UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

|

|

☒ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under §240.14a-12 |

VELO3D, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

|

|

☒ |

|

No fee required. |

☐ |

|

Fee paid previously with preliminary materials. |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY SUPPLEMENT—SUBJECT TO COMPLETION

DATED JUNE 5, 2025

VELO3D, INC.

2710 Lakeview Court

Fremont, California 94538

, 2025

Dear Stockholder:

We are writing to notify you of important information about the 2025 annual meeting of stockholders of Velo3D, Inc. (the “Company”).

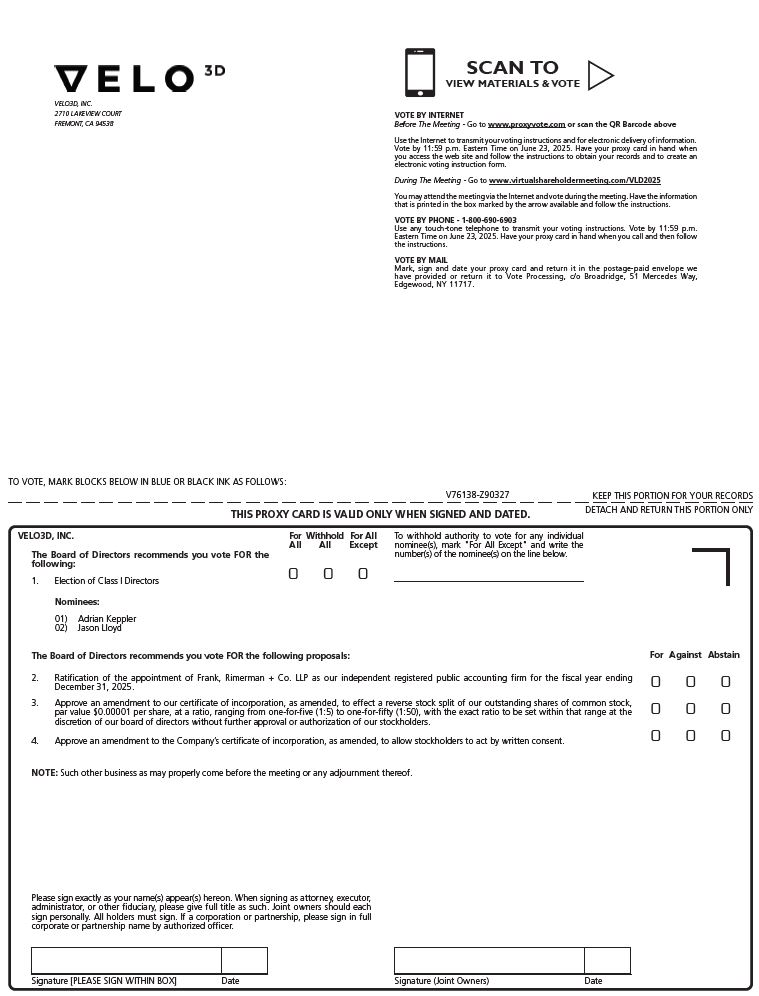

We previously filed and made available to our stockholders our proxy statement and related proxy materials on April 30, 2025 (the “Proxy Statement”), which contained two proposals. The enclosed supplementary proxy materials (the “Supplement”) is being sent to you because we have determined to (i) add a new Proposal 3 to the original Proxy Statement in order to approve an amendment to our certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders, and (ii) add a new Proposal 4 to the original Proxy Statement in order to approve an amendment to our certificate of incorporation, as amended, to allow stockholders to act by written consent.

Accordingly, we are furnishing to you, together with this letter, an Amended Notice of the 2025 Annual Meeting and the Supplement to the previously furnished Proxy Statement, which reflect the revised agenda for the annual meeting and describe the new proposal to be voted on at the annual meeting, as well as a new proxy card for purposes of casting your vote on all of the proposals to be voted on at the annual meeting. The annual meeting location and time is not being changed. The annual meeting will be held at 1:00 p.m. PT/4:00 p.m. ET on June 24, 2025, virtually at www.virtualshareholdermeeting.com/VLD2025. There is no physical location for the annual meeting.

Please read the Proxy Statement and the Supplement in their entirety as together they contain all of the information that is important to your decisions in voting at the annual meeting.

When you have finished reading the Proxy Statement and Supplement, please promptly submit your proxy by completing the enclosed new proxy card in its entirety, signing, dating and returning it in the enclosed envelope (or following the instructions to vote by Internet or telephone). We encourage you to submit your proxy so that your shares will be represented and voted at the meeting, whether or not you can attend. The enclosed new proxy card permits you to submit your proxy for all four of the proposals included in the Proxy Statement and the Supplement, and will replace any previously submitted proxy in connection with the annual meeting.

If you have already submitted your proxy and do not submit a new proxy, your previously submitted proxy will be voted at the annual meeting with respect to all other proposals; however, the Company strongly encourages you to submit a new proxy so that your vote will be considered on Proposals 3 and 4.

Sincerely,

|

|

|

Nancy Krystal |

General Counsel and Secretary |

Fremont, California

Amended Notice of Annual Meeting of Stockholders to be held Monday, June 24, 2025

Dear Stockholder:

The annual meeting of stockholders of Velo3D, Inc. (“Velo3D” or the “Company”) will be held virtually at www.virtualshareholdermeeting.com/VLD2025 on Monday, June 24, 2025, at 1:00 p.m. Pacific Time/4:00 p.m. Eastern Time, for the following purposes:

|

|

|

|

1. |

Elect two Class I directors of Velo3D, Inc., each to serve a three-year term expiring at the 2028 annual meeting of stockholders and until such director’s successor is duly elected and qualified. |

|

|

|

|

2. |

Ratify the appointment of Frank, Rimmerman + Co. LLP as our independent registered public accounting firm for the year ending December 31, 2025. |

|

|

|

|

3. |

Approve an amendment to our certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders. |

|

|

|

|

4. |

Approve an amendment to the Company’s certificate of incorporation, as amended, to allow stockholders to act by written consent. |

|

|

|

|

5. |

To transact such other business as may properly come before the meeting or any adjournment(s) thereof. |

The preceding items of business were described in our original Proxy Statement dated April 30, 2025 (the “Proxy Statement”), with the exception of Proposals 3 and 4, which are described in the attached supplement (the “Supplement”) to the Proxy Statement.

Stockholders of record at the close of business on April 29, 2025 will be entitled to vote at the annual meeting. Each of the foregoing items of business is more fully described in the Proxy Statement and Supplement, which accompany this Amended Notice or have been previously furnished to you.

The enclosed Supplement describes new Proposals 3 and 4 and includes a revised proxy card which covers the four proposals included in the Proxy Statement and adds new Proposals 3 and 4. If you wish to vote on these new Proposals, you must sign, date and return the enclosed proxy card (or follow the instructions to vote by Internet or telephone). Signing and submitting this new proxy card will revoke any prior proxy in its entirety. Therefore, if you submit the new proxy card (or vote by Internet or telephone), in addition to voting on Proposals 3 and 4, you must mark the new proxy card in the appropriate place (or follow the instructions to vote by Internet or telephone) to indicate your vote on Proposals 1 and 2.

