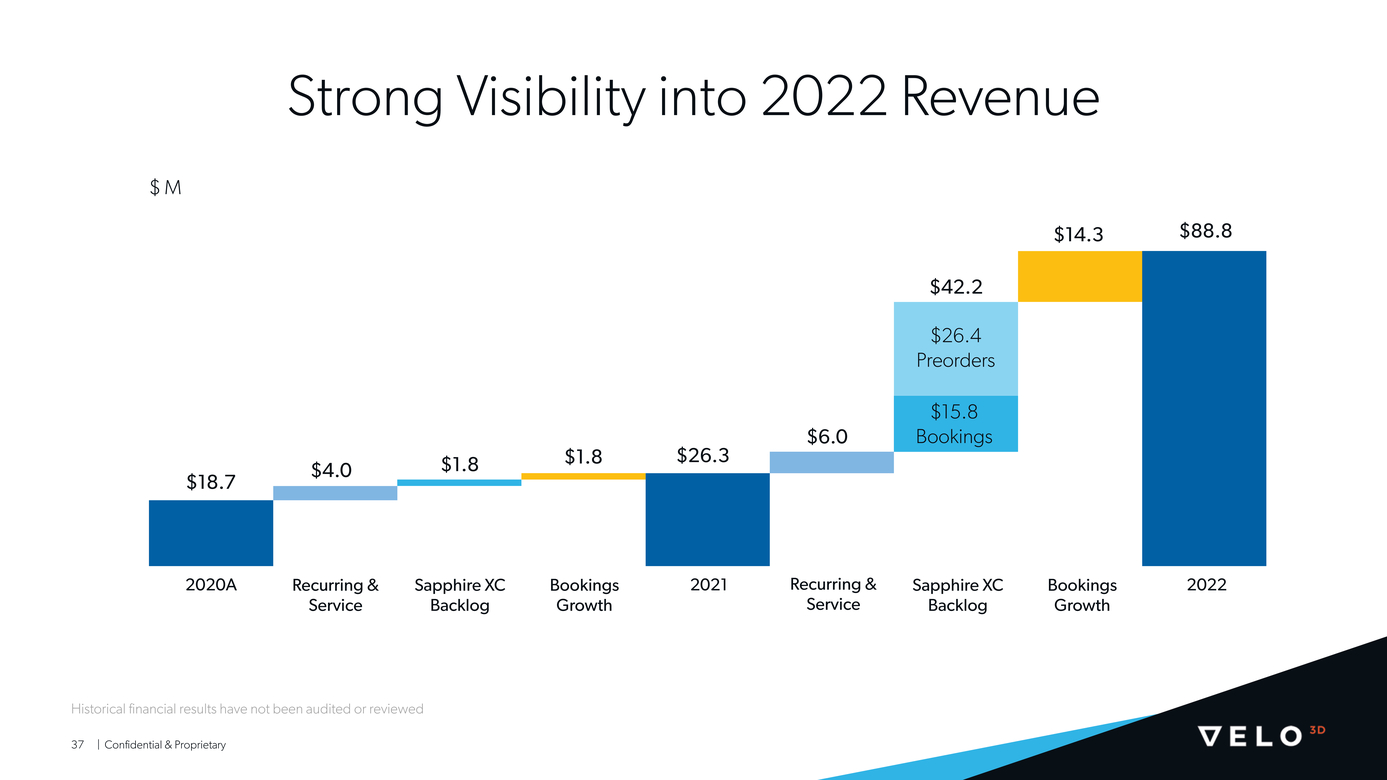

Strong Visibility into 2022 Revenue $ M $42.2 $26.4 Preorders $6.0 $15.8 Bookings $18.7 $4.0 $1.8 $1.8 $26.3 $88.8 Historical financial results have not been audited or reviewed | Confidential & Proprietary |

|

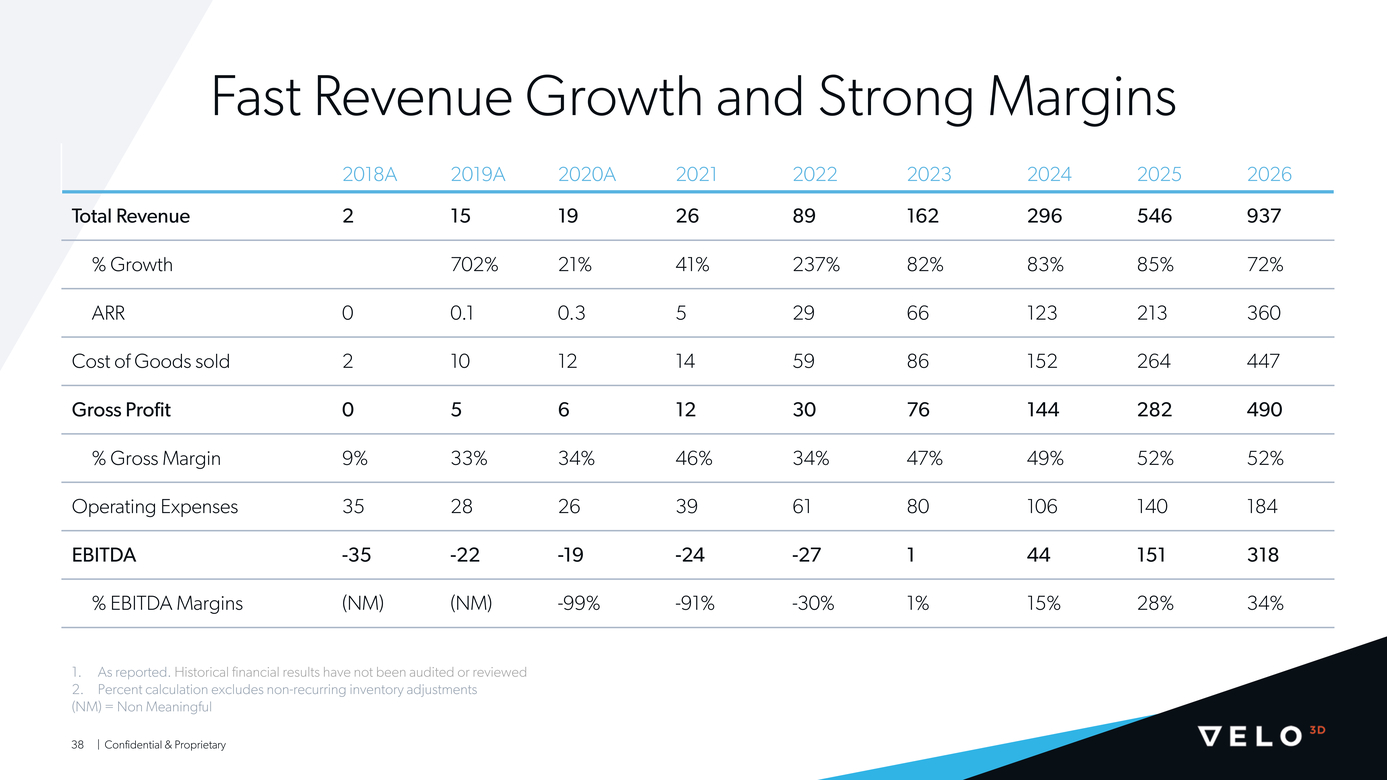

Fast Revenue Growth and Strong Margins As reported. Historical financial results have not been audited or reviewed Percent calculation excludes non-recurring inventory adjustments (NM) = Non Meaningful | Confidential & Proprietary |

