INVESTOR PRESENTATION | August 2025

Disclaimer FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to Velo3D, Inc. (“Velo3D” or the “Company”). Words such as “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” or the negative of these words, and similar expressions are often intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties, some of which cannot be predicted or quantified. Velo3D cannot assure you that the results, events, and circumstances reflected in the forward-looking statements in this presentation will be achieved or occur. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including those described in the section captioned “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and subsequent Quarterly Reports on Form 10-Q, filed with the Securities and Exchange Commission. If any of these risks materialize or underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. In addition, forward-looking statements reflect our expectations, plans, or forecasts of future events and views as of the date of this presentation. We anticipate that subsequent events and developments will cause our assessments to change. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Additional risks and uncertainties are identified and discussed in Velo3D’s disclosure materials filed from time to time with the SEC, which are available at the SEC’s website at www.sec.gov or on Velo3D’s Investor Relations website at https://ir.velo3d.com. USE OF MODELING AND DATA The data contained herein is derived from various internal and external sources. All of the market data in the presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. Velo3D has not independently verified the data obtained from external sources. No representation is made as to the reasonableness or reliability of the assumptions made within or the accuracy or completeness of any projections, modeling, or any other information contained herein. Any data on past performance or modeling contained herein is not an indication of future performance. Velo3D assumes no obligation to update the information in this presentation. TRADEMARKS Velo3D owns or has rights to various trademarks, service marks, and trade names that it uses in connection with the operation of its businesses. This presentation may also contain trademarks, service marks, trade names, and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names, or products in this presentation is not intended to, and does not imply, a relationship with Velo3D, or an endorsement or sponsorship by or of Velo3D. Solely for convenience, the trademarks, service marks, trade names, and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Velo3D will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensor to these trademarks, service marks, trade names, and copyrights. NON-GAAP FINANCIAL MEASURES In addition to results determined in accordance with U.S. generally accepted accounting principles (“GAAP"), this presentation contains Adjusted EBITDA, Adjusted EBITDA Margin, and, excluding depreciation and amortization, which are non-GAAP financial performance measures. Adjusted EBITDA is defined as net income or loss attributable to Velo3D before interest income, interest expense, income taxes, depreciation and amortization, as well as significant non-cash and/or non-recurring expenses as our management believes these items are not as useful in evaluating the Company's core operating performance. These items include, but are not limited to, stock-based compensation expense, unrealized (gain) loss on certain warrants/shares classified as derivative liabilities, litigation, settlements, and related costs, severance, income on equity method investment, investment loss on short-term investments, and transaction costs associated with debt and equity financings. We determine Adjusted EBITDA Margin by taking the ratio between our Adjusted EBITDA and our revenue and expressing such ratio as a percentage, excluding depreciation and amortization, minus our stock-based compensation expense. We determine total Gross Margin percentage by taking total revenue and reducing it by exclude depreciation and amortization. These non-GAAP financial measures should not be considered in isolation or as an alternative to measures of financial performance determined in accordance with GAAP. Please refer to the appendix herein and our SEC filings for a reconciliation of such non-GAAP financial measures to their most comparable measures reported in accordance with GAAP, and for a discussion of the presentation, comparability, and use of such metrics.

k Company Overview We are visionary, innovative, collaborative, and bold – unlocking the next generation of metal 3D printing Founded 2014 Employees1 133 Headquarters Fremont, CA What We Do We are a leading provider of advanced metal additive manufacturing (AM) 3D printing solutions, offering a full- stack manufacturing platform used across industries such as space, aviation, defense, automotive, energy, and semiconductors to enhance performance, reduce costs, and accelerate production. Velo3D Fully Integrated Metal AM Solution Our Winning Differentiators Disruptive Additive Manufacturing (“AM”) Platform: Proprietary laser powder bed fusion (“L-PBF”) technology enables complex, support-free metal parts, reducing costs, lead time, and enabling on-demand, low-volume production. Velo3D is differentiated by enabling affordable scalability of complex geometries of large metal parts Strong Relationships with Leading Customers: Strong direct and indirect relationships with industry leaders, backed by a track record of value delivery, repeat sales, and growing market adoption Tailored Support That Meets Customer Needs: Whether it’s hands-on white service or empowering customers through training and self- sufficiency to drive success, we align our support model to each customers’ needs – so they get exactly what they need to succeed, when they need it Robust Intellectual Property Portfolio: 63 issued patents, 51 pending applications, and trademark protections extending through 2047 create a strong IP moat supporting long-term differentiation and competitive advantage Capital-Efficient Business Model: Asset-efficient model focused on rapid return on investment that support scalable, high- margin growth 1) As of July 25, 2025