Our stockholders have previously received a Notice of Internet Availability of Proxy Materials, which provided instructions for accessing the proxy materials, but did not receive printed copies of the proxy materials unless they requested them, as we previously elected to use the internet as our primary means of providing our proxy materials to stockholders. We will provide access to the Supplement, this Amended Notice and a proxy card reflecting all four proposals to be voted on at the annual meeting, both by mailing to you a full set of these supplemental materials, and also by notifying you of the availability on the internet of all of our proxy materials, including these supplemental materials and the Proxy Statement and our annual report for the year ended December 31, 2024.

The stock transfer books of the Company will remain open between the record date, April 29, 2025, and the date of the meeting. A list of stockholders entitled to vote at the annual meeting will be available for inspection at the offices of the Company and at the meeting. Whether or not you plan to attend the annual meeting in person, please sign, date

and return the enclosed proxy card (or follow the instructions to vote by Internet or telephone). If you virtually attend the annual meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the annual meeting will be counted. The prompt return of your proxy will assist us in preparing for the annual meeting.

By Order of the Board of Directors,

|

|

|

Nancy Krystal |

General Counsel and Secretary |

Fremont, California

General Information about this Supplement and the

Annual Meeting

This Supplement describes new Proposals 3 and 4, which are being added to the agenda for the annual meeting and therefore are not described in the original Proxy Statement. Information about Proposals 1 and 2, each of which will also be presented to stockholders at the annual meeting, can be found in the Proxy Statement as originally filed with the SEC and made available to our stockholders on or about April 30, 2025. To the extent the information in the Supplement differs from, updates or conflicts with the information contained in the Proxy Statement, the information in the Supplement shall amend and supersede the information contained in the Proxy Statement. Except as so amended or superseded, all information set forth in the Proxy Statement remains unchanged and important for you to review. Accordingly, we urge you to read the Supplement carefully in its entirety together with the Proxy Statement. All capitalized terms used in the Supplement and not otherwise defined herein have the respective meanings given to them in the Proxy Statement. The Supplement is being made available to our stockholders on or about , 2025. Capitalized terms used herein without definition shall have the meanings ascribed to such terms in the Proxy Statement.

|

|

|

|

|

|

|

|

|

What is the purpose of the Supplement? |

|

We previously filed and made available to our stockholders our original Proxy Statement and related proxy materials on April 30, 2025, which contained two proposals. The enclosed Supplement is being sent to you because we have determined to (i) add a new Proposal 3 to the original Proxy Statement in order to approve an amendment to our certificate of incorporation, as amended, to effect a reverse stock split of our outstanding shares of common stock, par value $0.00001 per share, at a ratio, ranging from one-for-five (1:5) to one-for-fifty (1:50), with the exact ratio to be set within that range at the discretion of our board of directors without further approval or authorization of our stockholders, and (ii) add a new Proposal 4 to the original Proxy Statement in order to approve an amendment to the Company’s certificate of incorporation, as amended, to allow stockholders to act by written consent. |

|

|

|

|

|

|

How will the Supplement and proxy materials be delivered? |

|

Most of our stockholders who are entitled to notice of and to vote at the annual meeting previously received a Notice of Internet Availability of Proxy Materials for the annual meeting, which provided instructions on how to access the proxy materials on the Internet, but did not receive printed copies of the proxy materials unless they requested them. We will provide access to the Supplement, the Amended Notice and a proxy card reflecting all four proposals to be voted on at the annual meeting, both by mailing to you a full set of these supplemental materials, and also by notifying you of the availability on the Internet of all of our proxy materials, including these supplemental materials and the Proxy Statement and our annual report for the year ended December 31, 2024. Accordingly, and pursuant to applicable SEC rules that require us to notify our stockholders of the availability of all of our proxy materials on the Internet, we are providing the following notice: Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Monday, June 24, 2025. This proxy statement and the Company’s annual report are available electronically at www.proxyvote.com. |

|

|

|

|

|

|

|

|

|

|

|

|

How are votes counted for Proposals 3 and 4? |

|

The affirmative vote of the holders of a majority of the total outstanding shares of common stock will be required to approve Proposals 3 and 4. Abstentions from voting on the proposals and broker non-votes will not be counted as votes cast and accordingly will have the same effect as a negative vote on these proposals. The approval of Proposal 3 is a routine matter on which a broker has discretionary authority to vote, and, accordingly, there may be few or no broker non-votes with respect to this proposal. The approval of Proposal 4 is a non-routine matter on which a broker does not have discretionary authority to vote. |

|

|

|

|

|

|

How do I cast or revoke my proxy? |

|

Because this Supplement describes two new proposals to be voted on at the annual meeting that were not reflected or described in the original Proxy Statement, proxies submitted before the date of the Supplement will not include votes on these new proposals. As a result, if you want to vote on the new proposals described in the Supplement, you must cast a new vote for the annual meeting by signing, dating and returning the enclosed proxy card (or by following the instructions to vote by Internet or telephone), or by voting at the annual meeting. Signing and submitting the new proxy card, or voting at the annual meeting, will revoke any prior proxy in its entirety. Therefore, if you submit the new proxy card (or vote by Internet or telephone), in addition to voting on Proposals 3 and 4, you must mark the new proxy card in the appropriate place (or follow the instructions to vote by Internet or telephone) to indicate your vote on Proposals 1 and 2. |

|

|

|

|

|

|

Who will bear the costs of this proxy solicitation? |

|

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of the original Proxy Statement and related proxy materials we filed on or about April 30, 2025, and the Supplement and related proxy materials, as well as any additional solicitation material furnished to stockholders. Copies of solicitation material have been or will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs of forwarding the solicitation materials to such beneficial owners. The solicitation of proxies by mail may be supplemented by solicitation by telephone or other means by our directors, officers, employees or other agents we may engage for such purposes. No additional compensation will be paid to our directors, officers or employees for any such services. |

|

|

|

|

|

|

PROPOSAL NO. 3

APPROVAL OF REVERSE STOCK SPLIT

Background of the Reverse Stock Split

Our certificate of incorporation, as amended (the “Certificate of Incorporation”), currently authorizes the Company to issue a total of 510,000,000 shares of capital stock, consisting of 500,000,000 shares of common stock and 10,000,000 shares of preferred stock, par value $0.00001 per share. The text of the Certificate of Incorporation is attached as Exhibit 3.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 31, 2025.

On June 2, 2025, subject to stockholder approval, our Board approved a proposed amendment to our Certificate of Incorporation (the “Reverse Stock Split Charter Amendment”) to, at the discretion of the Board, effect a reverse stock split of our common stock at a ratio of one-for-five (1:5) to one-for-fifty (1:50),with the exact ratio within such range to be determined by the Board at its discretion (the “Reverse Stock Split”). The primary goals of the Reverse Stock Split are to: (i) increase the per share market price of our common stock to meet the initial listing requirements for the potential listing of our common stock on a national securities exchange and (ii) effectively increase the number of authorized and unissued shares of our common stock available for future issuance after we effect the Reverse Stock Split. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Reverse Stock Split is not intended to modify the rights of existing stockholders in any material respect.