|

Team |

|

Complete Team Ready to Scale to Next Level C E O Benny Buller Renette Youssef Dr. Zach Murphree C M O V P S A L E S V P , G L O B A L B D C F O | Confidential & Proprietary V P E N G I N E E R I N G Alex Varlahanov V P T E C H N O L O G Y Dr. Greg Brown Chris Brozek S R D I R E C T O R S E R V I C E S V P O P E R A T I O N S |

|

World Class IND E P E ND E NT BO A R D M E M BE R S Carl BassStefan Krause VELO3D ChairmanCFO BMW CEO AutodeskChairman Rolls Royce Executive Board Deutsche Bank CEO Canoo TO P T I E R F I N A N C I A L INV E S T O R S ST R A T E G I C INV E S T O R S | Confidential & Proprietary |

|

JAWS Spitfire VELO3D Investment Thesis Exceptional management team Highly-experienced team led by CEO Benny Buller and prior public company CFO Bill McCombe Differentiated additive manufacturing technology platform Leading full-stack AM solution producing high value-add, mission critical components for customers with a high cost of failure Poised to disrupt and take even greater share in the $100bn+ high value metal parts market VELO3D’s revolutionary Sapphire XC platform opens the aperture to deliver 5x larger parts and 65%+ lower costs Category creator VELO3D delivers parts that are out of reach for other AM suppliers and at higher performance, quicker and at lower costs than legacy producers, creating a large “Blue Ocean” in the market Strongest IP portfolio in metal AM 48 patents across systems, methods, and composition of matter Strong growth and cash flow profile VELO3D is already gross margin profitable with an asset-light business model that can rapidly scale to meet customer demand Blue-chip customers and investors Headlined by SpaceX, a customer and strategic investor, as well as multiple Fortune 500 companies and top-tier investors | Confidential & Proprietary |

|

Transaction Overview and Comparables |

|

Transaction Overview Transaction Summary Pro Forma Capitalization and Ownership Pro Forma Valuation Pro forma shares outstanding (M)(1) 208.6 Illustrative share price $10 Pro forma equity value ($M) $2,086 Pro forma cash on balance sheet ($M)(2) ($472) Pro forma enterprise value ($M) $1,614 Pro forma EV / '25E Revenue ($545M) 3.0x 100% primary proceeds; with existing owners maintaining 72% pro forma ownership (3) 20.9M earnout shares to sellers with 50% earned at $12.50 and 50% earned at $15.00(4) Illustrative Cash Sources & Uses ($M) Pro Forma Ownership (%) SPAC Sponsor Transaction Sources Transaction Uses SPFR cash in trust $345 Primary proceeds $465 PIPE investment $155 Fees and expenses $35 Total cash sources $500 Total cash uses $500 7.4% 4.1% SPFR 16.5% Assumes no redemptions. Includes 150.0M rollover shares to existing shareholders, 34.5M shares to SPFR, 15.5M shares to PIPE investors and 8.6M shares to SPAC sponsor. Excludes 20.9M earn out shares (struck at $12.50 and $15.00). Excludes 8.6M public warrants and 4.5M private placement warrants struck at $11.50. Calculated using balance sheet data as of December 31, 2020 including cash of $15.5M, debt of $8.7M and primary proceeds of $465.0M. Approximately 3% of the pro forma ownership interests held by current investors may be reallocated to new or existing investors prior to the transaction closing. Based on 10% of pro forma equity. Existing Shareholders 71.9% 44 | Confidential & Proprietary |

|

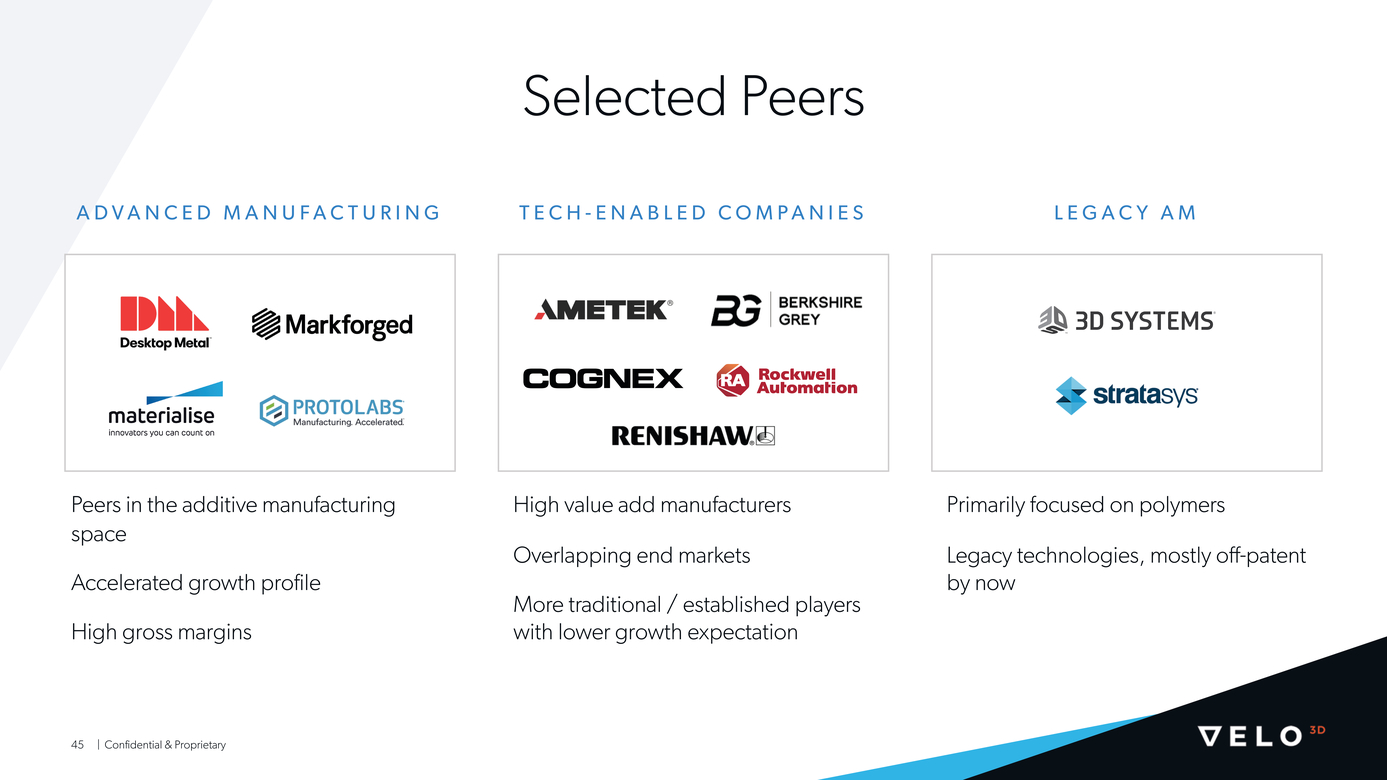

AD V AN C E D M AN U F A C T U R I N G TE C H - EN A B L ED C O M P A N I ESLE GA C Y A M Peers in the additive manufacturing space Accelerated growth profile High gross margins High value add manufacturers Overlapping end markets More traditional / established players with lower growth expectation Primarily focused on polymers Legacy technologies, mostly off-patent by now | Confidential & Proprietary |