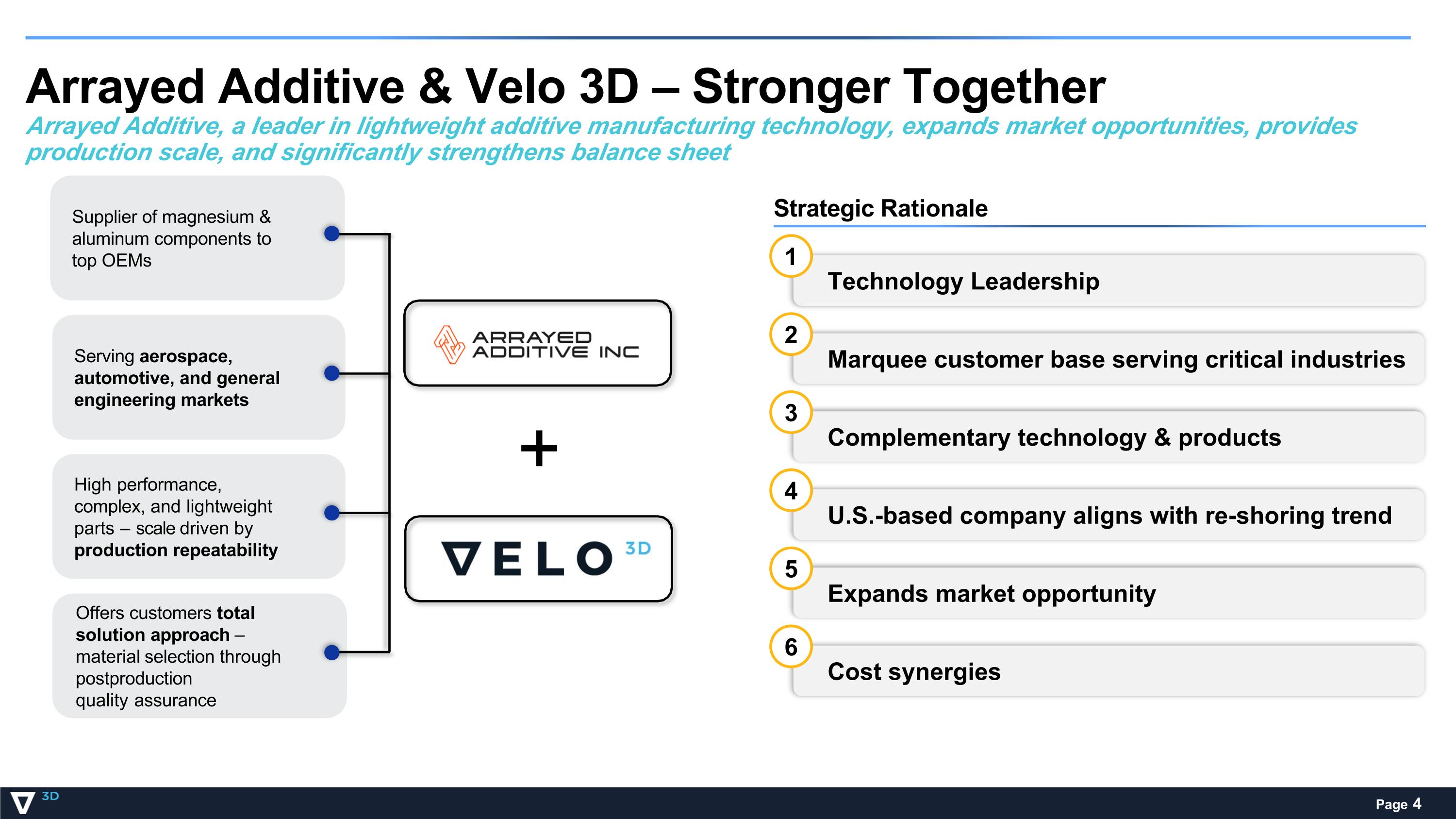

Arrayed Additive & Velo 3D – Stronger Together Arrayed Additive, a leader in lightweight additive manufacturing technology, expands market opportunities, provides production scale, and significantly strengthens balance sheet + Supplier of magnesium & aluminum components to top OEMs Serving aerospace, automotive, and general engineering markets High performance, complex, and lightweight parts – scale driven by production repeatability Offers customers total solution approach – material selection through postproduction quality assurance Strategic Rationale Technology Leadership 1 Marquee customer base serving critical industries 2 Complementary technology & products 3 U.S.-based company aligns with re-shoring trend 4 Expands market opportunity 5 Cost synergies 6

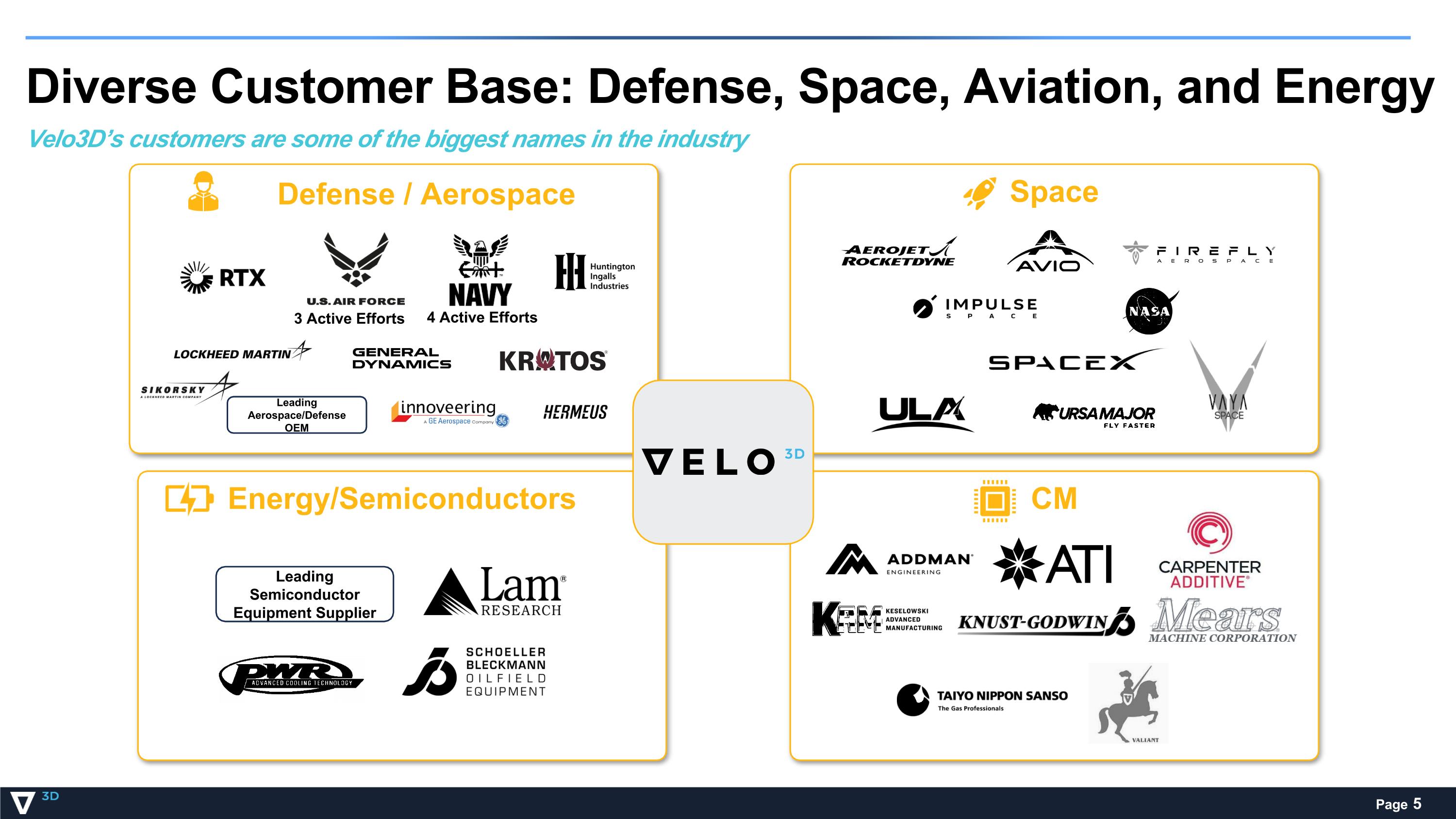

Energy/Semiconductors Diverse Customer Base: Defense, Space, Aviation, and Energy Velo3D’s customers are some of the biggest names in the industry Space CM Leading Semiconductor Equipment Supplier Leading Aerospace/Defense OEM 3 Active Efforts Defense / Aerospace 4 Active Efforts

Geopolitics Demands Domestic Supply Chain Velo3D Printed Hypersonic Scram Jet Key drivers of reshoring: national security, economic resilience, simplified supply chain, localized production Reshoring to be key investment theme of the next 5-10 years Annualized US manufacturing construction spend rose 86% to $237 billion (2022 – 2024) 90% of North American manufacturing companies have relocated part of their production / supply chain to the US in the past five years (50% shifting more than 20% of operations) Significant Pentagon emphasis on US defense-related manufacturing Increasing focus on securing domestic production of critical materials Velo3D - Only US Home Grown Large-Format Metal Additive Manufacturing Company