If the Reverse Stock Split Proposal is approved by our stockholders and the Reverse Stock Split is effected, up to every 50 shares of our outstanding common stock would be combined and reclassified into one share of common stock. The actual timing for implementation of the Reverse Stock Split would be determined by the Board based upon its evaluation as to when such action would be most advantageous to us and our stockholders. Notwithstanding approval of the Reverse Stock Split Proposal by our stockholders, our Board will have the sole authority to elect whether or not and when to amend the Certificate of Incorporation to effect the Reverse Stock Split. If the Reverse Stock Split Proposal is approved by our stockholders, our Board will make a determination as to whether effecting the Reverse Stock Split is in our best interests and those of our stockholders in light of, among other things, our ability to increase the per share market price of our common stock to meet the initial listing requirements for the potential listing of our common stock on a national securities exchange without effecting the Reverse Stock Split, the per share price of common stock immediately prior to the Reverse Stock Split and the expected stability of the per share price of common stock following the Reverse Stock Split, as well as the number of authorized and unissued shares of common stock available under the Certificate of Incorporation prior to the Reverse Stock Split, the number of shares of common stock reserved for future issuance prior the Reverse Stock Split and the estimated number of additional shares of common stock expected to be required or desirable to raise the additional financing necessary to operate our business and satisfy our obligations and otherwise for the continued growth and development of our business following the Reverse Stock Split. If the Board determines that it is in our best interests and those of our stockholders to effect the Reverse Stock Split, it will hold a Board meeting or agree via a unanimous written consent to determine the ratio of the Reverse Stock Split. For additional information concerning the factors the Board will consider in deciding whether to effect the Reverse Stock Split, see “—Determination of the Reverse Stock Split Ratio” and “—Board Discretion to Effect the Reverse Stock Split.”

The text of the Reverse Stock Split Charter Amendment to effect the Reverse Stock Split is attached as Annex A to this Proxy Statement. If the Reverse Stock Split Proposal is approved by our stockholders, we will have the authority to file the Reverse Stock Split Charter Amendment effecting the Reverse Stock Split with the Secretary of State of the State of Delaware, which will become effective upon its filing; provided, however, that the Reverse Stock Split Charter Amendment is subject to revision to include such changes as may be required by the office of the Secretary of State of the State of Delaware and as our Board deems necessary and advisable. The Board has determined that the Reverse

Stock Split Charter Amendment is advisable and in our best interests and those of our stockholders and has submitted the Reverse Stock Split Charter Amendment for consideration by our stockholders at the annual meeting.

Reasons for the Reverse Stock Split

Potential Future Listing of Our Common Stock on a National Securities Exchange

The Company’s primary reason for approving and recommending the Reverse Stock Split is to meet the initial listing requirements of a national securities exchange. Our common stock is currently quoted on the OTCQX Best Market (“OTCQX”) operated by OTC Markets Group, Inc. under the symbol “VLDX.” The Company may, in the future, apply to list its common stock on a national securities exchange. However, the initial listing rules of various national securities exchanges require certain minimum bid price requirements, which are higher than the Company’s recent closing sale prices on the OTCQX. For example, The Nasdaq Stock Market LLC (“Nasdaq”) generally requires a minimum bid price of $4.00. Although the intent of the Reverse Stock Split is to increase the price of our common stock, there can be no assurance, however, that even if the Reverse Stock Split is effected, that the bid price of the Company’s common stock will be sufficient for the Company to meet initial listing bid price requirements for a national securities exchange such as Nasdaq or that the Company will meet the other requirements for initial listing on a national securities exchange, and even if it does, that it will pursue such a listing.

If the Reverse Stock Split is effected, it would cause a decrease in the total number of shares of our common stock outstanding and increase the market price of our common stock. Our Board intends to effect the Reverse Stock Split only if it believes that a decrease in the number of shares outstanding is in our best interests and those of our stockholders and is likely to improve the trading price of our common stock and improve the likelihood that we will meet the initial listing requirements of a national securities exchange. Accordingly, our Board approved the Reverse Stock Split as being in our best interests.

Effective Increase of Authorized and Unissued Shares

Under our Certificate of Incorporation, we are authorized to issue 500,000,000 shares of common stock. As of June 2, 2025, we had 211,009,815 shares of common stock outstanding. In addition, as of June 2, 2025:

•9,740,087 shares of our common stock were reserved for issuance upon the exercise of outstanding options and upon the settlement of outstanding RSUs;

•11,393,081 shares of our common stock were reserved for issuance under our 2021 Equity Incentive Plan (the “2021 EIP”);

•2,233,461 shares of our common stock were reserved for issuance under our 2021 Employee Stock Purchase Plan (the “2021 ESPP”);

•246,429 shares of our common stock were reserved for issuance upon the exercise of the warrants included in the units issued in our December 2020 initial public offering (our “public warrants”);

•127,143 shares of our common stock were reserved for issuance upon the exercise of the warrants issued to Spitfire Sponsor LLC in a private placement in connection with our December 2020 initial public offering (our “private placement warrants”);

•48,980 shares of our common stock were reserved for issuance upon the exercise of our warrants issued to A.G.P./Alliance Global Partners in connection with our December 2024 registered direct offering (the “RDO Placement agent warrants”);

•236,735 shares of our common stock were reserved for issuance upon the exercise of our warrants issued in our April 2024 reasonable best efforts public offering (the “RBEO warrants”); and

•48,980 shares of our common stock were reserved for issuance upon the exercise of our warrants issued to A.G.P./Alliance Global Partners in connection with our April 2024 reasonable best efforts public offering (the “RBEO placement agent warrants”).

In addition, as of June 2, 2025, 952,381 shares of our common stock were non-exclusively reserved for issuance pursuant to outstanding senior secured notes due 2026, as amended (the “Secured Notes”).

Although the number of authorized shares of our common stock will not change as a result of the Reverse Stock Split, the number of shares of our common stock issued and outstanding will be reduced, which will effectively increase the number of authorized and unissued shares of our common stock available for future issuance. This effective increase in the number of shares available for issuance will provide the Board with the authority, without further action of the stockholders, to issue additional shares of common stock from time to time in such amounts as the Board deems necessary. Without limitation of the foregoing, additional shares may be issued in connection with (1) future capital raising transactions through the sale of common stock and/or securities convertible into or exercisable for common stock in the private and/or public equity markets; (2) future merger and acquisition transactions, strategic collaborations and partnerships and/or licensing arrangements involving the issuance of our securities; (3) the provision of equity incentives to employees, officers, directors or consultants; and (4) other corporate purposes.

Other Reasons

In addition to the primary goals of meeting the initial listing requirements of a national securities exchange and effectively increasing the number of our authorized and unissued shares available for future issuance, the other reasons for effecting the Reverse Stock Split include increasing the per share trading price of our common stock in order to:

•broaden the pool of investors that may be interested in investing in our common stock by attracting investors who may prefer to invest in shares that trade at higher share prices;

•make our common stock a more attractive investment to institutional investors; and

•provide us an opportunity to raise funds to execute our business plan and finance our strategic objectives.

Our Board further believes that an increased stock price may also encourage investor interest and improve the marketability of our common stock to a broader range of investors, and thus improve the liquidity of our shares and lower average transaction costs for our stockholders.

Risks Associated with the Reverse Stock Split

The Reverse Stock Split May Not Increase the Price of our Common Stock over the Long-Term.