|

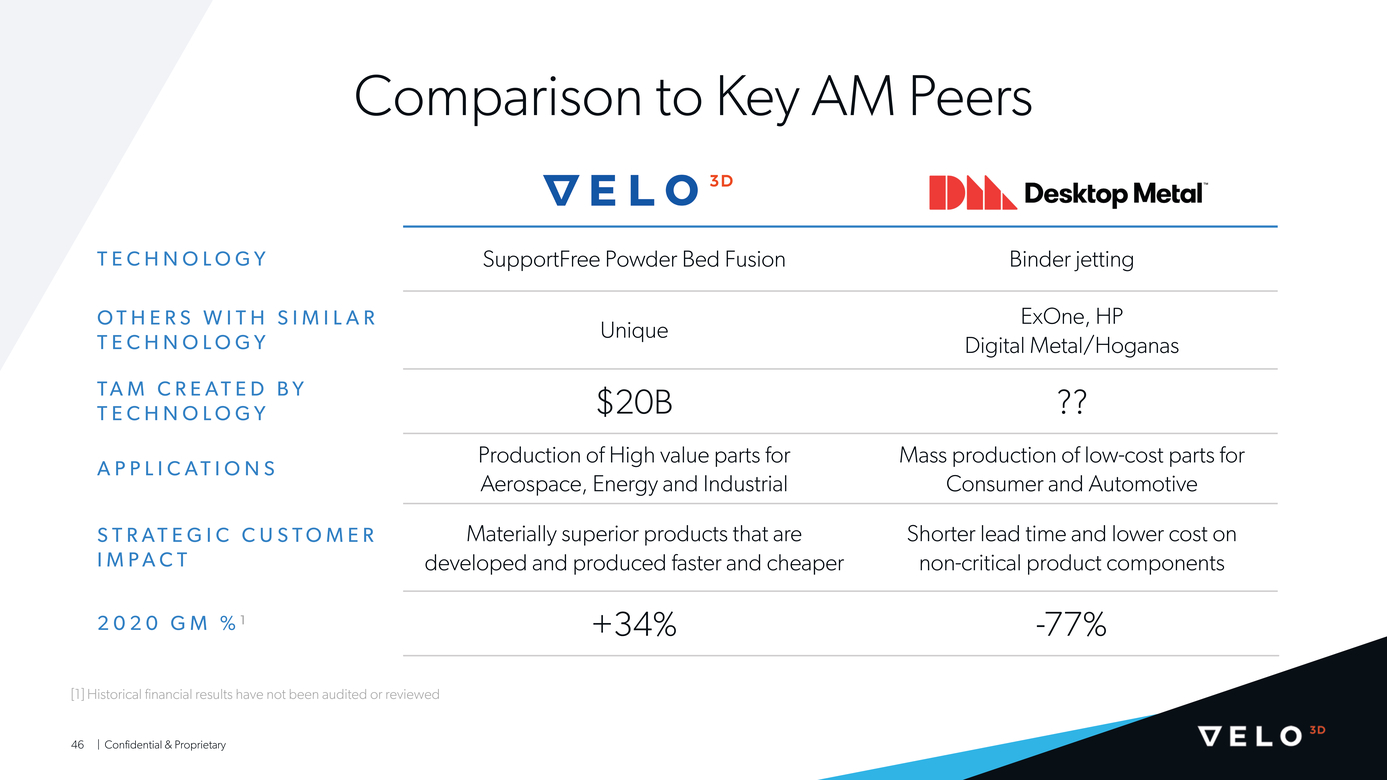

Comparison to Key AM Peers TE C H N O L O G YSupportFree Powder Bed FusionBinder jetting OT H E R S W I T H S I M I L A R TE C H N O L O G YUnique ExOne, HP Digital Metal/Hoganas $20B?? AP P L I C A T I O N SProduction of High value parts for Aerospace, Energy and Industrial Mass production of low-cost parts for Consumer and Automotive ST R A T E G I C C U ST O M E R IM P A C T Materially superior products that are developed and produced faster and cheaper Shorter lead time and lower cost on non-critical product components 2020 GM % 1+34%-77% [1] Historical financial results have not been audited or reviewed | Confidential & Proprietary |