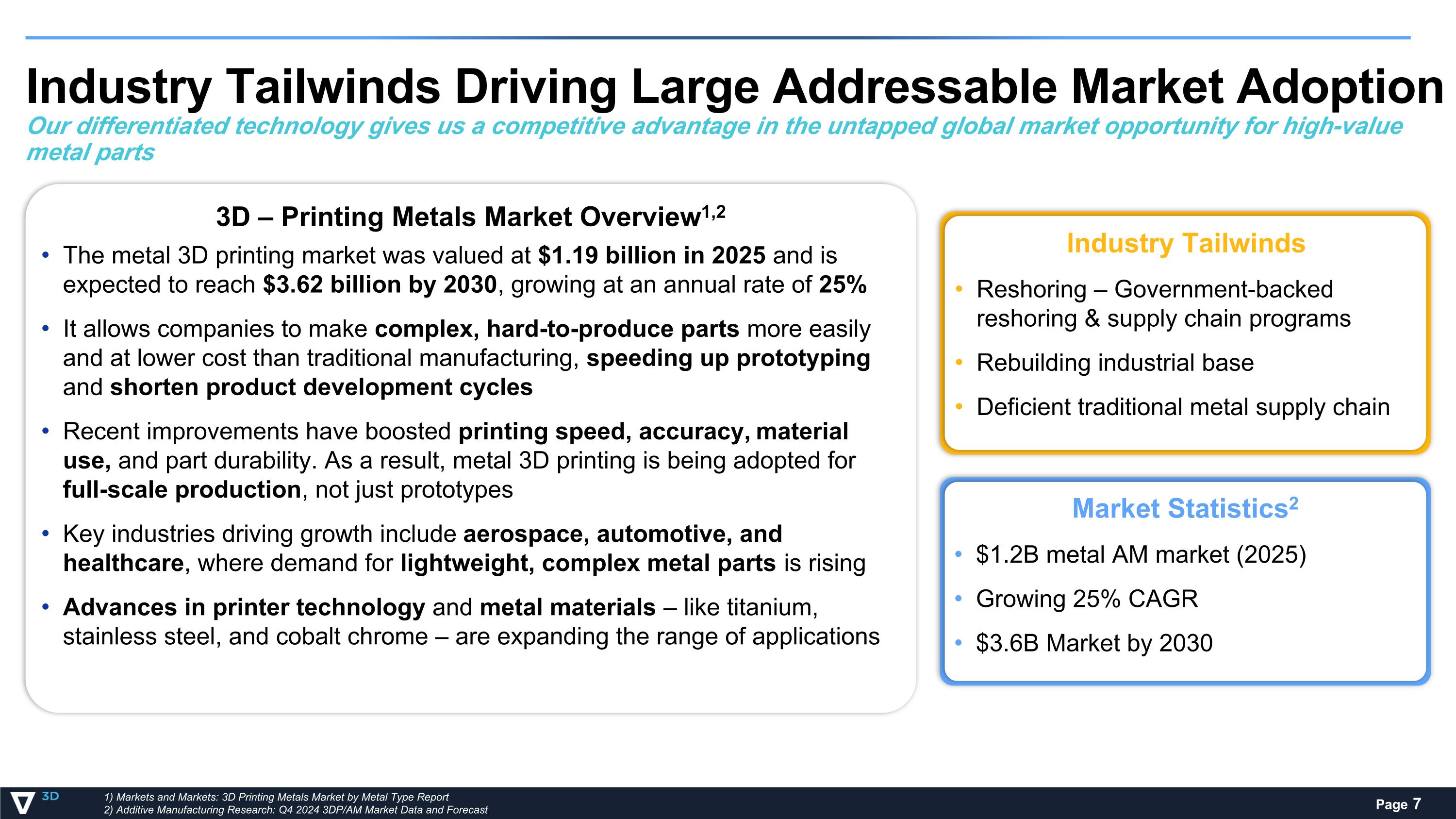

Industry Tailwinds Driving Large Addressable Market Adoption Our differentiated technology gives us a competitive advantage in the untapped global market opportunity for high-value metal parts 3D – Printing Metals Market Overview1,2 The metal 3D printing market was valued at $1.19 billion in 2025 and is expected to reach $3.62 billion by 2030, growing at an annual rate of 25% It allows companies to make complex, hard-to-produce parts more easily and at lower cost than traditional manufacturing, speeding up prototyping and shorten product development cycles Recent improvements have boosted printing speed, accuracy, material use, and part durability. As a result, metal 3D printing is being adopted for full-scale production, not just prototypes Key industries driving growth include aerospace, automotive, and healthcare, where demand for lightweight, complex metal parts is rising Advances in printer technology and metal materials – like titanium, stainless steel, and cobalt chrome – are expanding the range of applications Industry Tailwinds Reshoring – Government-backed reshoring & supply chain programs Rebuilding industrial base Deficient traditional metal supply chain Market Statistics2 $1.2B metal AM market (2025) Growing 25% CAGR $3.6B Market by 2030 1) Markets and Markets: 3D Printing Metals Market by Metal Type Report 2) Additive Manufacturing Research: Q4 2024 3DP/AM Market Data and Forecast