As noted above, one of the principal purposes of the Reverse Stock Split is to increase the trading price of our common stock to meet the initial listing requirements of a national securities exchange. However, the effect of the Reverse Stock Split on the market price of our common stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Stock Split will accomplish this objective for any meaningful period of time, or at all. There can be no assurance that even if the Reverse Stock Split is effected, that the bid price of the Company’s common stock will be sufficient for the Company to meet initial listing bid price requirements for a national securities exchange or that the Company will meet the other requirements for initial listing on a national securities exchange, and even if it does, that it will pursue such a listing.

While we expect that the reduction in the number of outstanding shares of common stock will proportionally increase the market price of our common stock, we cannot assure you that the Reverse Stock Split will increase the market price of our common stock by a multiple of the Reverse Stock Split ratio, or result in any permanent or sustained increase in the market price of our common stock. The market price of our common stock may be affected by other factors which may be unrelated to the number of shares outstanding, including our business and financial performance, general market conditions and volatility, and prospects for future success.

The Reverse Stock Split Will Increase the Number of Authorized and Unissued Shares of Common Stock.

As noted above, the other purpose of the Reverse Stock Split is to effectively increase the number of our authorized and unissued shares of common stock available for future issuance. Because the number of issued and outstanding shares of common stock would decrease as a result of the Reverse Stock Split, the number of shares remaining available for issuance under our authorized pool of common stock would correspondingly increase. Future issuances of common stock, if any, may, depending on the circumstances, have a dilutive effect on the earnings per share, voting power and other interests of our existing stockholders.

The issuance of authorized but unissued stock could be used to deter a potential takeover of our company that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the desires of our Board. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price. We do not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences.

Although an increase in the authorized shares of common stock could, under certain circumstances, have an anti-takeover effect, the Reverse Stock Split Proposal is not in response to any effort of which we are aware to accumulate common stock or obtain control of our company, nor is it part of a plan by management to recommend a series of similar amendments to our Board and stockholders.

The Reverse Stock Split May Decrease the Liquidity of our Common Stock.

Our Board believes that the Reverse Stock Split may result in an increase in the market price of our common stock, which could lead to increased interest in our common stock and possibly promote greater liquidity for our stockholders. However, the Reverse Stock Split will also reduce the total number of outstanding shares of common stock, which may lead to reduced trading and a smaller number of market makers for our common stock, particularly if the price per share of our common stock does not increase as a result of the Reverse Stock Split.

The Reverse Stock Split May Result in Some Stockholders Owning “Odd Lots” That May Be More Difficult to Sell or Require Greater Transaction Costs per Share to Sell.

If the Reverse Stock Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares of common stock. A purchase or sale of less than 100 shares of common stock may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares of common stock following the Reverse Stock Split may be required to pay higher transaction costs if they sell their common stock.

The Reverse Stock Split May Lead to a Decrease in our Overall Market Capitalization.

The Reverse Stock Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our common stock does not increase in proportion to the Reverse Stock Split ratio, or following such increase does not maintain or exceed such price, then the value of the Company, as measured by our market capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of common stock outstanding following the Reverse Stock Split.

Potential Consequences if the Reverse Stock Split Proposal is Not Approved

If the Reverse Stock Split Proposal is not approved by our stockholders, our Board will not have the authority to effect the Reverse Stock Split to, among other things, increase the per share market price of our common stock to meet the initial listing requirements for the potential listing of our common stock on a national securities exchange. In addition, if the number of authorized and unissued shares of our common stock available for future issuance is not effectively increased as a result of the Reverse Stock Split, we will have less unissued shares available to satisfy our existing

contractual obligations, to raise the additional financing necessary to operate our business and satisfy our obligations and otherwise to pursue our continued growth and development.

Determination of the Reverse Stock Split Ratio

Our Board believes that stockholder approval of a range of potential Reverse Stock Split ratios is in our best interests and those of our stockholders because it is not possible to predict market conditions at the time the Reverse Stock Split would be implemented. We believe that a range of Reverse Stock Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Stock Split. The Reverse Stock Split ratio to be selected by our Board will be anywhere from one-for-five (1:5) to one-for-fifty (1:50).

The selection of the specific Reverse Stock Split ratio will be based on several factors, including, among other things:

•our ability to meet the initial listing requirements for a national securities exchange;

•the per share price of our common stock immediately prior to the Reverse Stock Split;

•the expected stability of the per share price of our common stock following the Reverse Stock Split;

•the likelihood that the Reverse Stock Split will result in increased marketability and liquidity of our common stock;

•prevailing market conditions and volatility;

•general economic conditions in our industry;

•our market capitalization before, and anticipated market capitalization after, the Reverse Stock Split;

•the number of authorized and unissued shares of common stock available under our Certificate of Incorporation prior to the Reverse Stock Split;

•the number of shares of common stock reserved for future issuance prior to the Reverse Stock Split; and

•the estimated number of additional shares of common stock our Board expects to be required or desirable to raise the additional financing necessary to operate our business and satisfy our obligations and otherwise for the continued growth and development of our business following the Reverse Stock Split.

We believe that granting our Board the authority to set the ratio for the Reverse Stock Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If the Board chooses to implement the Reverse Stock Split, we will make a public announcement regarding the determination of the Reverse Stock Split ratio.

Board Discretion to Effect the Reverse Stock Split

Even if this Reverse Stock Split proposal is approved by our stockholders, our Board will have the discretion to implement the Reverse Stock Split or to not effect the Reverse Stock Split at all. Our Board currently intends to effect the Reverse Stock Split. If the trading price of our common stock increases without effecting the Reverse Stock Split, and subject to our expected requirements for available authorized and unissued shares of our common stock, the Reverse Stock Split may not be necessary. Following the Reverse Stock Split, if implemented, there can be no assurance that the market price of our common stock will rise in proportion to the reduction in the number of outstanding shares resulting from the Reverse Stock Split or that the market price of the post-split common stock can be maintained above the minimum bid price required for initial listing on the national securities exchange on which the Company may seek to list its common stock (if at all). There also can be no assurance that our common stock will be approved for listing on a national securities exchange.

If our stockholders approve the Reverse Stock Split proposal at the annual meeting, the Reverse Stock Split will be effected, if at all, only upon a determination by the Board that the Reverse Stock Split is in our best interests and those of our stockholders at that time. No further action on the part of the stockholders will be required to either effect or abandon the Reverse Stock Split. If our Board does not implement the Reverse Stock Split prior to the one-year anniversary of stockholder approval of the Reverse Split proposal, the authority granted in this proposal to implement the Reverse Stock Split will terminate and the Reverse Stock Split will be abandoned.

The market price of our common stock is dependent upon our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our

common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split.

Furthermore, the reduced number of shares that will be outstanding after the Reverse Stock Split could significantly reduce the trading volume and otherwise adversely affect the liquidity of our common stock.

We have not proposed the Reverse Stock Split in response to any effort of which we are aware to accumulate our shares of common stock or obtain control of our company, nor is it a plan by management to recommend a series of similar actions to our Board or our stockholders. Notwithstanding the decrease in the number of outstanding shares of common stock following the Reverse Stock Split, our Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Exchange Act.