|

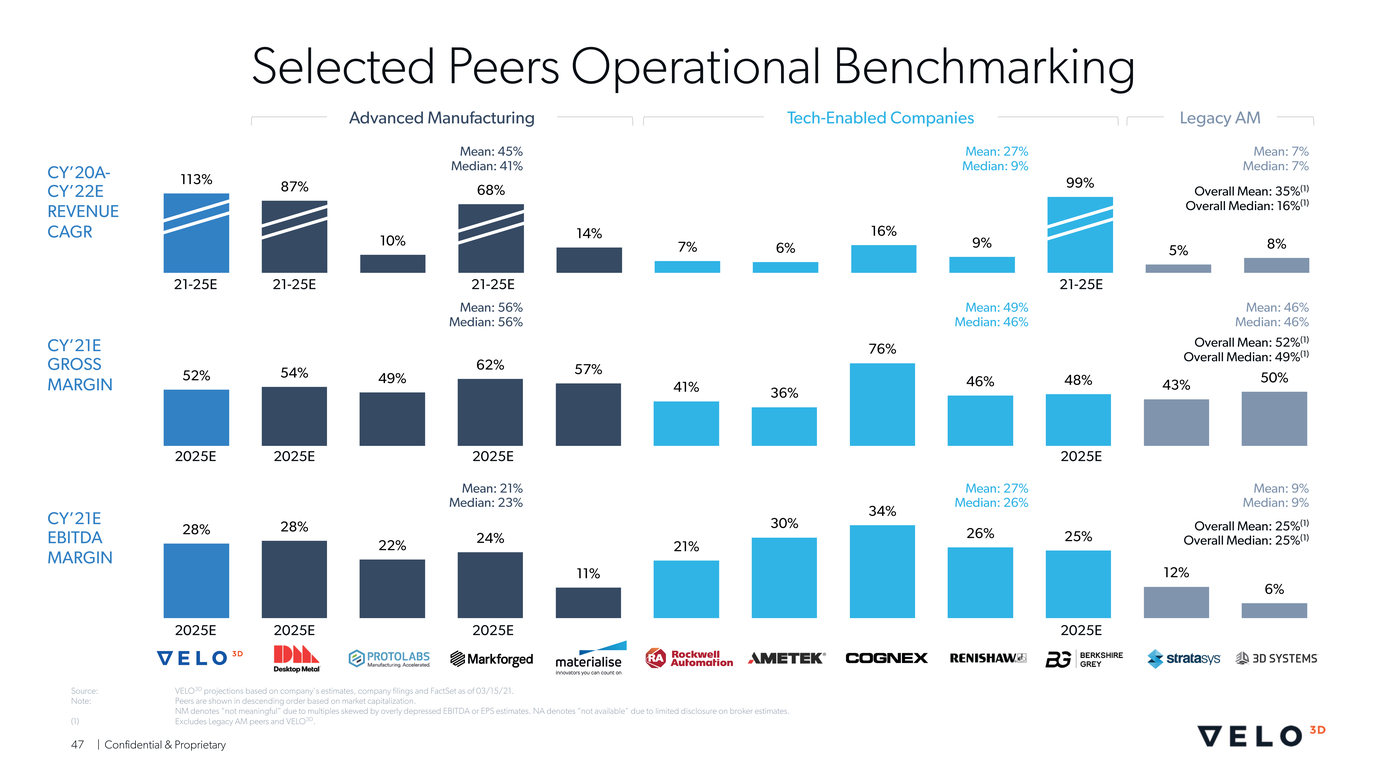

Selected Peers Operational Benchmarking Advanced Manufacturing Tech-Enabled Companies Legacy AM CY’20A-CY’22E REVENUE CAGR 87% 10% Mean: 45% Median: 41% 68% 7%6% 16% Mean: 27% Median: 9% 9% Mean: 7% Median: 7% Overall Mean: 35%(1) Overall Median: 16%(1) 8% 113% 14% 99% 21-25E21-25E CY’21E Mean: 56% Median: 56% 76% Mean: 49% Median: 46% Mean: 46% Median: 46% Overall Mean: 52%(1) (1) 52% 54% 49% 62%57% 41%36% Overall Median: 49% 50% 2025E2025E 2025E2025E CY’21E EBITDA 22% Mean: 21% Median: 23% 21% Mean: 27% Median: 26% 26%25% Mean: 9% Median: 9% Overall Mean: 25%(1) (1) MARGIN 11% Overall Median: 25% 12% 6% 28% 28% 24% 30% 34% 2025E2025E Source:VELO3D projections based on company’s estimates, company filings and FactSet as of 03/15/21. Note:Peers are shown in descending order based on market capitalization. NM denotes “not meaningful” due to multiples skewed by overly depressed EBITDA or EPS estimates. NA denotes “not available” due to limited disclosure on broker estimates. (1)Excludes Legacy AM peers and VELO3D. | Confidential & Proprietary |

|

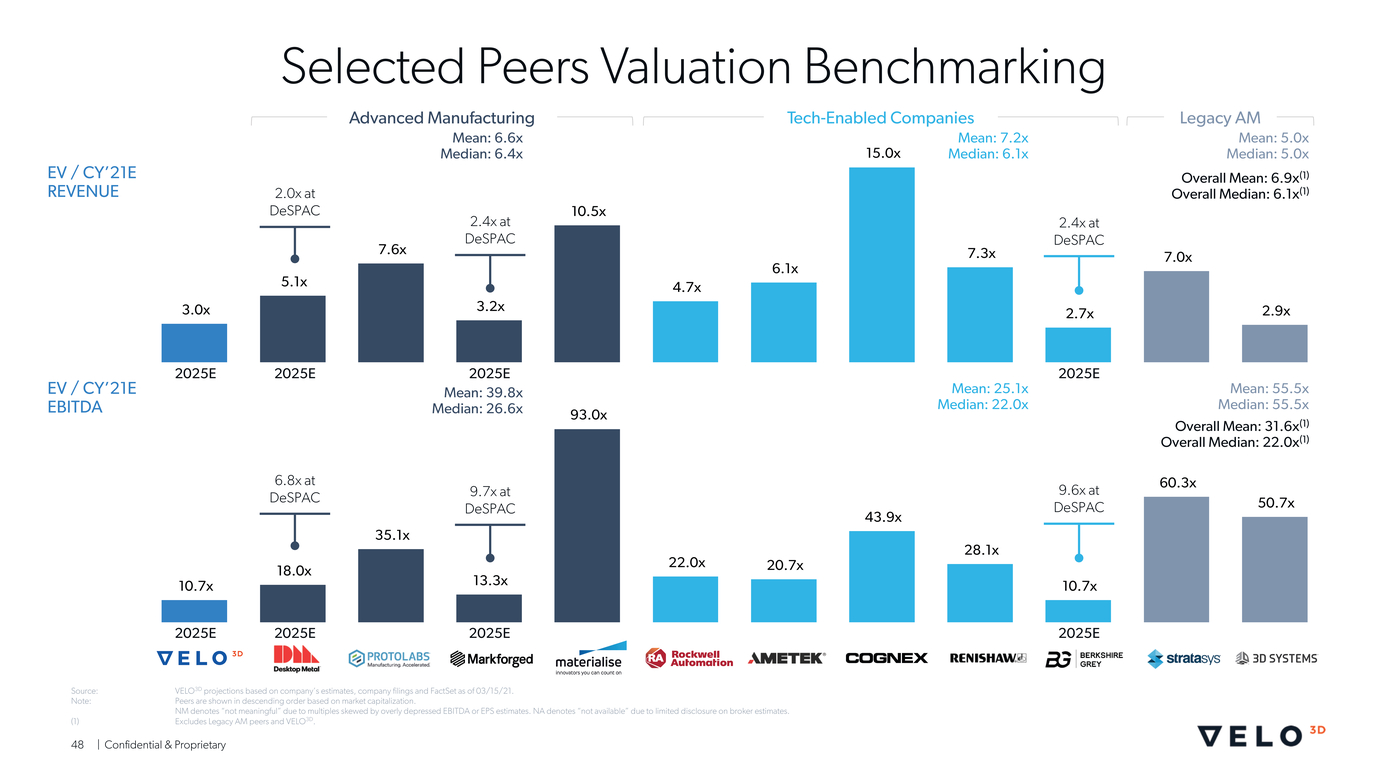

Selected Peers Valuation Benchmarking Advanced Manufacturing Tech-Enabled Companies Legacy AM EV / CY’21E REVENUE 3.0x 2.0x at DeSPAC 5.1x Mean: 6.6x Median: 6.4x 2.4x at DeSPAC 10.5x 4.7x 6.1x 15.0x Mean: 7.2x Median: 6.1x 7.3x 2.4x at DeSPAC 2.7x Mean: 5.0x Median: 5.0x Overall Mean: 6.9x(1) Overall Median: 6.1x(1) 7.0x 2.9x 7.6x 3.2x 2025E2025E EV / CY’21E EBITDA 10.7x 6.8x at DeSPAC 18.0x 35.1x Mean: 39.8x Median: 26.6x 9.7x at DeSPAC 13.3x 93.0x 20.7x 43.9x Mean: 25.1x Median: 22.0x 28.1x x at DeSPAC 10.7x Mean: 55.5x Median: 55.5x Overall Mean: 31.6x(1) Overall Median: 22.0x(1) 60.3x 22.0x 2025E 2025E NM denotes “not meaningful” due to multiples skewed by overly depressed EBITDA or EPS estimates. NA denotes “not available” due to limited disclosure on broker estimates. Excludes Legacy AM peers and VELO3D. 48 | Confidential & Proprietary |