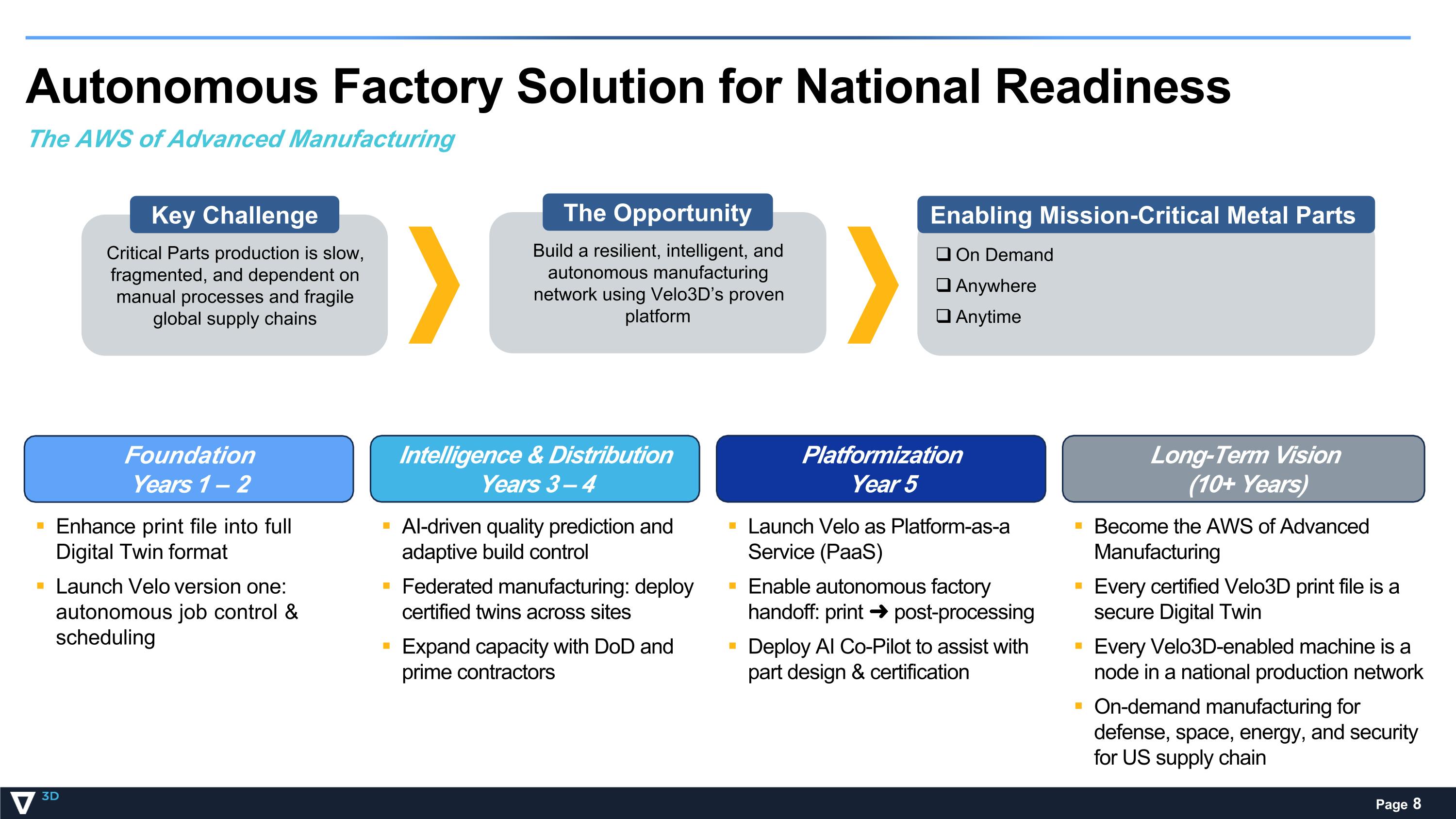

Enhance print file into full Digital Twin format Launch Velo version one: autonomous job control & scheduling Autonomous Factory Solution for National Readiness The AWS of Advanced Manufacturing Foundation Years 1 – 2 Intelligence & Distribution Years 3 – 4 Platformization Year 5 Long-Term Vision (10+ Years) AI-driven quality prediction and adaptive build control Federated manufacturing: deploy certified twins across sites Expand capacity with DoD and prime contractors Launch Velo as Platform-as-a Service (PaaS) Enable autonomous factory handoff: print ➜ post-processing Deploy AI Co-Pilot to assist with part design & certification Become the AWS of Advanced Manufacturing Every certified Velo3D print file is a secure Digital Twin Every Velo3D-enabled machine is a node in a national production network On-demand manufacturing for defense, space, energy, and security for US supply chain Critical Parts production is slow, fragmented, and dependent on manual processes and fragile global supply chains Key Challenge Build a resilient, intelligent, and autonomous manufacturing network using Velo3D’s proven platform The Opportunity On Demand Anywhere Anytime Enabling Mission-Critical Metal Parts

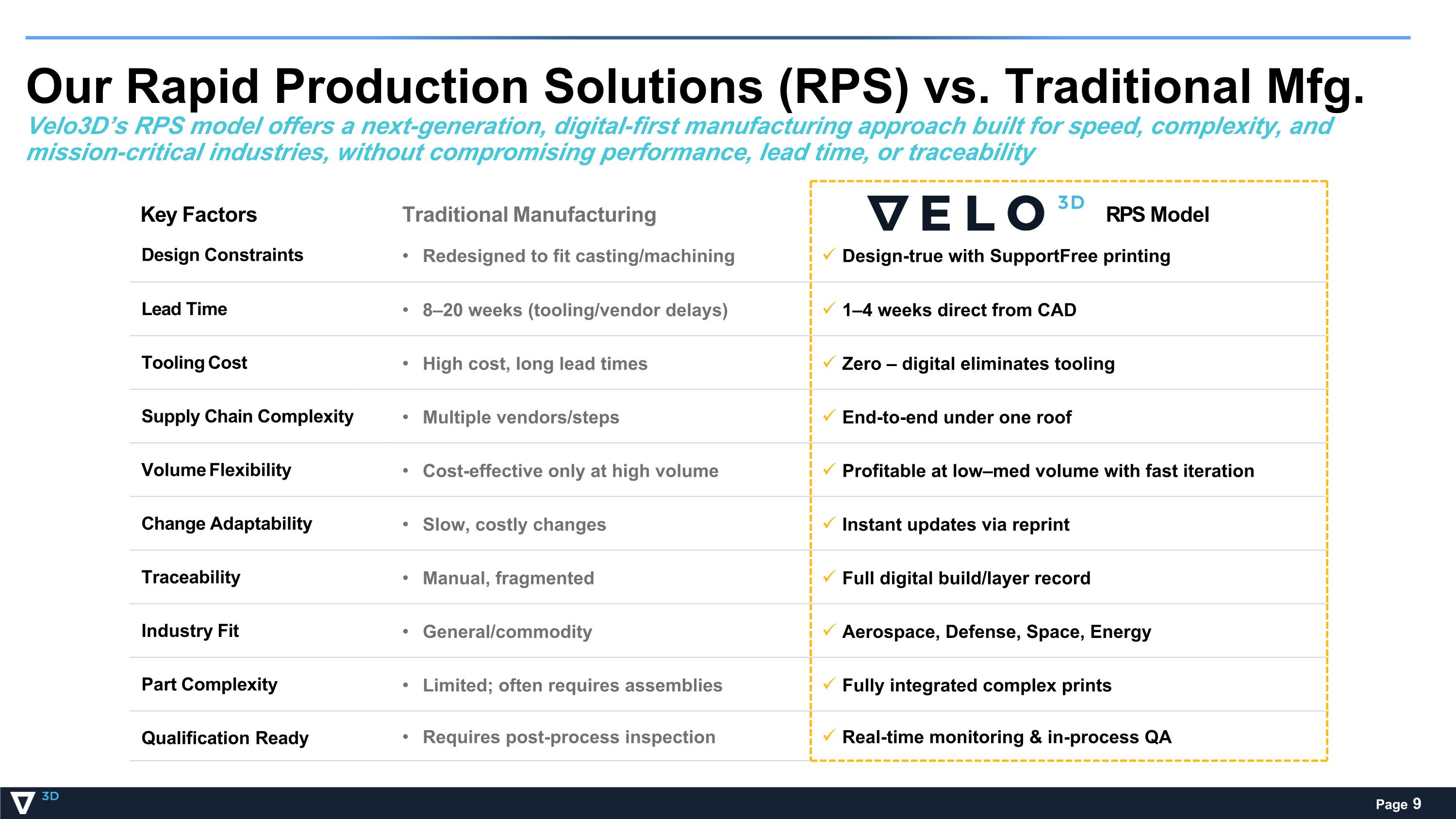

Our Rapid Production Solutions (RPS) vs. Traditional Mfg. Velo3D’s RPS model offers a next-generation, digital-first manufacturing approach built for speed, complexity, and mission-critical industries, without compromising performance, lead time, or traceability Key Factors Traditional Manufacturing RPS Model Design Constraints Redesigned to fit casting/machining Design-true with SupportFree printing Lead Time 8–20 weeks (tooling/vendor delays) 1–4 weeks direct from CAD Tooling Cost High cost, long lead times Zero – digital eliminates tooling Supply Chain Complexity Multiple vendors/steps End-to-end under one roof Volume Flexibility Cost-effective only at high volume Profitable at low–med volume with fast iteration Change Adaptability Slow, costly changes Instant updates via reprint Traceability Manual, fragmented Full digital build/layer record Industry Fit General/commodity Aerospace, Defense, Space, Energy Part Complexity Limited; often requires assemblies Fully integrated complex prints Qualification Ready Requires post-process inspection Real-time monitoring & in-process QA