Effectiveness of the Reverse Stock Split

The Reverse Stock Split, if approved by our stockholders, will become effective upon the filing with the Secretary of State of the State of Delaware of the Reverse Stock Split Charter Amendment in substantially the form of the Reverse Stock Split Charter Amendment attached to this proxy statement as Annex A. The exact timing of the filing of the Reverse Stock Split Charter Amendment will be determined by the Board based upon its evaluation of when such action will be most advantageous to us and our stockholders. The Board reserves the right, notwithstanding stockholder approval and without further action by our stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the Reverse Stock Split Charter Amendment, the Board, in its sole discretion, determines that it is no longer in our best interests and those of our stockholders. The Board currently intends to effect the Reverse Stock Split. If our Board does not implement the Reverse Stock Split prior the one-year anniversary of stockholder approval of the Reverse Split proposal, the authority granted in this proposal to implement the Reverse Stock Split will terminate and the Reverse Stock Split will be abandoned.

Effects of the Reverse Stock Split on our Capital Stock

Pursuant to the Reverse Stock Split Charter Amendment, each holder of our common stock outstanding immediately prior to the effectiveness of the Reverse Stock Split (“Old Common Stock”), will become the holder of fewer shares of our common stock (“New Common Stock”) after consummation of the Reverse Stock Split.

Based on 211,009,815 shares of our common stock outstanding as of June 2, 2025, the following table reflects the approximate number of shares of our common stock that would be outstanding as a result of the Reverse Stock Split under certain possible exchange ratios within the range of Reverse Stock Split ratios to be approved under the Reverse Stock Split Proposal.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed Ratio (Old Common Stock: New Common Stock) |

|

Percentage Reduction in Outstanding Common Stock |

|

Approximate Number of Shares of Common Stock to be Outstanding after the Reverse Stock Split |

5:1 |

|

80.0% |

|

42,201,963 |

10:1 |

|

90.0% |

|

21,100,981 |

15:1 |

|

93.3% |

|

14,067,321 |

20:1 |

|

95.0% |

|

10,550,490 |

25:1 |

|

96.0% |

|

8,440,392 |

30:1 |

|

96.7% |

|

7,033,660 |

35:1 |

|

97.1% |

|

6,028,851 |

40:1 |

|

97.5% |

|

5,275,245 |

45:1 |

|

97.8% |

|

4,689,107 |

50:1 |

|

98.0% |

|

4,220,196 |

The Reverse Stock Split will affect all stockholders equally and will not affect any stockholder’s proportionate equity interest in us, except for those stockholders who receive an additional share of our common stock in lieu of a fractional share. None of the rights currently accruing to holders of our common stock will be affected by the Reverse Stock Split. Following the Reverse Stock Split, each share of New Common Stock will entitle the holder thereof to one vote per share and will otherwise be identical to Old Common Stock. The Reverse Stock Split also will have no effect on the number of authorized shares of our common stock. The shares of New Common Stock will be fully paid and non-assessable.

The par value per share of our common stock will remain unchanged at $0.00001 per share after the Reverse Stock Split. As a result, on the effective date of the Reverse Stock Split, if any, the stated capital on our balance sheet attributable to the common stock will be reduced proportionately based on the Reverse Stock Split ratio, from its present amount, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. After the Reverse Stock Split, net income or loss per share and other per share amounts will be increased because there will be fewer shares of our common stock outstanding. In future financial statements, net income or loss per share and other per share amounts for periods ending before the Reverse Stock Split would be recast to give retroactive effect to the Reverse Stock Split. As described below under “Effects of the Reverse Stock Split on Outstanding Equity Awards and Warrants to Purchase Common Stock and Other Obligations to Issue Common Stock,” the per share exercise price of outstanding option awards and warrants would increase proportionately, and the number of shares of our common stock issuable upon the exercise of outstanding options and warrants, or that relate to RSUs and other equity awards would decrease proportionately, in each case based on the Reverse Stock Split ratio selected by our Board. In addition, pursuant to the Business Combination Agreement, the number of Earn-Out Shares issuable to certain former equity holders of Legacy Velo3D upon the occurrence of the Triggering Events (as defined in the Business Combination Agreement) specified therein would decrease proportionately, and the Stock Price Level (as defined in the Business Combination Merger Agreement) applicable to each Trigger Event would increase proportionately, in each case based on the Reverse Stock Split ratio selected by our Board. We do not anticipate that any other accounting consequences would arise as a result of the Reverse Stock Split.

As of June 2, 2025, there were no issued or outstanding shares of our preferred stock and no outstanding options or warrants to purchase, or RSUs that maybe settled for, shares of our preferred stock. The Reverse Stock Split will not impact the number of authorized shares of our preferred stock.

As noted above, we are currently authorized to issue a maximum of 500,000,000 shares of our common stock, and as of June 2, 2025, there were 211,009,815 shares of our common stock issued and outstanding. Although the number of

authorized shares of our common stock will not change as a result of the Reverse Stock Split, the number of shares of our common stock issued and outstanding will be reduced in proportion to the ratio selected by the Board. As a result, the Reverse Stock Split will effectively increase the number of authorized and unissued shares of our common stock available for future issuance by the amount of the reduction effected by the Reverse Stock Split.

Conversely, with respect to the number of shares reserved for issuance under, for example, our 2021 EIP and our 2021 ESPP, our Board will proportionately reduce such reserve in accordance with the terms of the 2021 EIP and the 2021 ESPP. As of June 2, 2025, there were 11,393,081 shares of common stock reserved for issuance under the 2021 EIP, of which 9,740,087 remained available for future awards, and 2,233,534 shares of common stock reserved for issuance under the 2021 ESPP, all of which remained available for future purchase rights, and following the Reverse Stock Split, if any, such reserves will be reduced to between 1,948,017 and 194,801 shares of common stock under the 2021 EIP and between 446,706 and 44,670 shares of common stock under the 2021 ESPP.

Following the Reverse Stock Split, our Board will have the authority, subject to applicable securities laws, to issue all authorized and unissued shares without further stockholder approval, upon such terms and conditions as the Board deems appropriate, including, without limitation, in connection with (1) future capital raising transactions through the sale of common stock and/or securities convertible into or exercisable for common stock in the private and/or public equity markets; (2) future merger and acquisition transactions, strategic collaborations and partnerships and/or licensing arrangements involving the issuance of our securities; (3) the provision of equity incentives to employees, officers, directors or consultants; and (4) other corporate purposes. If the Reverse Stock Split is approved and effected, we believe that the availability of the additional authorized shares of common stock resulting from the Reverse Stock Split will provide us the ability to raise the additional financing necessary to operate our business and satisfy our obligations and otherwise to pursue the continued growth and development of our business. If we issue additional shares of common stock for any of these purposes, the ownership interest of our current stockholders would be diluted. We desire to have the authorized shares available to provide additional flexibility to use our common stock for business and financial purposes in the future.