|

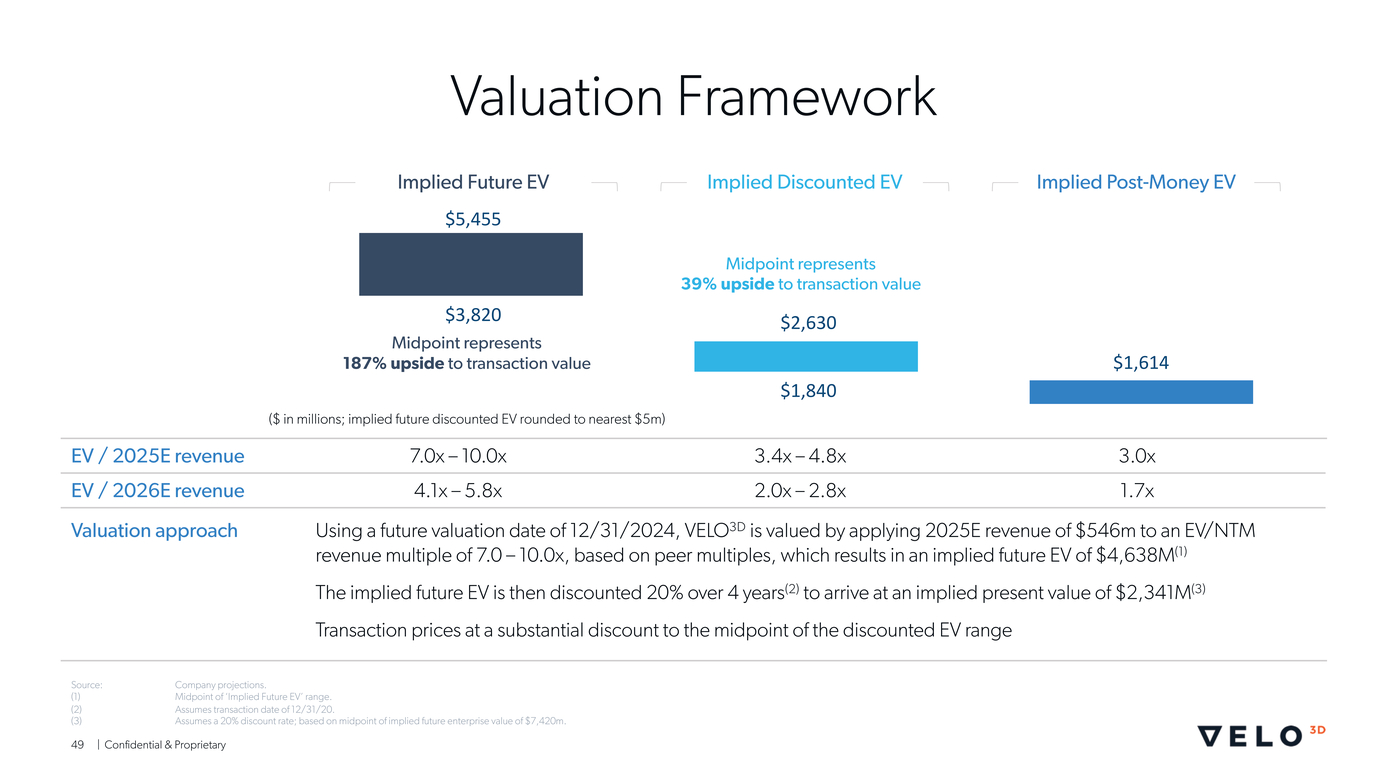

Valuation Framework Implied Future EV Implied Discounted EV Implied Post-Money EV $5,455 $3,820 Midpoint represents 187% upside to transaction value ($ in millions; implied future discounted EV rounded to nearest $5m) Midpoint represents 39% upside to transaction value $2,630 $1,840 $1,614 EV / 2025E revenue EV / 2026E revenue Valuation approach 7.0x – 10.0x 4.1x – 5.8x 3.4x – 4.8x 2.0x – 2.8x 3.0x 1.7x Using a future valuation date of 12/31/2024, VELO3D is valued by applying 2025E revenue of $546m to an EV/NTM revenue multiple of 7.0 – 10.0x, based on peer multiples, which results in an implied future EV of $4,638M(1) The implied future EV is then discounted 20% over 4 years(2) to arrive at an implied present value of $2,341M(3) Transaction prices at a substantial discount to the midpoint of the discounted EV range Source:Company projections. Midpoint of ‘Implied Future EV’ range. Assumes transaction date of 12/31/20. Assumes a 20% discount rate; based on midpoint of implied future enterprise value of $7,420m. 49 | Confidential & Proprietary |

|

Appendix |

|

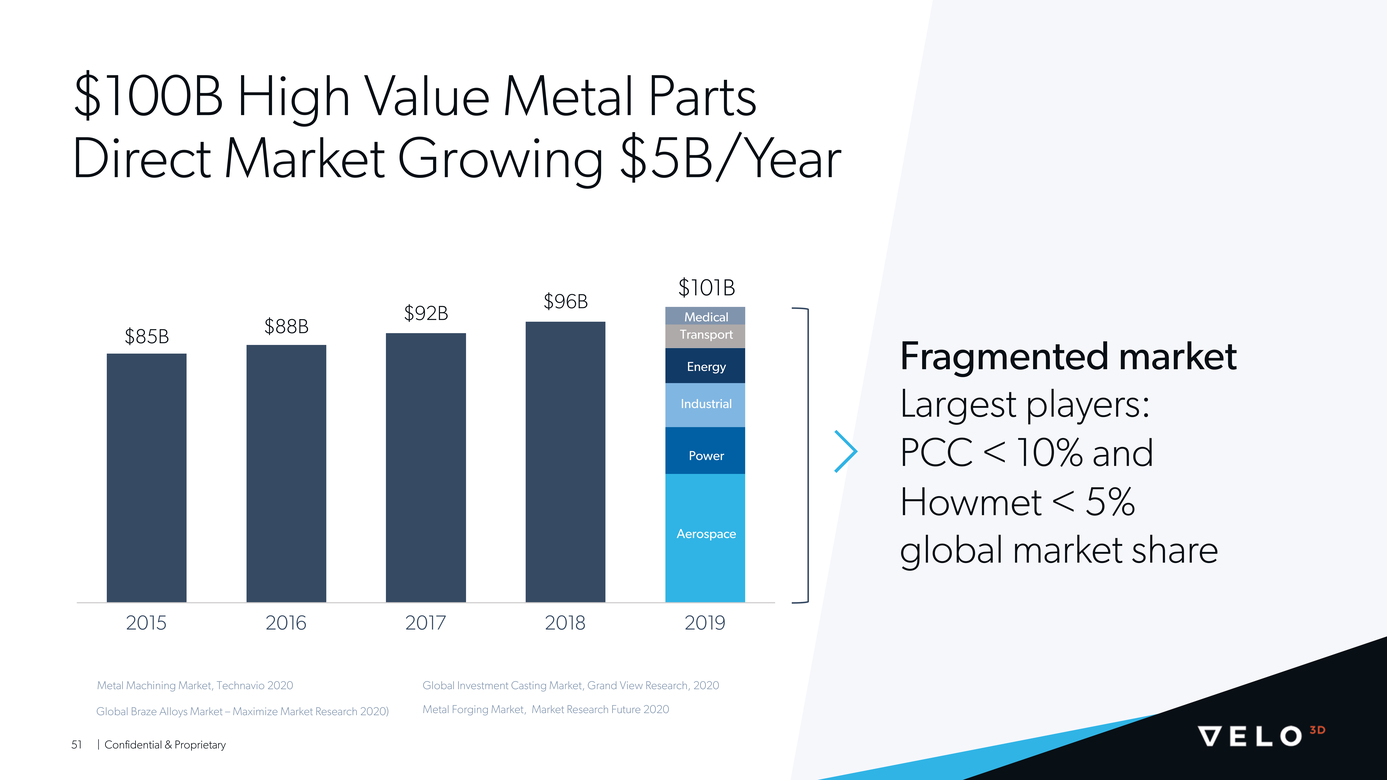

$100B High Value Metal Parts Direct Market Growing $5B/Year $85B $88B $92B $96B Medical Transport Energy Industrial Power Aerospace Largest players: PCC < 10% and Howmet < 5% 20152016201720182019 Metal Machining Market, Technavio 2020Global Investment Casting Market, Grand View Research, 2020 Global Braze Alloys Market – Maximize Market Research 2020) Metal Forging Market, Market Research Future 2020 51| Confidential & Proprietary |