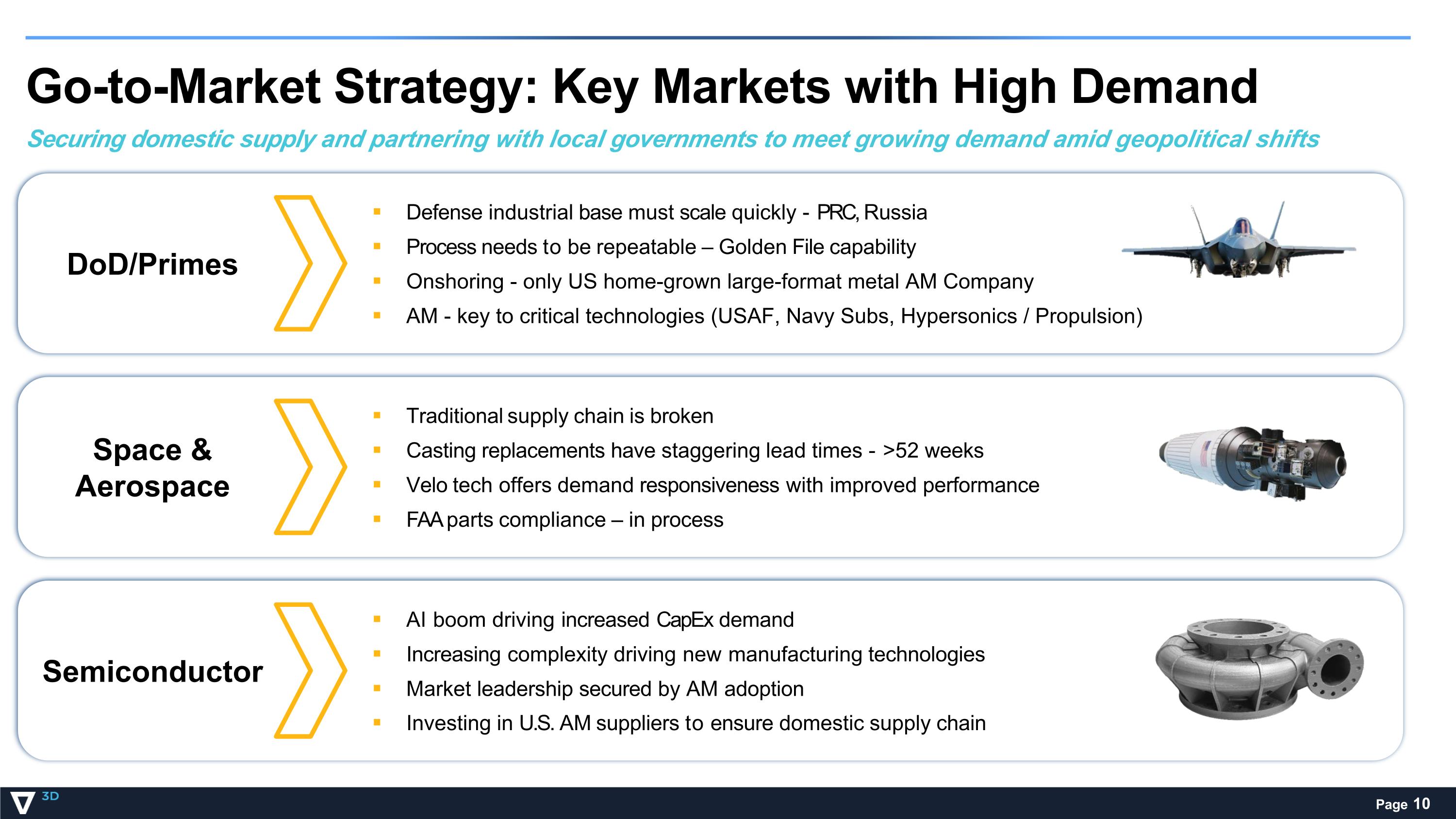

Go-to-Market Strategy: Key Markets with High Demand Securing domestic supply and partnering with local governments to meet growing demand amid geopolitical shifts Defense industrial base must scale quickly - PRC, Russia Process needs to be repeatable – Golden File capability Onshoring - only US home-grown large-format metal AM Company AM - key to critical technologies (USAF, Navy Subs, Hypersonics / Propulsion) DoD/Primes Traditional supply chain is broken Casting replacements have staggering lead times - >52 weeks Velo tech offers demand responsiveness with improved performance FAA parts compliance – in process Space & Aerospace AI boom driving increased CapEx demand Increasing complexity driving new manufacturing technologies Market leadership secured by AM adoption Investing in U.S. AM suppliers to ensure domestic supply chain Semiconductor