Effects of the Reverse Stock Split on Outstanding Equity Awards and Options and Warrants to Purchase Common Stock and Other Obligations to Issue Common Stock

If the Reverse Stock Split is effected, all outstanding options and warrants (including the outstanding public warrants exercisable for up to 8,625,000 shares of our common stock, the outstanding private placement warrants exercisable for up to 4,450,000 shares of our common stock, the outstanding 2022 Private Warrant exercisable for up to 70,000 shares of our common stock, the outstanding RDO warrants exercisable for up to 36,000,000 shares of our common stock, the outstanding RDO placement agent warrants exercisable for up to 1,800,000 shares of our common stock, the outstanding 2024 Private Warrants exercisable for up to 21,949,079 shares of our common stock, the outstanding RBEO warrants exercisable for up to 34,285,715 shares of our common stock, and the outstanding RBEO placement agent warrants exercisable for up to 1,714,286 shares of our common stock) entitling their holders to purchase shares of our common stock, as well as RSUs and any other equity awards granted pursuant to, or available under, the 2021 EIP and the 2021 ESPP (collectively, the “Incentive Plans”), will be proportionately reduced, in accordance with the terms of the applicable Incentive Plan and/or award agreements or the applicable warrant agreement or form of warrant governing the terms of our warrants. Correspondingly, the per share exercise price of any such options and warrants will be increased in direct proportion to the Reverse Stock Split ratio (rounded up to the nearest whole cent), so that the aggregate dollar amount payable for the purchase of the shares subject to the options and warrants will remain materially unchanged. For example, assuming that we effect the Reverse Stock Split at a ratio of 1-for-10, and that a warrant holder holds warrants to purchase 1,000 shares of our common stock at an exercise price of $11.50 per share, upon the effectiveness of the Reverse Stock Split at such ratio, the number of shares of the common stock subject to that option would be reduced to 100 and the exercise price would be proportionately increased to $115.00 per share.

As of June 2, 2025, there were outstanding options to purchase a total of 66,576 shares of common stock at a weighted average exercise price of $67.03 per share, outstanding warrants to purchase a total of 839,039 shares of common stock at a weighted average exercise price of $189.40 per share and outstanding RSUs that may be settled for 12,876,395 shares of common stock. If the Reverse Stock Split is effected, the outstanding number of options, warrants and RSUs will automatically be reduced in the same ratio as the reduction in the number of shares of outstanding common stock. Correspondingly, the per share exercise price of such options and warrants will be increased in direct

proportion to the Reverse Stock Split ratio, so that the aggregate dollar amount payable for the purchase of the shares of common stock subject to the options and warrants will remain unchanged.

Further, if the Reverse Stock Split is effected, the number of Earn-Out Shares issuable under the Business Combination Merger Agreement to certain former equity holders of Legacy Velo3D upon the occurrence of the Triggering Events will be proportionately reduced, in accordance with the terms of the Business Combination Agreement in the same ratio as the reduction in the number of shares of outstanding common stock. Correspondingly, the Stock Price Level applicable to each Triggering Event under the Business Combination Agreement will be increased in direct proportion to the Reverse Stock Split ratio. As of June 2, 2025, up to an aggregate of 621,661 Earn-Out Shares were issuable under the Business Combination Agreement upon the occurrence of the Triggering Events, and the Stock Price Level applicable to the Triggering Events were $437.50 and $525.00 per share, respectively.

Effects of the Reverse Stock Split on Registered and Beneficial Stockholders

Upon the Reverse Stock Split, we intend to treat stockholders holding shares of our common stock in “street name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders of record whose shares of common stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our common stock in “street name”; however, these banks, brokers or other nominees may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our common stock with a bank, broker or other nominee, and have any questions in this regard, we encourage you to contact your nominee.

Effects of the Reverse Stock Split on “Book-Entry” Stockholders of Record

Our stockholders of record may hold some or all of their shares electronically in book-entry form. These stockholders will not have stock certificates evidencing their ownership of our common stock. They are, however, provided with a statement reflecting the number of shares of common stock registered in their accounts.

If you hold registered shares of Old Common Stock in a book-entry form, you do not need to take any action to receive your shares of New Common Stock in registered book-entry form, if applicable. A transaction statement will automatically be sent to your address of record as soon as practicable after the effective time of the Reverse Stock Split indicating the number of shares of New Common Stock you hold.

Effects of the Reverse Stock Split on Registered Certificated Shares

Some stockholders of record hold their shares of our common stock in certificate form or a combination of certificate and book-entry form. If any of your shares of our common stock are held in certificate form, you will receive a transmittal letter from the Transfer Agent as soon as practicable after the effective time of the Reverse Stock Split, if any. The transmittal letter will be accompanied by instructions specifying how to exchange your certificate representing the Old Common Stock for a statement of holding or a certificate of New Common Stock.

STOCKHOLDERS SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Other Effects of the Reverse Stock Split on Shares of Common Stock Issued and Outstanding

With the exception of the number of shares issued and outstanding, the rights and preferences of the shares of our common stock prior and subsequent to the Reverse Stock Split will remain the same. After the effectiveness of the Reverse Stock Split, we do not anticipate that our financial condition, the percentage ownership of management, the number of our stockholders, or any aspect of our business would materially change as a result of the Reverse Stock Split.

Our common stock is currently registered under Section 12(g) of the Exchange Act, and as a result, we are subject to the periodic reporting and other requirements of the Exchange Act. If effected, the proposed Reverse Stock Split will not affect the registration of our common stock under the Exchange Act or our periodic or other reporting requirements thereunder.

Anti-Takeover Effects

We have not proposed the Reverse Stock Split, with its corresponding increase in the authorized and unissued number of shares of common stock, with the intention of using the additional shares for anti-takeover purposes, although we could theoretically use the additional shares to make more difficult or to discourage an attempt to acquire control of our company.

Fractional Shares

Fractional shares will not be issued in connection with the Reverse Stock Split. Each stockholder who would otherwise hold a fractional share of common stock as a result of the Reverse Stock Split will receive one share of common stock in lieu of such fractional share. If such shares are subject to an award granted under the Incentive Plans, each fractional share of common stock will be rounded down to the nearest whole share of common stock in order to comply with the requirements of Sections 409A and 424 of the Internal Revenue Code of 1986, as amended (the “Code”).

Appraisal Rights

Under the General Corporation Law of the State of Delaware (the “DGCL”), our stockholders are not entitled to appraisal or dissenter’s rights with respect to the Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Regulatory Approvals

The Reverse Stock Split will not be consummated, if at all, until after approval of our stockholders is obtained. We are not obligated to obtain any governmental approvals or comply with any state or federal regulations prior to consummating the Reverse Stock Split other than the filing of the Reverse Stock Split Charter Amendment with the Secretary of State of the State of Delaware.

Certain U.S. Federal Income Tax Consequences of the Reverse Stock Split

The following is a summary of the material U.S. federal income tax consequences arising from and relating to the Reverse Stock Split.

This summary is based upon provisions of the Code, regulations, rulings and judicial decisions as of the date hereof. Those authorities may be changed, perhaps retroactively, or be subject to differing interpretations, so as to result in U.S. federal tax considerations different from those summarized below. No legal opinion from U.S. legal counsel or ruling from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the U.S. federal income tax consequences related to the Reverse Stock Split. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary.

This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax consequences related to the Reverse Stock Split. This summary does not discuss applicable tax reporting requirements. In addition, this summary does not take into account the individual facts and circumstances of any particular holder that may affect the U.S. federal income tax consequences to such holder.