|

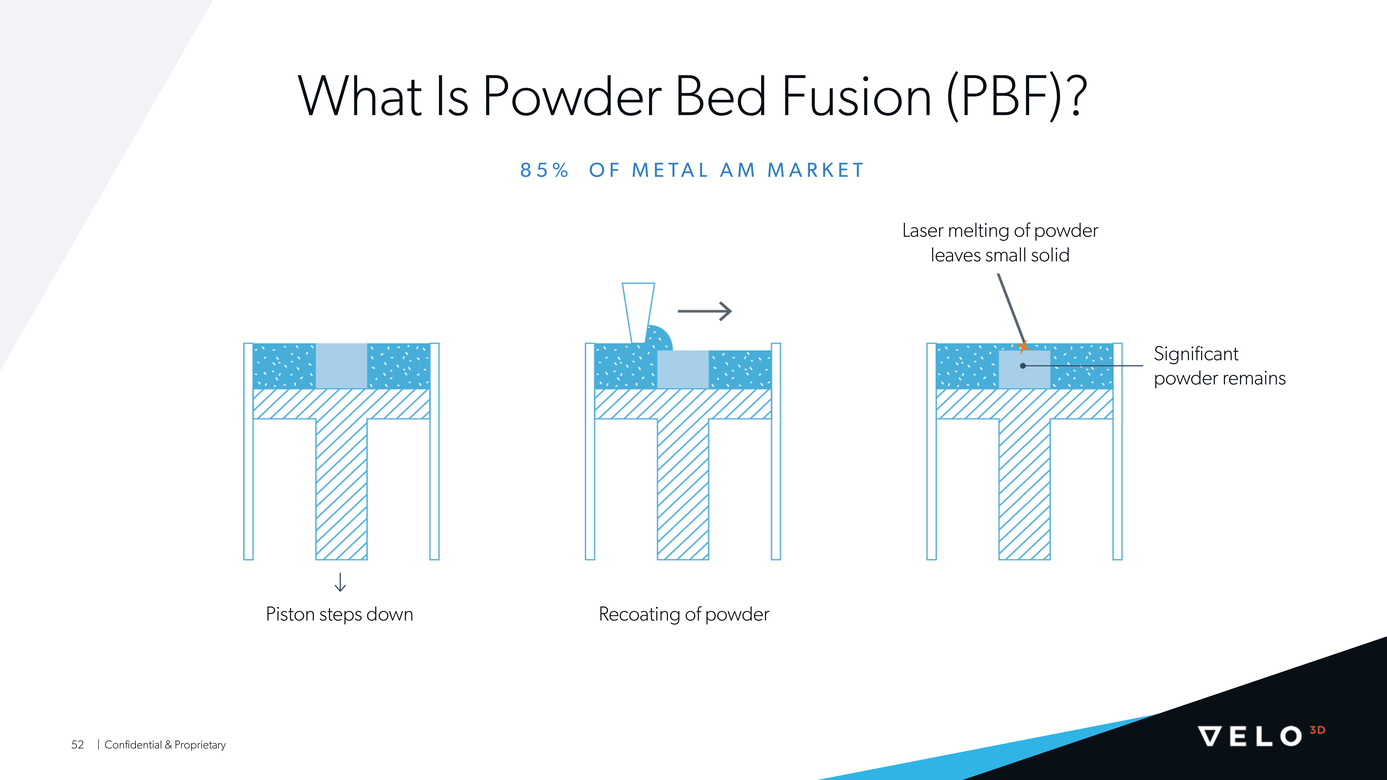

What Is Powder Bed Fusion (PBF)? 85%O F ME TA L A M MA R K E T Laser melting of powder leaves small solid Significant powder remains Piston steps downRecoating of powder 52 | Confidential & Proprietary |

|

What are supports? INC U M B E NT C O M M O D IT Y A MVE L O 3 D The desired outcome Outcome when produced without supports Supports added as anchors to prevent Outcome, as desired 53 | Confidential & Proprietary |

|

Risk Factors Below is a summary of certain risks and uncertainties relating to the Business Combination and the business of Velo3D, Inc. (“Velo3D”). The risks and uncertainties described below are not the only ones Velo3D faces, and you should consider them together with all of the other information included in our filings with the United States and Exchange Commission (the “SEC”) when evaluating Velo3D’s business, including a more detailed set of risk factors to be included in a registration statement on Form S-4 to be filed by [JAWS Spitfire] in connection with the Business Combination. Risks Related to Velo3D’s Business and Industry Velo3D’s financial projections are subject to significant risks, assumptions, estimates and uncertainties, and actual results may differ materially. These estimates and assumptions include estimates of the total addressable market for its products, assumptions regarding customer demand and performance under existing customer agreements, as well as anticipated customer agreements currently in negotiations, and assumptions regarding its ability to scale production to meet increased demand. These estimates and assumptions are subject to various factors beyond Velo3D’s control, including, for example, changes in customer demand, increased costs in Velo3D’s supply chain, increased labor costs, changes in the regulatory environment, the impact of global health crises and changes in Velo3D’s executive team. Velo3D’s financial projections and future performance are based, in part, on current contracts under negotiation with and indications of interest from potential customers that may withdraw from such negotiations and indications of interest. Such withdrawals may have an adverse effect on Velo3D’s future financial condition, results of operations and prospects, as well as assumptions regarding the exercise of options by existing customers. These estimates and assumptions are subject to various factors beyond Velo3D’s control; therefore, its future financial condition and results of operations may differ materially from its financial projections. Velo3D’s failure to manage growth effectively could have a material and adverse effect on its business, results of operations and financial condition. To manage the growth of its operations, Velo3D must establish appropriate and scalable production capacity, operational and financial systems, procedures and controls and must ensure it builds and maintains a qualified finance, administrative and operations staff. Velo3D has generated substantially all of its revenues to date from the sale of Sapphire systems for additive manufacturing of metal parts. Velo3D’s business model is predicated, in part, on building a customer base that will generate a recurring stream of revenues through the use of its additive manufacturing system and service contracts. If that recurring stream of revenues does not develop as expected, or if its business model changes as the industry evolves, its operating results may be adversely affected. The additive manufacturing industry in which Velo3D operates is characterized by rapid technological change, which requires it to continue to develop new additive manufacturing products and innovations to meet constantly evolving customer demands and which could adversely affect market adoption of its products. If demand for additive manufacturing products does not grow as expected, or if market adoption of additive manufacturing technology, and in particular the adoption of additive manufacturing of metal parts where it focuses its system, does not continue to develop, or develops more slowly than expected, its revenues may stagnate or decline, and its business may be adversely affected. Velo3D’s proposed future production facilities, will be in the developmental stage for several years until commercial production and volume commitments are expected to begin to be satisfied during the first half of 2022. As of March 2021, Velo3D has not selected a site for the its planned expansion facility or any future facility and may have difficulty finding a site with appropriate infrastructure and that meet the power requirements for production as there are limited facilities available. Velo3D has no agreement with an engineering, procurement and construction firm in relation to these future facilities; consequently, Velo3D’s management cannot predict on what terms such firm may agree to design and construct these future facilities. The design and construction of each future facility may experience cost overruns and delays that could materially and adversely affect Velo3D, and the cost to acquire or lease the land necessary to construct such future facilities may be substantial. Velo3D’s subsequent facilities will present similar risks and uncertainties. Defects in its additive manufacturing system or to enhancements to its additive manufacturing system that give rise to part failures for its customers or warranty or other claims could result in material expenses, diversion of management time and attention and damage to its reputation. If Velo3D fails to grow its business as anticipated, its net sales, gross margin and operating margin will be adversely affected. If Velo3D grows as anticipated but fail to manage its growth and expand its operations accordingly, its business may be harmed and its results of operation may suffer. | Confidential & Proprietary |