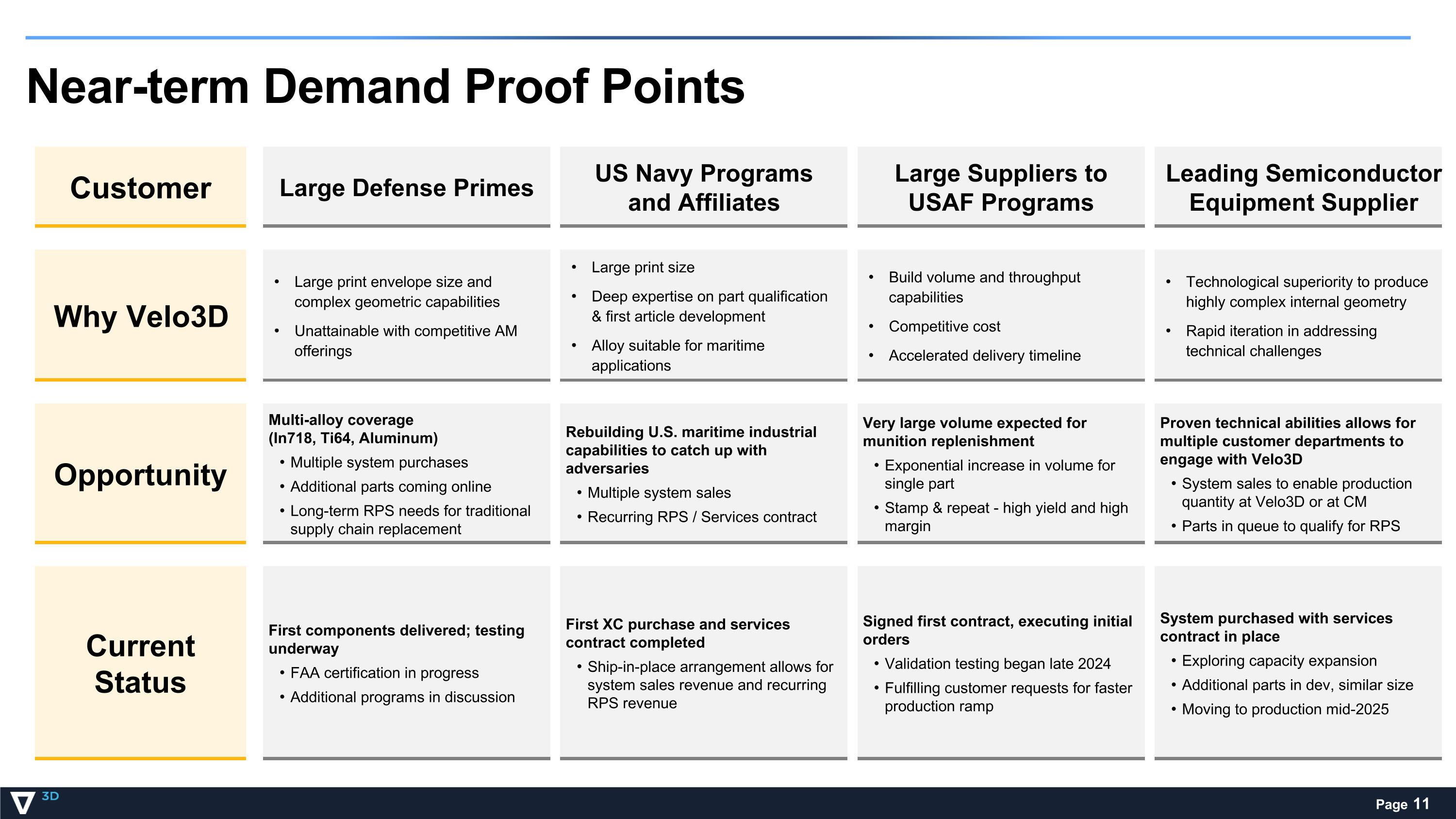

Near-term Demand Proof Points Customer Current Status Why Velo3D Opportunity Large Defense Primes US Navy Programs and Affiliates Large Suppliers to USAF Programs Leading Semiconductor Equipment Supplier Technological superiority to produce highly complex internal geometry Rapid iteration in addressing technical challenges Proven technical abilities allows for multiple customer departments to engage with Velo3D System sales to enable production quantity at Velo3D or at CM Parts in queue to qualify for RPS System purchased with services contract in place Exploring capacity expansion Additional parts in dev, similar size Moving to production mid-2025 Large print envelope size and complex geometric capabilities Unattainable with competitive AM offerings Multi-alloy coverage (In718, Ti64, Aluminum) Multiple system purchases Additional parts coming online Long-term RPS needs for traditional supply chain replacement First components delivered; testing underway FAA certification in progress Additional programs in discussion Large print size Deep expertise on part qualification & first article development Alloy suitable for maritime applications Rebuilding U.S. maritime industrial capabilities to catch up with adversaries Multiple system sales Recurring RPS / Services contract First XC purchase and services contract completed Ship-in-place arrangement allows for system sales revenue and recurring RPS revenue Build volume and throughput capabilities Competitive cost Accelerated delivery timeline Very large volume expected for munition replenishment Exponential increase in volume for single part Stamp & repeat - high yield and high margin Signed first contract, executing initial orders Validation testing began late 2024 Fulfilling customer requests for faster production ramp

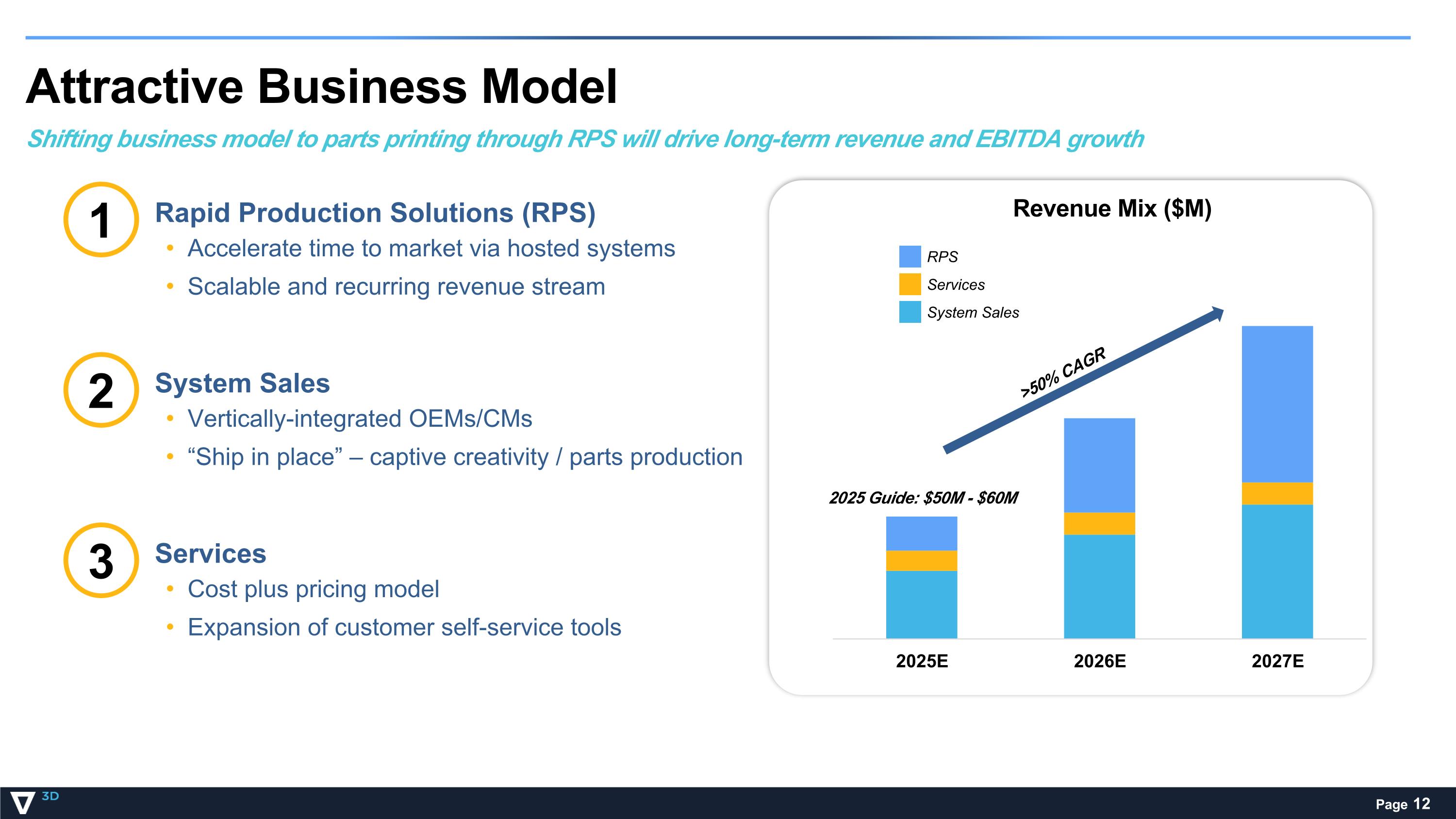

Attractive Business Model Shifting business model to parts printing through RPS will drive long-term revenue and EBITDA growth 1 Rapid Production Solutions (RPS) Accelerate time to market via hosted systems Scalable and recurring revenue stream 2 System Sales Vertically-integrated OEMs/CMs “Ship in place” – captive creativity / parts production 3 Services Cost plus pricing model Expansion of customer self-service tools Revenue Mix ($M) RPS Services System Sales 2025 Guide: $50M - $60M >50% CAGR