This summary assumes that the Old Common Stock shares were, and the New Common Stock shares will be, held as a “capital asset,” as defined in Section 1221 of the Code (generally, property held for investment purposes). This summary does not address all aspects of U.S. federal income taxation that may be applicable to holders in light of their particular circumstances or to holders subject to special treatment under U.S. federal income tax law, such as: banks, insurance companies, and other financial institutions; dealers or traders in securities, commodities or foreign currencies; regulated investment companies; U.S. expatriates or former long-term residents of the U.S.; persons holding shares as part of a straddle, appreciated financial position, synthetic security, hedge, conversion transaction or other integrated investment; persons holding shares as a result of a constructive sale; real estate investment trusts; U.S. holders that have a “functional currency” other than the U.S. dollar; tax-exempt organizations, pension funds or governmental organizations; holders that acquired shares in connection with the exercise of employee stock options

or otherwise as consideration for services; persons who own or will own (directly or through attribution) 10% or more (by vote or value) of the outstanding shares; holders who hold shares as qualified small business stock for purposes of Sections 1045 or 1202 of the Code or as “section 1244 stock” for purposes of Section 1244 of the Code, that are S corporations or hybrid entities, who hold their shares through individual retirement or other tax-deferred accounts, or holders that are “controlled foreign corporations” or “passive foreign investment companies.” Holders that are subject to special provisions under the Code, including holders described immediately above, should consult their own tax advisors regarding the U.S. federal, state and local, and non-U.S. tax consequences arising from and relating to the Reverse Stock Split.

This summary does not address the U.S. state and local tax, U.S. federal estate and gift tax, U.S. federal alternative minimum tax, net investment income tax or non-U.S. tax consequences to holders of the Reverse Stock Split. Each holder should consult its own tax advisors regarding the U.S. state and local tax, U.S. federal estate and gift tax, U.S. federal alternative minimum tax, net investment income tax, and non-U.S. tax consequences of the Reverse Stock Split.

If an entity classified as a partnership for U.S. federal income tax purposes holds Old Common Stock shares, the tax treatment of a partner will generally depend on the status of the partner and the activities of the partnership. This summary does not address the tax consequences to any such owner or entity. Partners of entities or arrangements that are classified as partnerships for U.S. federal income tax purposes should consult their own tax advisors regarding the U.S. federal income tax consequences arising from and relating to the Reverse Stock Split.

This discussion of U.S. federal income tax considerations is for information purposes only and is not tax advice. Holders should consult their own tax advisors regarding the U.S. federal, state, local and non-U.S. income and other tax considerations of the Reverse Stock Split.

In general, the federal income tax consequences of a Reverse Stock Split will vary among stockholders depending upon whether they receive solely a reduced number of shares of common stock in exchange for their old shares of common stock or a full share in lieu of a fractional share. We believe that because the Reverse Stock Split is not part of a plan to increase periodically a stockholder’s proportionate interest in our assets or earnings and profits, the Reverse Stock Split should have the following federal income tax effects. The Reverse Split is expected to constitute a “recapitalization” for U.S. federal income tax purposes pursuant to Section 368(a)(1)(E) of the Code. With the possible exception of a stockholder that receives a full share of New Common Stock in lieu of a fractional share of New Common Stock (as discussed below), a stockholder generally will not recognize a gain or loss by reason of such stockholder’s receipt of shares of New Common Stock pursuant to the Reverse Stock Split solely in exchange for shares of Old Common Stock held by such stockholder immediately prior to the Reverse Stock Split. A stockholder’s aggregate tax basis in the shares of New Common Stock received pursuant to the Reverse Stock Split will equal the stockholder’s aggregate basis in the Old Common Stock exchanged therefore. A stockholder’s holding period in the shares of New Common Stock received pursuant to the Reverse Stock Split will include the stockholder’s holding period in the shares of Old Common Stock surrendered in exchange therefore. The basis of the shares of Old Common Stock must be allocated to the shares of New Common Stock received in a manner that reflects, to the greatest extent possible, that a share of New Common Stock is received in respect of shares of Old Common Stock that were acquired on the same date and at the same price.

Holders should consult their own tax advisors regarding the allocation of basis to, and the determination of their holding periods of, New Common Stock received pursuant to the Reverse Stock Split.

As noted above, we will not issue fractional shares in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive a fractional share will receive one share of common stock in lieu of such fractional share. The U.S. federal income tax treatment of the receipt of a full share in lieu of a fractional share in a Reverse Stock Split is not clear. It is possible that the receipt of such an additional fraction of a share of New Common Stock may be treated as a distribution taxable as a dividend (to the extent of our earnings and profits) or as an amount received in a taxable exchange for Old Common Stock. We intend to treat the issuance of such an additional fraction of a share of New Common Stock in the Reverse Stock Split as a non-recognition event, but there can be no assurance that the IRS or a court would not successfully assert otherwise. Holders are urged to consult their own tax advisors as to the possible tax consequences of receiving an additional fraction of a share in the Reverse Stock Split.

No gain or loss will be recognized by us as a result of the Reverse Stock Split.

Vote Required for Approval

This Reverse Stock Split Proposal will be adopted and approved only if holders of a majority our outstanding shares of common stock entitled to vote thereon at the annual meeting vote “FOR” the Reverse Stock Split Proposal at the annual meeting. Because the vote is based on the total number of shares outstanding rather than the votes cast at the annual meeting, your failure to vote, as well as an abstention from voting and a broker non-vote with respect to the Reverse Stock Split Proposal, will have the same effect as a vote against this proposal.

Recommendation of the Board

OUR BOARD RECOMMENDS

A VOTE “FOR” PROPOSAL 3.

We do not believe that our executive officers or directors have substantial interests in this proposal that are different from or greater than those of any other of our stockholders.

PROPOSAL NO. 4

AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO ALLOW STOCKHOLDERS TO ACT BY WRITTEN CONSENT

The Board has unanimously approved and declared advisable, and recommends that our stockholders adopt, a proposal to amend our Certificate of Incorporation to delete Article VIII, Section 1 “No Action by Written Consent of Stockholders” (the “Written Consent Amendment”). As a result, the Company’s Certificate of Incorporation would permit stockholders to act by written consent to the extent permitted by the DGCL. The text of the Written Consent Amendment is attached to the Proxy Statement as Annex B. The text of the Certificate of Incorporation is attached as Exhibit 3.1 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on March 31, 2025.

Current Status

Under Article VIII, Section 1 of the Company’s Certificate of Incorporation, stockholders are currently expressly prohibited from taking action by written consent.

We seek out and highly value the perspectives of our stockholders. Additionally, Arun Jeldi, our Chief Executive Officer and Chairman, currently holds approximately 185,151,333 shares, or approximately 88.1%, of our outstanding common stock as of June 2, 2025, and as a result, controls a majority of the total voting power of our common stock. After careful consideration, and in consultation with Mr. Jeldi, our Board determined to approve the Written Consent Amendment, subject to approval of the Company’s stockholders.