|

Risk Factors The loss of one or more of Velo3D’s significant customers, a significant reduction in their orders, their non-exercise of options, their inability to perform under their contracts, their unwillingness to extend contractual deadlines if there is a delay in Velo3D’s ability to produce the required amounts of contracted products, or a significant deterioration in their financial condition could have a material adverse effect on Velo3D’s business, results of operations and financial condition. There are significant technological and logistical challenges associated with producing, marketing, selling and delivering additive manufacturing systems such as Velo3D’s that make high-value component parts for its customers, and Velo3D may not be able to resolve all of the difficulties that may arise in a timely or cost-effective manner, or at all. While Velo3D believes that it understands the engineering and process characteristics necessary to successfully design and produce additive manufacturing systems to make high-value metal parts for its customers, its assumptions may prove to be incorrect, and it may be unable to consistently produce additive manufacturing products in an economical manner in commercial quantities. Declines in the prices of Velo3D’s additive manufacturing system and services, or in its volume of sales, together with its relatively inflexible cost structure, may adversely affect its financial results. Additive manufacturing is subject to price competition. Such price competition may adversely affect Velo3D’s results of operation, especially during periods of decreased demand. Decreased demand may also adversely impact the volume of Velo3D’s additive manufacturing systems sales. If Velo3D is not able to offset price reductions resulting from these pressures, or decreased volume of sales due to contractions in the market, by improved operating efficiencies and reduced expenditures, then its operating results will be adversely affected. Furthermore, changes in product mix may impact Velo3D’s gross margins and financial performance. The parts Velo3D creates are sold, and will continue to be sold, at different price points. Sales of certain of its parts or other products have, or are expected to have, higher gross margins than others. If the product mix shifts too far into lower gross margin products, and Velo3D is not able to sufficiently reduce the engineering, production and other costs associated with those products or substantially increase the sales of its higher gross margin products, its profitability could be reduced. The additive manufacturing industry in which Velo3D operates is fragmented and competitive and in which innovation is critical. Velo3D competes for customers with a wide variety of producers of additive manufacturing and/or 3D printing equipment that creates 3D objects and end-use parts, as well as with providers of materials and services for this equipment. Some of its existing and potential competitors are researching, designing, developing and marketing other types of products and services that may render its existing or future products obsolete, uneconomical or less competitive. Existing and potential competitors may also have substantially greater financial, technical, marketing and sales, manufacturing, distribution and other resources than Velo3D, including name recognition, as well as experience and expertise in intellectual property rights and operating within certain international markets, any of which may enable them to compete effectively against Velo3D. For example, a number of companies that have substantial resources have announced that they are beginning production of 3D printing systems, which will further enhance the competition Velo3D faces.Velo3D may lose market share to, or fail to gain market share from, producers of products that can be substituted for its products, which may have an adverse effect on its results of operations and financial condition. A substantial portion of Velo3D’s revenue is processed through a single customer, SpaceX, and the loss of this customer may adversely affect its operations and financial condition. Approximately 30% and 70% of its revenue was derived from sales through SpaceX for the fiscal years ended January 31, 2020 and 2019, respectively. Velo3D anticipates that a significant portion of its revenue will continue to be derived from sales through SpaceX in the foreseeable future. Velo3D also faces risks from financial difficulties or other uncertainties experienced by its suppliers, distributors or other third parties on which it relies. Velo3D does not have long-term agreements with any of these suppliers that obligate them to continue to sell components, subsystems, systems or products to it. Its reliance on these suppliers involves significant risks and uncertainties, including whether the suppliers will provide an adequate supply of required components, subsystems, or systems of sufficient quality, will increase prices for the components, subsystems or systems and will perform their obligations on a timely basis. In addition, certain suppliers have long lead times, which Velo3D cannot control. If third parties are unable to supply Velo3D with required materials or components or otherwise assist it in operating its business, its business could be harmed. In addition, compliance with the SEC’s conflict minerals regulations may increase Velo3D’s costs and adversely impact the supply-chain for its products. In addition, additive manufacturing has been identified by the U.S. government as an emerging technology and is currently being further evaluated for national security impacts. Velo3D expects additional regulatory changes to be implemented that will result in increased and/or new export controls related to 3D printing technologies, components and related materials and software. These changes, if implemented, may result in its being required to obtain additional approvals and/or licenses to sell 3D printers in the global market. Velo3D is subject to extensive government regulation, and its failure to comply with applicable regulations could subject it to penalties that may restrict its ability to conduct its business. Velo3D is subject to the Arms Export Control Act and the International Traffic in Arms Regulations and changes in restrictions and control may hamper Velo3D’s sales and marketing efforts. | Confidential & Proprietary |

|

Risk Factors Velo3D’s products and services are or may be distributed in more than 25 countries around the world. Accordingly, Velo3D faces significant operational risks from doing business internationally. For current and potential international customers whose contracts are denominated in U.S. dollars, the relative change in local currency values creates relative fluctuations in its product pricing. These changes in international end-user costs may result in lost orders and reduce the competitiveness of Velo3D’s products in certain foreign markets. As Velo3D realizes its strategy to expand internationally, its exposure to currency risks may increase. Other risks and uncertainties it faces from its global operations include: limited protection for the enforcement of contract and intellectual property rights in certain countries where it may sell its products or work with suppliers or other third parties; potentially longer sales and payment cycles and potentially greater difficulties in collecting accounts receivable; costs and difficulties of customizing products for foreign countries; challenges in providing solutions across a significant distance, in different languages and among different cultures; laws and business practices favoring local competition; being subject to a wide variety of complex foreign laws, treaties and regulations; compliance with U.S. laws affecting activities of U.S. companies abroad, including the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act or compliance with anti-corruption laws in other countries; tariffs, trade barriers and other regulatory or contractual limitations on its ability to sell or develop its products in certain foreign markets; operating in countries with a higher incidence of corruption and fraudulent business practices; changes in regulatory requirements, including export controls, tariffs and embargoes, other trade restrictions, competition, corporate practices and data privacy concerns; potential adverse tax consequences arising from global operations; rapid changes in government, economic and political policies and conditions; and political or civil unrest or instability, terrorism or epidemics and other similar outbreaks or events. In addition, Velo3D’s products and services in foreign jurisdictions may trigger unforeseen tax liabilities if foreign governments interpret tax treaties defining permanent establishment differently than Velo3D’s tax advisors. Velo3D’s services involve the storage and transmission of customers’ proprietary information, and security breaches could expose it to a risk of loss of information or the total or partial deletion or encryption of all stored customer data, litigation and possible liability. Velo3D’s security measures may be breached as a result of third-party action, employee error, and malfeasance or otherwise. Third parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as usernames, passwords or other information in order to gain access to its data or its customers’ data. Additionally, hackers may develop and deploy viruses, worms, and other malicious software programs that attack or gain access to its networks and data centers. Because the techniques used to obtain unauthorized access, or to sabotage systems, change frequently, grow more complex over time, and generally are not recognized until launched against a target, Velo3D may be unable to anticipate these techniques or to implement adequate preventative measures. Moreover, its security measures and those of its third-party service providers or customers may not detect such security breaches if they occur. Velo3D could be subject to litigation, which may be costly and time-consuming. Velo3D could be subject to personal injury, property damage, product liability, warranty and other claims involving allegedly defective products that it supplies. The products Velo3D supplies are sometimes used in potentially hazardous or critical applications, such as the assembled parts of an aircraft, medical device or automobile, that could result in death, personal injury, property damage, loss of production, punitive damages and consequential damages. The existence of any defects, errors, or failures in Velo3D’s products or the misuse of its products could also lead to product liability claims or lawsuits against us. While Velo3D has not experienced any such claims to date, actual or claimed defects in the products it supplies could result in it being named as a defendant in lawsuits asserting potentially large claims. Compliance with extensive environmental, health and safety laws could require material expenditures, changes in Velo3D’s operations or site remediation. In addition, Velo3D uses hazardous materials in its business, and it must comply with environmental laws and regulations associated therewith. Any claims relating to improper handling, storage or disposal of these materials or noncompliance with applicable laws and regulations could be time consuming and costly and could adversely affect its business and results of operations. Velo3D may be required to make significant capital investments in developing intellectual property and other proprietary information to improve and scale its technological processes, and failure to fund and make these investments, or underperformance of the technology funded by these investments, could severely impact Velo3D’s business, financial condition, results of operations and prospects. Velo3D’s business relies on intellectual property and other proprietary information, and Velo3D’s failure to protect its rights could harm its competitive advantages with respect to the manufacturing of its products, which may have an adverse effect on Velo3D’s results of operations and financial condition. As a result, Velo3D may be required to defend against claims of intellectual property infringement that may be asserted by its competitors against it and, if the outcome of any such litigation is adverse to Velo3D, it may affect its ability to compete effectively. Velo3D’s additive manufacturing software contains third-party open-source software components, and failure to comply with the terms of the underlying open-source software licenses could restrict its ability to sell its products. Open source licensors generally do not provide warranties or other contractual protections regarding infringement claims or the quality of the code. In addition, if Velo3D combines its proprietary software with open source software in a certain manner, it could, under certain open source licenses, be required to release to the public or remove the source code of its proprietary software. Velo3D may also face claims alleging noncompliance with open source license terms or infringement or misappropriation of proprietary software. Velo3D depends on information technology systems throughout its operations. The failure of any such systems or the failure of such systems to scale as Velo3D’s business grows, could adversely affect its results of operations. Velo3D is dependent on management and key personnel, and Velo3D’s business would suffer if it fails to retain its key personnel and attract additional highly skilled employees. The unaudited pro forma financial information included in the investor presentation may not be indicative of what Velo3D’s actual financial position or results of operations will be. | Confidential & Proprietary |