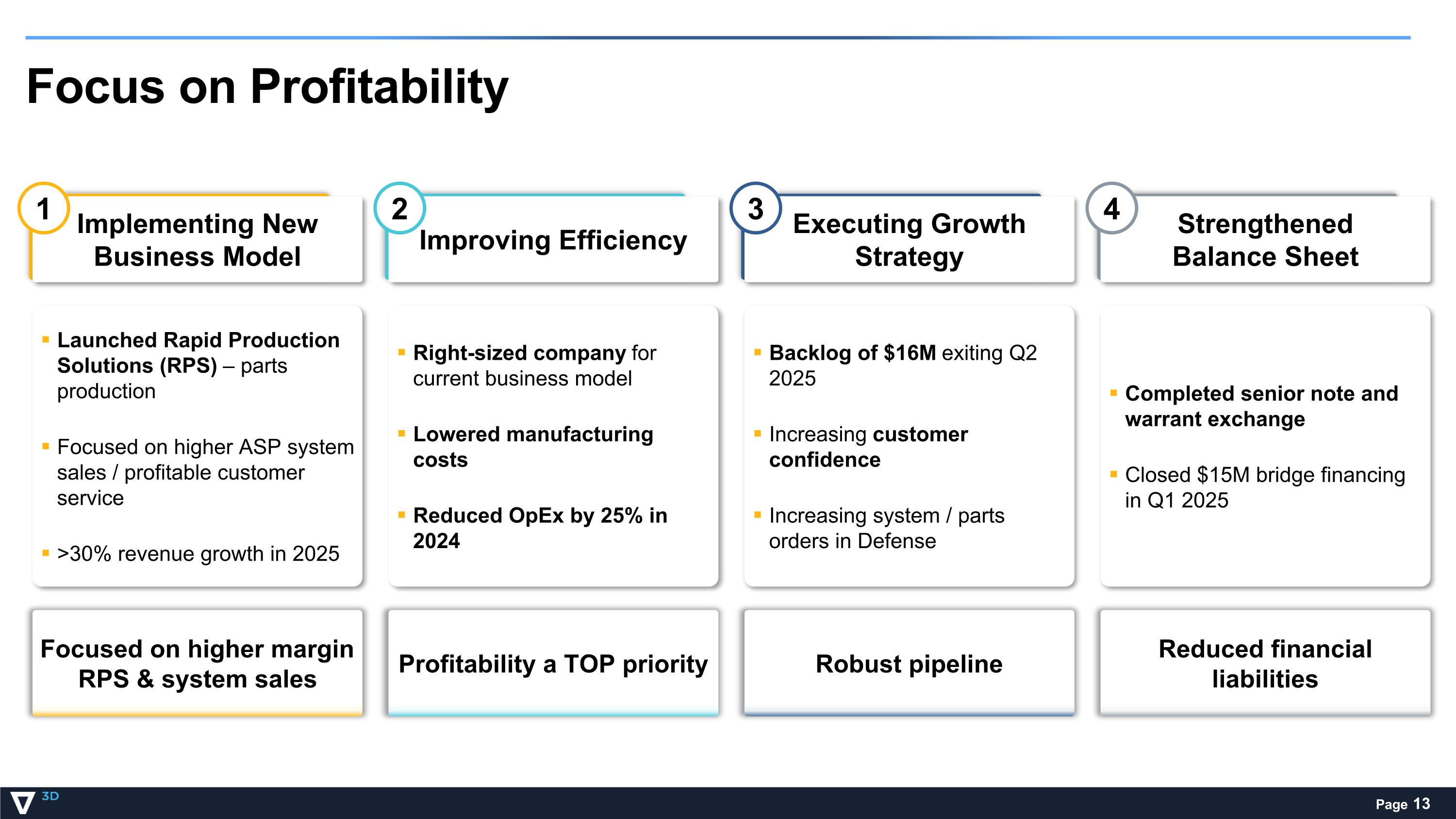

Focus on Profitability Implementing New Business Model 1 Launched Rapid Production Solutions (RPS) – parts production Focused on higher ASP system sales / profitable customer service >30% revenue growth in 2025 Focused on higher margin RPS & system sales Improving Efficiency 2 Right-sized company for current business model Lowered manufacturing costs Reduced OpEx by 25% in 2024 Profitability a TOP priority Executing Growth Strategy 3 Backlog of $16M exiting Q2 2025 Increasing customer confidence Increasing system / parts orders in Defense Robust pipeline Strengthened Balance Sheet 4 Completed senior note and warrant exchange Closed $15M bridge financing in Q1 2025 Reduced financial liabilities

Partnering with Local Governments for Expansion Location: In Discussion Multiple state / county sites in consideration Focusing on manufacturing and technology hubs Strategically located to major cities with significant infrastructure already in place Strong local governmental support Partnership with major developers Capacity ramp – 18 months construction

Join Us at the Inflection Point First-mover in mission-critical AM with proven IP Transforming into high-margin recurring revenue business Deep traction in defense and aerospace Visionary team and marquee customer base

Appendix

Executive team has the vision and experience to execute Education Experience Arun Jeldi Chief Executive Officer & Director Hull Xu Chief Financial Officer Michelle Sidwell Chief Revenue Officer Zachary Murphree Chief Strategy Officer +1 11+ +1 29+ +1 30+ 8+ 14+ Years with Company Years Experience Years with Company Years Experience Years with Company Years Experience Years with Company Years Experience Green Metal Reclaim