Rationale for the Proposal

The Board believes that a stockholder right to act by written consent is a way to bring an important matter to the attention of both management and stockholders outside of the traditional stockholder meeting process. Stockholder written consents can also provide a cost-effective and efficient mechanism to obtain stockholder approval for certain corporate matters (including, but not limited to, mergers, sales of all or substantially all of the Company’s assets, stock splits, significant securities issuances under exchange continued listing rules, etc.) which require stockholder approval. Unless otherwise provided in a corporation’s certificate of incorporation, the DGCL generally permits any action required by to be taken at any annual or special meeting of stockholders, or any action which may be taken at any annual or special meeting of such stockholders, to be taken without a meeting by written consent signed by the holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Additionally, for so long as we are subject to the reporting requirements of the Exchange Act, even if the Written Consent Amendment is approved and filed with the Secretary of State of the State of Delaware, such that stockholders would be permitted to act by written consent in the future, we would still have to comply with certain SEC rules, which require the filing of an information statement on Schedule 14C to inform stockholders in accordance with Rule 14c-2 promulgated under the Exchange Act of the actions taken by written consent before such actions take effect. Such actions would then become effective on the 20th day after a definitive information statement is mailed to stockholders. Such an information statement would also satisfy the notice requirements under Section 228 of DGCL.

While this Proposal is not prompted by any specific contemplated or anticipated stockholder action of which the Board is currently aware, if approved, the Board believes the Written Consent Amendment will provide additional flexibility to the Company, the Board and management given the Company’s current stock ownership.

Risks Associated with the Written Consent Amendment

Unlike meetings of stockholders, action by written consent may:

•result in certain stockholders being denied the ability to vote on or otherwise have a say on or be informed about (other than in an information statement filed by the Company) proposed stockholder actions;

•enable the minimum percentage of stockholders required to approve an action under the DGCL to take action on a proposal without the benefit of hearing the views, questions and arguments of other stockholders;

•potentially result in multiple contradictory stockholder written consents being solicited simultaneously, creating administrative and financial burdens for the company and also putting our stockholders at risk of confusion;

•disenfranchise smaller stockholders, in particular in a consent solicitation that does not require their involvement to achieve majority support; and

•enable a party attempting an unsolicited bid to circumvent negotiating with the Board and result in terms that may not be in the best interest of all stockholders.

In addition, action by written consent eliminates the need for notice to be given to stockholders about a proposed action prior to the approval of such action, and therefore, certain stockholders may not be informed about the proposed action until after the action has already been taken. This would deny these stockholders the ability to determine whether to exercise their rights, such as by expressing their views as to the merits of the proposal, encouraging the Board to reconsider the matter and voting on the proposed action.

Effect of Proposal

If the Written Consent Amendment is approved, stockholders will be permitted to act by written consent to the extent permitted under the DGCL. The Board believes this will have an effect of easing administrative burdens on the Company to call a meeting for matters requiring stockholder approval.

If stockholders approve this Proposal No. 4, the changes described in this Proposal No. 4 will become legally effective upon the filing of a Certificate of Amendment to the Company’s Certificate of Incorporation with the Secretary of State of the State of Delaware, which is expected to occur shortly following the annual meeting. However, even if stockholders approve this Proposal No. 4, our board of directors may, in its sole discretion, abandon this action without further stockholder action prior to the effectiveness of the filing of the Certificate of Amendment to the Certificate of Incorporation and, if abandoned, the changes reflected therein will not become effective. If stockholders do not approve this Proposal No. 4, our Certificate of Incorporation will not be amended, and the modifications described in this Proposal No. 4 will not take effect.

Required Vote

This Proposal 4 will be adopted and approved only if holders of a majority our outstanding shares of common stock entitled to vote thereon at the annual meeting vote “FOR” this Proposal 4 at the annual meeting. Because the vote is based on the total number of shares outstanding rather than the votes cast at the annual meeting, your failure to vote, as well as an abstention from voting and a broker non-vote with respect to this Proposal, will have the same effect as a vote against this Proposal 4.

Recommendation of the Board

OUR BOARD RECOMMENDS

A VOTE “FOR” PROPOSAL 4.

Arun Jeldi, our Chief Executive Officer and Chairman, is our controlling stockholder, as he currently holds approximately 88.1% of our outstanding common stock as of June 2, 2025. As such, Mr. Jeldi would benefit from the ability to approve certain stockholder matters by written consent rather than at a duly called stockholder meeting. We do not believe that our other executive officers or directors have substantial interests in this proposal that are different from or greater than those of any other of our stockholders.

ANNEX A

CERTIFICATE OF AMENDMENT TO THE

CERTIFICATE OF INCORPORATION

of

VELO3D, INC.

Velo3D, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify as follows:

1.This Certificate of Amendment (this “Second Certificate of Amendment”) amends the provisions of the Corporation’s Certificate of Incorporation filed with the Secretary of State on September 29, 2021, as amended by the Certificate of Amendment filed with the Secretary of State on June 8, 2023 and by the Certificate of Amendment filed with the Secretary of State on June 12, 2024 (the “Certificate of Incorporation”).

2.Pursuant to Section 242 of the DGCL, the Board of Directors of the Corporation has duly adopted this Certificate of Amendment, and the Corporation’s stockholders have duly approved this Certificate of Amendment.

3.Section 1 of Article IV of the Certificate of Incorporation is hereby amended by adding the following paragraph to the end of such section:

“Effective at 12:01 a.m. Eastern Daylight Time on , 202 (the “Effective Time”), each ( ) shares of Common Stock then issued and outstanding, or held in treasury of the Corporation, immediately prior to the Effective Time shall automatically be reclassified and converted into one (1) share of Common Stock, without any further action by the Corporation or the respective holders of such shares (the “Reverse Stock Split”). No fractional shares shall be issued in connection with the Reverse Stock Split. A holder of Common Stock who would otherwise be entitled to receive a fractional share of Common Stock as a result of the Reverse Stock Split will receive one whole share of Common Stock in lieu of such fractional share.”

4.The foregoing terms and provisions of this Certificate of Amendment shall be effective as of the Effective Time.

5.Except as herein amended, the Corporation’s Certificate of Incorporation shall remain in full force and effect.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer this day of , 2025.

VELO3D, INC.

By: _________________________

Name: Nancy Krystal

Title: Secretary

ANNEX B

CERTIFICATE OF AMENDMENT TO THE

CERTIFICATE OF INCORPORATION

of

VELO3D, INC.

Velo3D, Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”), does hereby certify as follows:

6.This Certificate of Amendment (this “Second Certificate of Amendment”) amends the provisions of the Corporation’s Certificate of Incorporation filed with the Secretary of State on September 29, 2021, as amended by the Certificate of Amendment filed with the Secretary of State on June 8, 2023 and by the Certificate of Amendment filed with the Secretary of State on June 12, 2024 (the “Certificate of Incorporation”).

7.Pursuant to Section 242 of the DGCL, the Board of Directors of the Corporation has duly adopted this Certificate of Amendment, and the Corporation’s stockholders have duly approved this Certificate of Amendment.

8.The heading and text of Section 1 of Article VIII of the Certificate of Incorporation is hereby deleted and amended and restated in its entirety to read as follows:

“[RESERVED].”

9.The foregoing terms and provisions of this Certificate of Amendment shall be effective as of the Effective Time.

10.Except as herein amended, the Corporation’s Certificate of Incorporation shall remain in full force and effect.

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be signed by its duly authorized officer this day of , 2025.

VELO3D, INC.

By: _________________________

Name: Nancy Krystal

Title: Secretary