|

Risk Factors Risks Related to Velo3D’s Financial Condition and Need for Additional Capital Velo3D is an early stage company with a history of losses, and its future profitability is uncertain. It has experienced net losses and negative cash close in each year since inception. Velo3D expects that its net losses and negative cash flow will continue for the foreseeable future as it continues to invest in its research and development projects and expand its sales and marketing efforts. Velo3D’s limited operating history and rapid growth makes evaluating its current business and future prospects difficult and may increase the risk of your investment, and its operating results and financial condition may fluctuate from period to period. Velo3D may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all. Risks Related to Being a Public Company Velo3D’s management team has limited experience managing a public company and may not successfully or effectively manage Velo3D’s transition to a public company. As with any public company, JAWS Spitfire may be subject to securities litigation, which is expensive and could divert management’s attention. Velo3D’s internal control over financial reporting may not be effective detecting or preventing material errors at a reasonable level of assurance. Velo3D’s past or future financial statements may not be accurate and Velo3D may not be able to timely report its financial condition or results of operations, which may adversely affect investor confidence in Velo3D and the price of JAWS Spitfire’s securities. Velo3D is an emerging growth company that has not previously been audited. As a result, Velo3D does not have comprehensive documentation of its internal controls and expects that an audit report will likely conclude that there are and/or were material weaknesses in its internal controls or a combination of significant deficiencies that constitute material weaknesses in its internal controls. In addition, following any proposed business combination, Velo3D may be unable to timely and adequately complete any assessments with respect to its internal controls as may be necessary to comply with applicable reporting requirements. Risks Related to JAWS Spitfire’s Securities If the benefits of the business combination do not meet the expectations of investors or securities analysts, the market price of JAWS Spitfire’s securities may decline, either before or after the closing of the business combination. The combined entity will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on its business, financial condition and results of operations. An active trading market for JAWS Spitfire’s Class A ordinary shares may not be available on a consistent basis to provide stockholders with adequate liquidity. The stock price may be extremely volatile, and stockholders could lose a significant part of their investment. JAWS Spitfire Class A ordinary shares may fail to meet the continued listing standards of the New York Stock Exchange (“NYSE”), and additional shares may not be approved for listing on NYSE. Because Velo3D has no current plans to pay cash dividends for the foreseeable future, you may not receive any return on investment unless you sell your shares for a price greater than that which you paid for them. If, following the transaction, securities or industry analysts do not publish or cease publishing research or reports about Velo3D, its business, or its market, or if they change their recommendations regarding Velo3D’s securities adversely, the price and trading volume of Velo3D’s securities could decline. | Confidential & Proprietary |

|

Risk Factors General Risks Economic downturns and political and market conditions beyond JAWS Spitfire’s control could adversely affect its business, financial condition and results of operations. Velo3D is exposed to the risk of natural disasters, political events, health crises such as the global Covid-19 outbreak, war and terrorism and other macroeconomic events, each of which could disrupt its business and adversely affect its results of operations. Risks Related to JAWS Spitfire and the Business Combination Directors of JAWS Spitfire have potential conflicts of interest in recommending that JAWS Spitfire’s shareholders vote in favor of the adoption of the merger agreement and the business combination, and approval of the other proposals to be described in the proxy statement/prospectus. JAWS Spitfire may, in accordance with their terms, redeem unexpired JAWS Spitfire warrants prior to their exercise at a time that is disadvantageous to holders of JAWS Spitfire warrants. JAWS Spitfire’s founders, directors, officers, advisors and their affiliates may elect to purchase JAWS Spitfire Class A ordinary shares or JAWS Spitfire warrants from public shareholders, which may influence the vote on the business combination and reduce the public “float” of JAWS Spitfire’s Class A ordinary shares. JAWS Spitfire’s sponsor has agreed to vote in favor of the business combination, regardless of how JAWS Spitfire’s public shareholders vote. As a result, approximately 20.0% of JAWS Spitfire’s voting securities outstanding, representing the JAWS Spitfire voting securities held by JAWS Spitfire’s sponsor, will be contractually obligated to vote in favor of the business combination. Even if JAWS Spitfire consummates the business combination, there can be no assurance that JAWS Spitfire’s public warrants will be in the money during their exercise period, and they may expire worthless. The ability of JAWS Spitfire’s shareholders to exercise redemption rights with respect to a large number of outstanding JAWS Spitfire Class A ordinary shares could increase the probability that the business combination would not occur. The business combination is subject to conditions, including certain conditions that may not be satisfied on a timely basis, if at all. The JAWS Spitfire board has not obtained and will not obtain a third-party valuation or financial opinion in determining whether to proceed with the business combination. Current JAWS Spitfire shareholders will own a smaller proportion of the post-closing company than they currently own of JAWS Spitfire ordinary shares. In addition, following the closing of the business combination, JAWS Spitfire may issue additional shares or other equity securities without the approval of its shareholders, which would further dilute their ownership interests and may depress the market price of its shares. | Confidential & Proprietary |