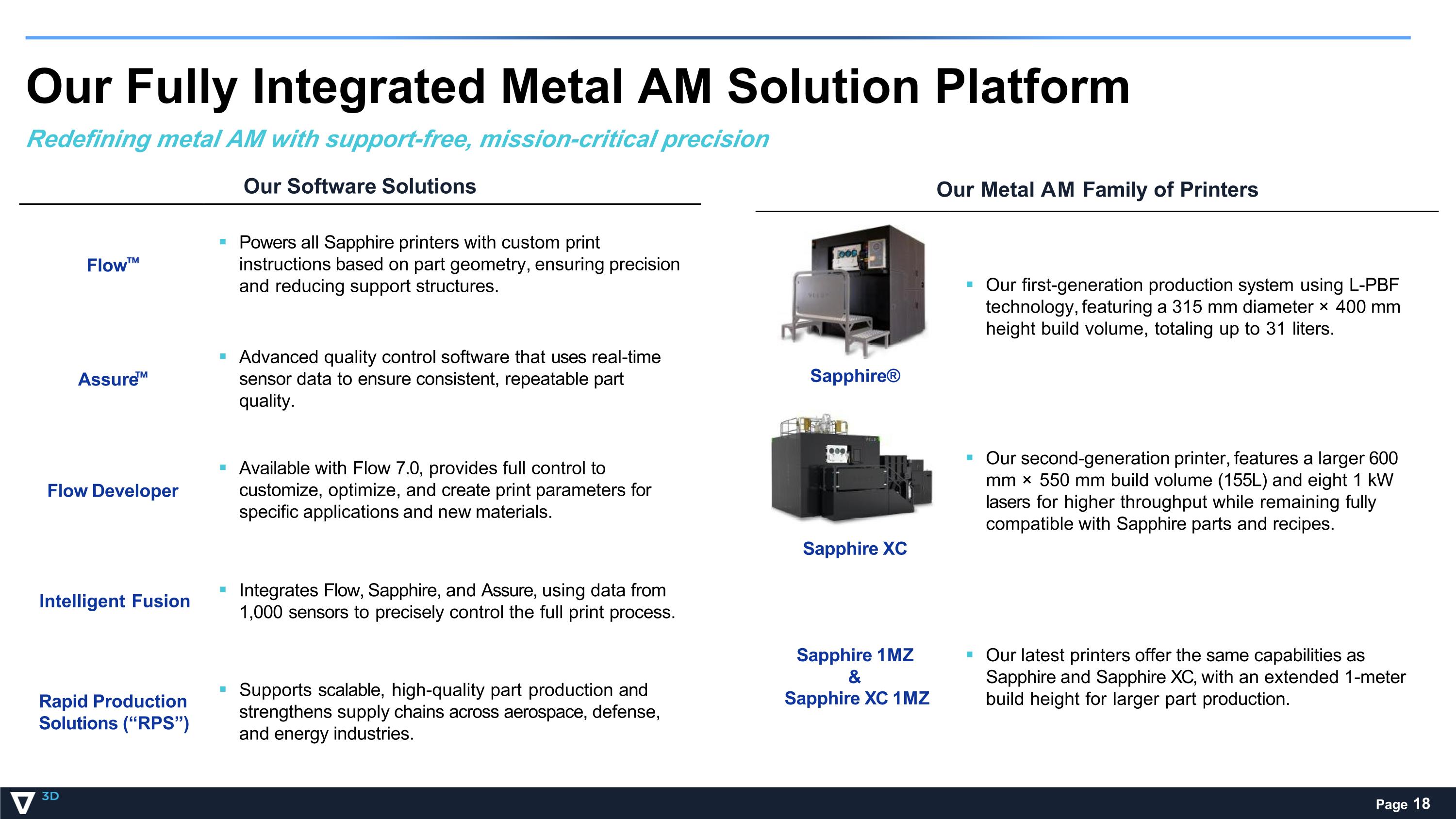

Our Fully Integrated Metal AM Solution Platform Redefining metal AM with support-free, mission-critical precision Our Software Solutions Flow Powers all Sapphire printers with custom print instructions based on part geometry, ensuring precision and reducing support structures. Assure Advanced quality control software that uses real-time sensor data to ensure consistent, repeatable part quality. Flow Developer Available with Flow 7.0, provides full control to customize, optimize, and create print parameters for specific applications and new materials. Intelligent Fusion Integrates Flow, Sapphire, and Assure, using data from 1,000 sensors to precisely control the full print process. Rapid Production Solutions (“RPS”) Supports scalable, high-quality part production and strengthens supply chains across aerospace, defense, and energy industries. Our Metal AM Family of Printers Sapphire® Our first-generation production system using L-PBF technology, featuring a 315 mm diameter × 400 mm height build volume, totaling up to 31 liters. Sapphire XC Our second-generation printer, features a larger 600 mm × 550 mm build volume (155L) and eight 1 kW lasers for higher throughput while remaining fully compatible with Sapphire parts and recipes. Sapphire 1MZ & Sapphire XC 1MZ Our latest printers offer the same capabilities as Sapphire and Sapphire XC, with an extended 1-meter build height for larger part production.

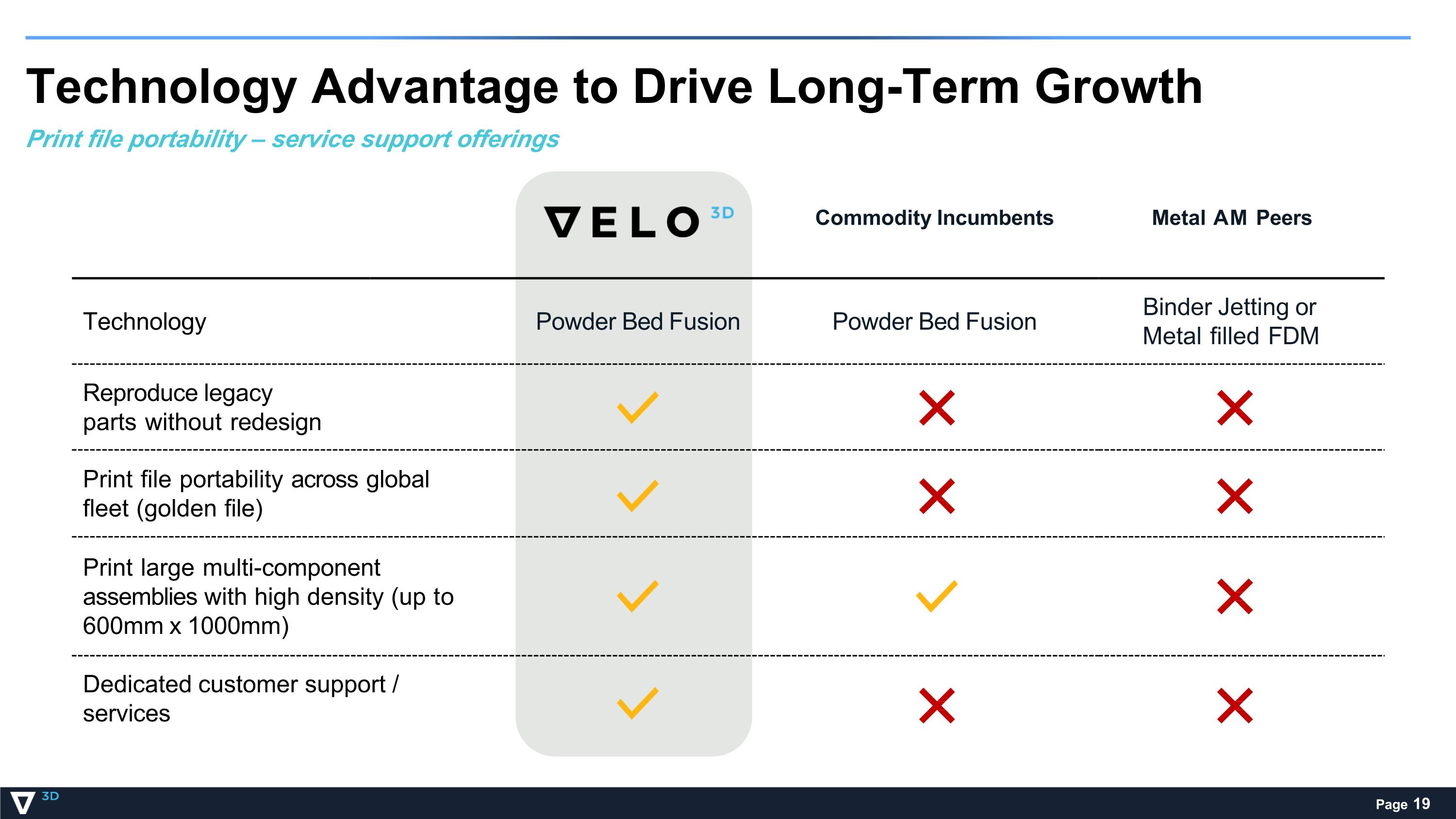

Technology Advantage to Drive Long-Term Growth Print file portability – service support offerings Commodity Incumbents Metal AM Peers Technology Powder Bed Fusion Powder Bed Fusion Binder Jetting or Metal filled FDM Reproduce legacy parts without redesign Print file portability across global fleet (golden file) Print large multi-component assemblies with high density (up to 600mm x 1000mm) Dedicated customer support / services